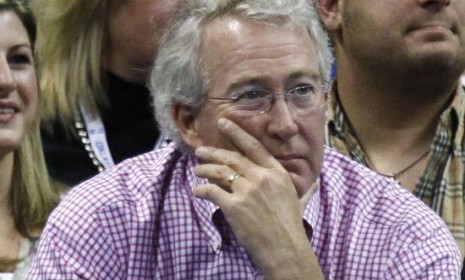

The trials and tribulations of America's natural gas king: A guide

Aubrey McClendon turned Chesapeake Energy into the country's second-largest producer of natural gas, but his alleged reckless greed has landed him in big trouble

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

In 1989, Aubrey McClendon started Chesapeake Energy with 10 employees. Today, the company is the country's second-largest producer of natural gas after Exxon Mobil; it got to that place using a controversial drilling technique known as fracking to tap into previously inaccessible reservoirs of natural gas in shale rock. McClendon has been hailed as a visionary in the industry, and analysts say fracking could one day make America energy-independent for the first time in modern history. But lately, McClendon has been in the headlines for all the wrong reasons. Chesapeake shareholders say he is running the company into the ground, and he has also been accused of financial mismanagement, cronyism, and insatiable greed. Some are even calling for him to step down from the empire he built from scratch. Here, a guide to McClendon's trials and tribulations:

How did McClendon build his empire?

Chesapeake's "geologists helped identify North American basins that may hold a hundred-year supply of natural gas," says Reuters. Based in Oklahoma City, Chesapeake is now a "giant company with unparalleled assets that undergird the shale gas miracle," says Christopher Helman at Forbes. "No one has grabbed more land or drilled more wells" than McClendon, making him "the quintessential wildcatter of his generation."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Then why is Chesapeake in trouble?

In a way, McClendon has been a victim of his own success. The fracking boom has created so much natural gas that it is overwhelming demand, and causing prices to plummet. The company also took on massive amounts of debt to finance its drilling operations, and must now sell an estimated $14 billion in assets — such as valuable pipelines — to avoid a cash crunch. With his customary bravado, McClendon has dismissed concerns that Chesapeake is running into financial trouble. "We don't intend to kick the can down the road. We intend to crush the can. We can sell billions of dollars of assets," he said. Still, Chesapeake's stock price has dropped 40 percent over the past year.

How else has he disappointed shareholders?

McClendon's reputation took a severe hit when a report earlier this year revealed that he had run a secret $200 million hedge fund within Chesapeake to bet on the natural gas market. He also used his personal stake in Chesapeake's oil and gas wells (his contract allowed him to own a small percentage of each one) to secure $1.3 billion in loans. Shareholders say McClendon was recklessly using Chesapeake to make his own bets and investments, putting the whole company at risk.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

What did he need the loans for?

The loans were used to develop his private stake in the wells, a bid to expand a mini-empire within the empire of Chesapeake. But McClendon has mortgaged nearly all his personal assets in a "seemingly insatiable desire to own more and more — of everything," says Reuters. He has taken out loans using his 19 percent stake in the Oklahoma City Thunder basketball team as collateral. He has mortgaged his houses in the U.S. and Bermuda, his restaurants, his boats, and his collection of trophy wines — all of which are used to buy more properties and valuables.

How have shareholders reacted?

In May, McClendon was stripped of his chairmanship of the company, though he remains CEO. Last week, shareholders replaced four of the nine members of the board, and rejected two directors up for re-election. The newly constituted board plans to nominate an independent chairman to oversee McClendon's work. In addition, his sketchy finances have prompted investigations by the IRS and the SEC.

Will he step down as CEO?

Many shareholders say Chesapeake will never regain its credibility as long as McClendon is at the helm, singling out his "expensive hobbies" and dubious financial dealings. But McClendon, who "loves the company like his own child," should be given an "opportunity to redeem himself," says Helman. "Give him until next year's" shareholder meeting. "If he drags his feet, boot him."

Sources: Associated Press, Bloomberg, Forbes, The New York Times, Reuters, TIME

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown