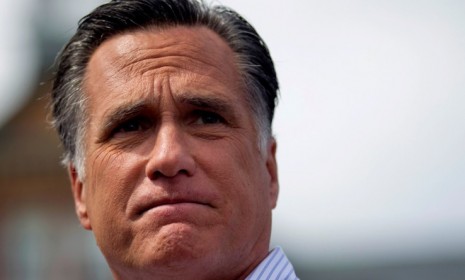

Gawker's Bain files: 7 revelations about Mitt Romney's finances

It took a site best known for snarky gossip to lift the lid on Romney's investment portfolio, giving us a peek at how Mitt gets those enviably low tax rates

Democrats, and even many frustrated Republicans, have been hounding Mitt Romney all summer to release more of his tax returns and give Americans a better sense of how he manages his estimated $250 million fortune. Of course, the GOP presidential hopeful has insisted that he'll only release his 2010 and 2011 returns. But now, Gawker has stepped in, WikiLeaks-style, with a dump of more than 950 pages of confidential financial documents about 18 Bain Capital investment funds and three hedge funds that hold at least $10 million of the Romneys' wealth. "Together, they reveal the mind-numbing, maze-like, and deeply opaque complexity with which Romney has handled his wealth," says Gawker's John Cook, including "exotic tax-avoidance schemes available only to the preposterously wealthy." Since the internal audits, financial statements, and private investor letters are "exceedingly complicated," Gawker is crowd-sourcing the "Bain Files" dump, asking readers and journalists to see if anything jumps out. Here are seven revelations unearthed so far:

1. His Bain retirement funds were created long after he retired

One of the "new, and potentially controversial, details," says Dylan Byers at Politico, is information about "a retirement package investment that was made almost a decade after Romney retired." Romney insists he left Bain in 1999, says Gawker's Cook. But two funds, which are listed as part of his retirement agreement, were founded in 2002 and 2008, respectively. That sure "sounds scandalous," says Joe Weisenthal at Business Insider. But remember, while Romney retired in 1999, he spent the next three years negotiating his retirement package — thus the 2002 fund. Besides, says Dan Primack at Fortune, "his retirement package provided Romney with ownership positions in Bain funds raised for 10 years after he left the firm."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. The funds use elaborate tax-avoidance schemes

Eight of the 21 funds that Gawker examined are domiciled in the Cayman Islands, and their financial documents "are refreshingly clear on the tax consequences of not being located in the United States," says Gawker's Cook. Offshore "tax-dodging tricks" are, of course, routine and usually legal — Gawker Media is based in the Caymans, too — but they're also "one of many reasons that Romney has paid just 13 percent in federal taxes over the last 10 years." The Caymans details are waved off as no big deal by some financial journalists, says Amy Davidson at The New Yorker. But it's instructive to know "how the man who wants a job managing not just his own money but our entire economy understands what the meaning of normal is, or should be, when it comes to taxes and financial responsibility and our shared burdens."

3. And some of the tax-dodging tricks may be dubious

While setting up shop in the Caymans is legal, "one of the most interesting, but contentious, bits of the Gawker doc dump" reveals a much shadier tax-saving trick, say Cardiff Garcia and Joseph Cotterill at Britain's Financial Times. At Caymans-based Bain Capital Fund VII, fund managers used a legally questionable maneuver to convert their management fees — taxed at 35 percent — into capital gains, which are taxed at 15 percent. University of Colorado tax law professor Victor Fleischer says that this "aggressive" tax-minimizing strategy "is difficult to justify." The IRS seems to tolerate this trick, Fleischer adds, but "if challenged in court, Bain would lose." The Gawker files don't say whether the Romneys benefited from this strategy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

4. Romney is indirectly betting on Europe's recovery...

At least two of the funds Romney has sizable stakes in are "invested primarily in Europe," says Rich Adams at Britain's The Guardian. "Mitt Romney the presidential candidate is fond of berating Europe for its weak economy, and there are a couple of reasons why he might feel so strongly." And that's just a tiny slice of his potential conflicts of interest. "It's almost as if Romney needs to make a financial disclaimer for every policy position he takes."

5. ...And Obama's stimulus

Inconveniently, when it comes to investing, "Romney puts his money where Obama's mouth is," says Gawker's Cook. In a 2010 letter to investors in Prospect Harbor Credit Partners LP, for example, the fund's managers say that "with an economy that is still highly dependent on fiscal support... an expiration of stimulus would be a significant fiscal drag." Just "let that one sink in." Another fund's 2010 PowerPoint presentation also says that "regulation will improve liquidity and transparency." Romney, of course, is a fan of neither Obama's stimulus nor financial regulation.

6. The funds lent $3 million to Sheldon Adelson's casinos

Romney's money is supposedly invested in a blind trust he has no control over, but as someone who's on record as against gambling, says Gawker's Cook, it's worth noting that his Sankaty High Yield Partners II has "lent money to such un-Mormon concerns as Las Vegas Sands LLC ($3 million), which operates casinos in Las Vegas and China; Motor City Casinos ($1.8 million); and Yonkers Racing Corporation ($214,000)." It's also worth noting, says Alex Seitz-Wald at Salon, that Las Vegas Sands owner Sheldon Adelson "has become the largest donor to the Republican Party and conservative outside groups, dropping at least $70 million," $10 million of that to Romney's super PAC alone.

7. He invests in National Enquirer... and British toilets

The gambling investments aren't the only ones that would seem to go against Romney's beliefs, says Cook. There's Core-Mark, a nationwide cigarette distributor, and a $3.8 million loan to the parent company of "the salacious and ethically frisky newspaper" the National Enquirer. Yes, that's right, "Romney is the National Enquirer's banker." In fact, despite the "theatrical yawns" from some journalists, says The Guardian's Adams, there are plenty of interesting and amusing investments in Romney's portfolio: The British soccer club Manchester United, for example, and the Harlem Globetrotters, plus Ideal Standard International Topco, which owns Armitage Shanks, "a familiar name to anyone who has used a toilet in Britain." In other words, "Mitt Romney profits from British shit."

Sources: Gawker (2,3,4,5), AP, Bloomberg, Business Insider, Financial Times, Fortune, Guardian, New York Times, New Yorker, Politico, Salon, Washington Post

Read more political coverage at The Week's 2012 Election Center.

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Reforming the House of Lords

Reforming the House of LordsThe Explainer Keir Starmer’s government regards reform of the House of Lords as ‘long overdue and essential’

-

Sudoku: February 2026

Sudoku: February 2026Puzzles The daily medium sudoku puzzle from The Week

-

The billionaires’ wealth tax: a catastrophe for California?

The billionaires’ wealth tax: a catastrophe for California?Talking Point Peter Thiel and Larry Page preparing to change state residency

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding US deportees in El Salvador, the editor-in-chief of CBS News has become the main story

-

Has Zohran Mamdani shown the Democrats how to win again?

Has Zohran Mamdani shown the Democrats how to win again?Today’s Big Question New York City mayoral election touted as victory for left-wing populists but moderate centrist wins elsewhere present more complex path for Democratic Party

-

Millions turn out for anti-Trump ‘No Kings’ rallies

Millions turn out for anti-Trump ‘No Kings’ ralliesSpeed Read An estimated 7 million people participated, 2 million more than at the first ‘No Kings’ protest in June

-

Ghislaine Maxwell: angling for a Trump pardon

Ghislaine Maxwell: angling for a Trump pardonTalking Point Convicted sex trafficker's testimony could shed new light on president's links to Jeffrey Epstein

-

The last words and final moments of 40 presidents

The last words and final moments of 40 presidentsThe Explainer Some are eloquent quotes worthy of the holders of the highest office in the nation, and others... aren't

-

The JFK files: the truth at last?

The JFK files: the truth at last?In The Spotlight More than 64,000 previously classified documents relating the 1963 assassination of John F. Kennedy have been released by the Trump administration

-

'Seriously, not literally': how should the world take Donald Trump?

'Seriously, not literally': how should the world take Donald Trump?Today's big question White House rhetoric and reality look likely to become increasingly blurred