Is the Fed on the verge of another round of stimulus?

The central bank says it may take steps to boost the economy "fairly soon," leading antsy investors to conclude that reinforcements are on the way

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Federal Reserve may be calling in the cavalry. That's the message investors took from the minutes of the central bank's latest interest-rate meeting, which said "many members" of the Fed's policy-making committee believe it's "likely" that economic stimulus will be needed "fairly soon" if the faltering recovery does not rally in the coming months. Global markets jumped in anticipation of a new round of quantitative easing — in which the central bank would buy assets like Treasuries and mortgage-backed securities, essentially by printing more money. However, the Fed's gnomic public statements leave plenty of doubt that quantitative easing is in the cards, particularly since the central bank has already purchased more than $2 trillion worth of assets to seemingly little effect. Is the Fed on the verge of another round of stimulus?

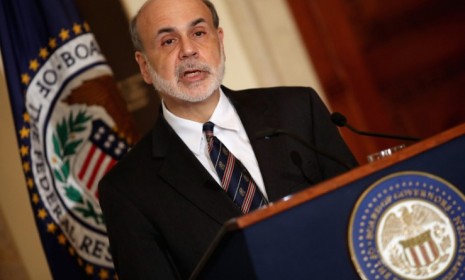

Yes. The Fed's message is loud and clear: The Fed's "printing presses are warming up right now," says Eric Rosenbaum at The Street. The central bank's dry public statements are usually difficult to parse, with investors obsessing over Chairman Ben Bernanke's choice of adjectives describing the economy, but the latest minutes could not be clearer. The combination of "many members," "likely," and "fairly soon" is a "notable Fed-speak grammatical triumvirate if there ever was one," and the strongest signal yet that the Fed is stepping up to the plate.

"'Y' I'm 'fairly' sure 'many' Fed printing presses are warming up"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And the economy won't save itself: The Fed says new stimulus is dependent on whether the economic recovery strengthens, and that's clearly not going to happen, says Rex Nutting at MarketWatch. The economy is "growing at a mediocre 2 percent annual pace," and the unemployment rate, at 8.2 percent, is at "unacceptable levels." Furthermore, the eurozone is "sliding toward a breakup," and Congress is "skidding closer to" a fiscal disaster, all of which suggests that the "odds of another economic shock are rising daily." Get ready for more quantitative easing.

Not so fast...: The private sector added an impressive 172,000 jobs in July, and a similar performance in August might convince the Fed that the recovery is fine on its own, says Marc Chandler at Business Insider. "What seems to some so inevitable today may seem decidedly less so in two weeks time." Furthermore, if the Fed unleashes stimulus now, it will use up its firepower before a real emergency occurs, such as a breakup of the eurozone.

"The August jobs report will be key for QE3"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral