The news at a glance

The return of the euro crisis; Traders face arrest; Samsung and Apple head to court; Surprise drop in home sales; Microsoft reports its first loss

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Markets: The return of the euro crisis

Global markets were battered this week over fears that the Spanish bank bailout hasn’t worked, said Michael Birnbaum and Steven Mufson in The Washington Post. The $120 billion bailout in June came with the condition that Spain accept full liability for the loan, which has driven up the government’s debt and raised new doubts about the country’s financial stability. Spain has struggled to get its public-sector finances under control as it grapples with 25 percent unemployment and a recession predicted to last through 2013. Concerns that the country may need a bigger bailout sent its borrowing costs soaring to euro-era highs, and pushed the euro to a two-year low against the dollar.

The ongoing debt crisis is beginning to infect some of the Continent’s strongest economies, said Liz Alderman in The New York Times. Moody’s dimmed its outlook for Germany this week, sending Chancellor Angela Merkel’s government an implicit warning that more euro zone bailouts could harm the country’s stellar credit rating. The ratings service also downgraded the outlooks for Luxembourg and the Netherlands, as well as for the euro zone rescue fund, which could make it more expensive to raise money for future bailouts. The unwelcome news came as international lenders met in Greece, which may need more EU funds as it struggles to meet bailout targets.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Libor scandal: Traders face arrest

The scandal over the rigging of the Libor benchmark interest rate could soon lead to arrests, said Matthew Goldstein in Reuters.com. U.S. prosecutors and European regulators are close to charging traders at several banks with colluding to manipulate the London Interbank Offered Rate, which affects an estimated $800 trillion worth of financial instruments. Current and former employees at Barclays, UBS, and Citigroup, among other banks, are believed to be under investigation. Beyond the criminal charges, banks may face regulatory penalties and civil lawsuits over the alleged manipulation.

Patents: Samsung and Apple head to court

A landmark patent case between two tech giants goes to trial next week in a federal courthouse in San Jose, said Ashby Jones and Jessica E. Vascellaro in The Wall Street Journal. Apple has accused Samsung of cheating its way to the top of the smartphone market by “ripping off the designs behind Apple’s iPhone and iPad.” Samsung has countered that “Apple’s designs aren’t as unique as the company says.” Apple has already scored a “significant win”: The judge has pulled Samsung Galaxy tablets from store shelves pending the jury’s decision.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Housing: Surprise drop in home sales

New-home sales dropped unexpectedly in June, putting a damper on hopes that the housing market was finally turning a corner, said Michelle Jamrisko in Bloomberg.com. Purchases in June fell 8.4 percent, the biggest decline since February 2011, led by a record 60 percent plunge in the Northeast. Analysts say that sluggish job growth is likely keeping sales low. “Any time you have a conversation about housing, I think it has to start and end with a labor backdrop,” said Tom Porcelli of RBC Capital Markets.

Tech: Microsoft reports its first loss

Microsoft “posted its first quarterly loss in its 26 years” as a public company last week, said Ryan Nakashima in the Associated Press. The company reported a loss of $492 million, largely a result of taking a $6.2 billion write-down on its failed online ad business, aQuantive. Investors are now looking toward the October debut of Windows 8, the “most extreme redesign of the company’s flagship operating system since 1995.” The update will allow Windows to operate on tablet computers, including Microsoft’s soon-to-launch Surface.

-

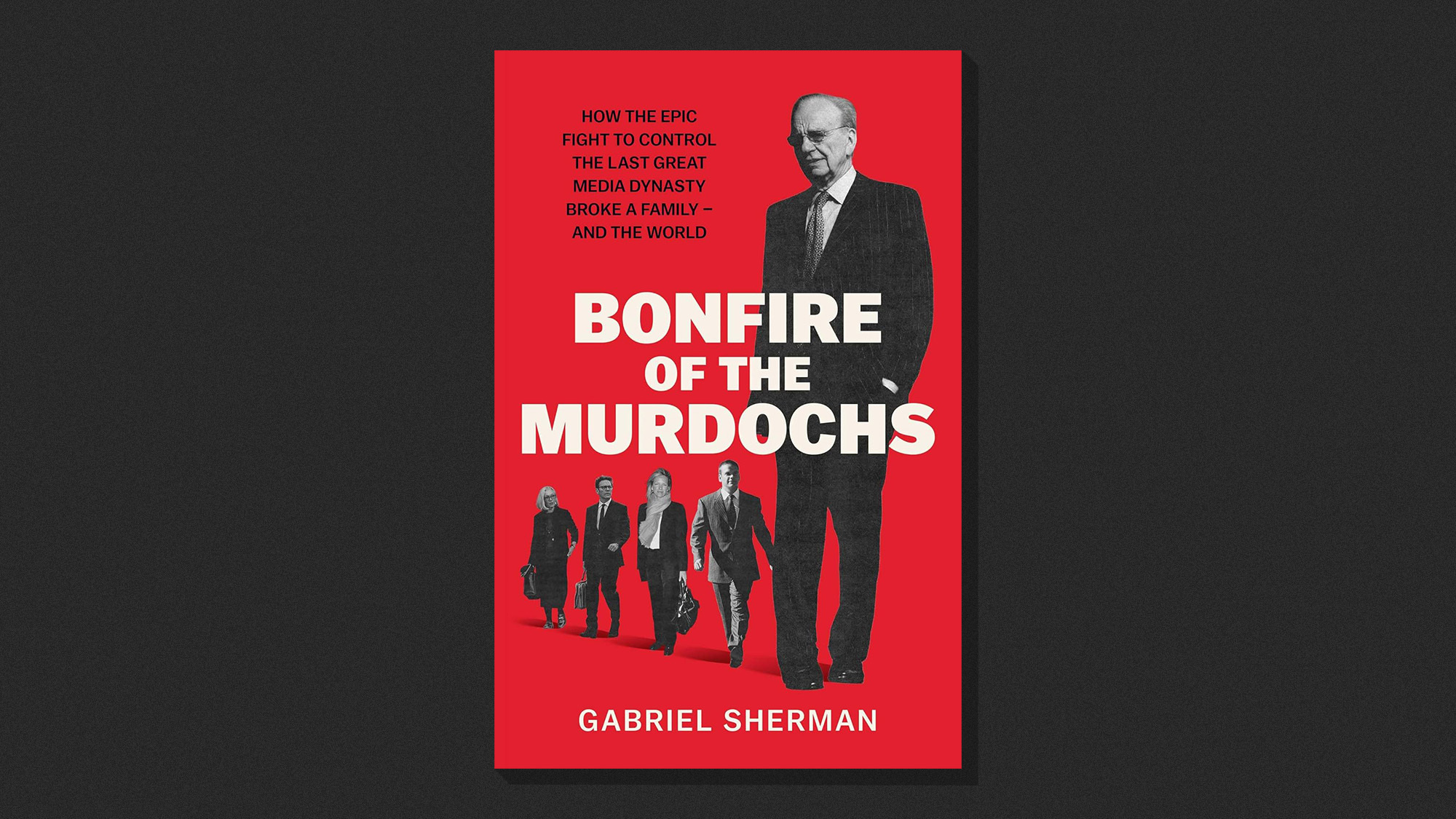

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire

-

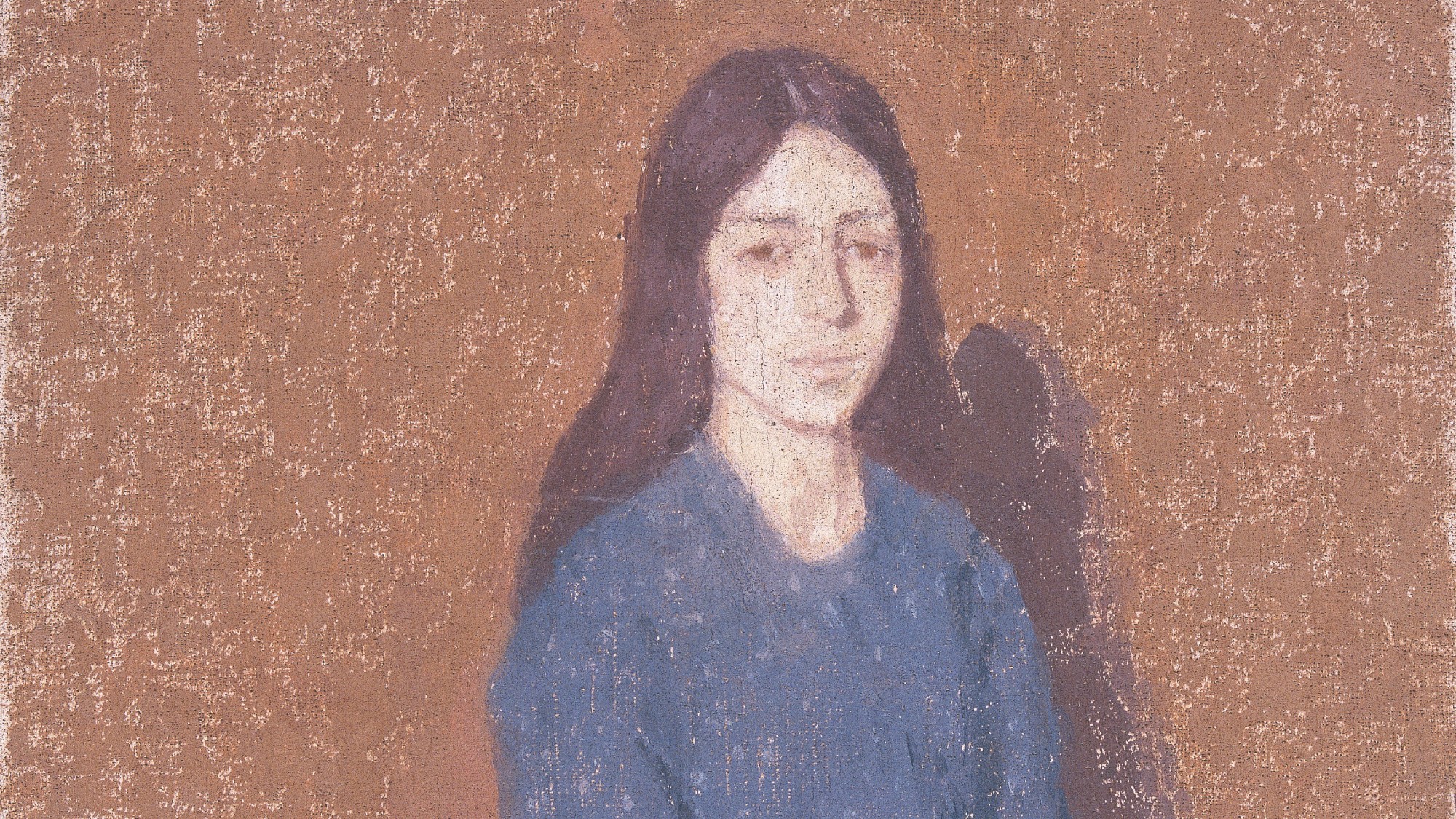

Gwen John: Strange Beauties – a ‘superb’ retrospective

Gwen John: Strange Beauties – a ‘superb’ retrospectiveThe Week Recommends ‘Daunting’ show at the National Museum Cardiff plunges viewers into the Welsh artist’s ‘spiritual, austere existence’

-

Should the EU and UK join Trump’s board of peace?

Should the EU and UK join Trump’s board of peace?Today's Big Question After rushing to praise the initiative European leaders are now alarmed

-

The news at a glance...International

feature International

-

The bottom line

feature Youthful startup founders; High salaries for anesthesiologists; The myth of too much homework; More mothers stay a home; Audiences are down, but box office revenue rises

-

The week at a glance...Americas

feature Americas

-

The news at a glance

feature Comcast defends planned TWC merger; Toyota recalls 6.39 million vehicles; Takeda faces $6 billion in damages; American updates loyalty program; Regulators hike leverage ratio

-

The news at a glance...United States

feature United States

-

The bottom line

feature The rising cost of graduate degrees; NSA surveillance affects tech profits; A glass ceiling for female chefs?; Bonding to a brand name; Generous Wall Street bonuses

-

The news at a glance

feature GM chief faces Congress; FBI targets high-frequency trading; Yellen confirms continued low rates; BofA settles mortgage claims for $9.3B; Apple and Samsung duke it out

-

The week at a glance...International

feature International