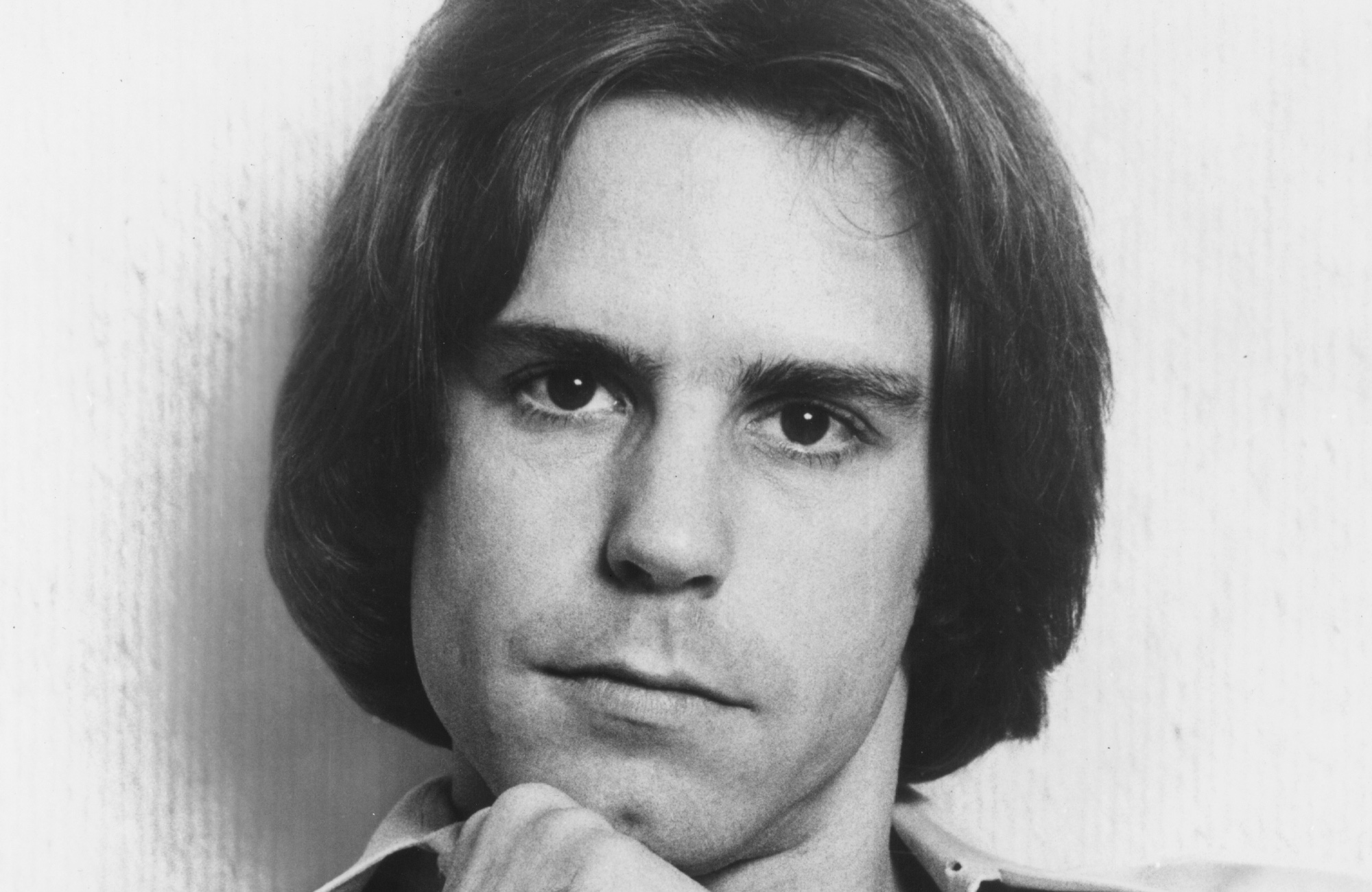

Theodore Forstmann, 1940–2011

The pioneer of private equity

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It was on the golf course that Ted Forstmann inadvertently coined the term for which he became best known. His partner in a game in the late 1980s asked what it meant for a company to be taken over by a buyout firm. “It means the barbarians are at the gates,” said Forstmann. The term entered Wall Street lore, becoming linked to the private equity industry that Forstmann pioneered and flourished in.

But Forstmann was hardly a barbarian. He was “raised in affluence” in Greenwich, Conn., said the Los Angeles Times, and studied at Yale and Columbia Law School. After working on Wall Street for several years, he founded Forstmann Little in 1978, which quickly became “one of Wall Street’s most successful specialists in leveraged buyouts”—corporate acquisitions financed mainly by borrowed money, which is repaid with funds from either the company’s cash flow or asset sales. Forstmann’s private equity firm would go on to turn around such corporate giants as Dr Pepper, Gulfstream Aerospace, and IMG.

Forstmann was famous not just as a financier but also as a “regular boldface name in the gossip pages,” said The New York Times. He had a “brief romantic relationship” with Diana, Princess of Wales, and was linked to actress Elizabeth Hurley and Top Chef presenter and model Padma Lakshmi. He never married, but adopted two orphaned children from South Africa.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Education reform was Forstmann’s special passion, said The Wall Street Journal. In 1998, he and fellow financier John Walton started the Children’s Scholarship Fund, a charity that raises private funds to give scholarships to underprivileged children whose parents are willing to pitch in toward tuition. The initial response “entered the realm of legend,” with 1.25 million applications in the first year. The CSF has since raised $483 million, given scholarships to 123,000 students, and thrust reform of America’s “failing inner-city schools” into the spotlight.

Never a technocrat, Forstmann credited his success in business to his creativity. “I never went to business school, I was basically never in an investment firm worthy of mentioning,” he said. “I’ve always been a guy who had ideas.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Hyatt chair joins growing list of Epstein files losers

Hyatt chair joins growing list of Epstein files losersSpeed Read Thomas Pritzker stepped down as executive chair of the Hyatt Hotels Corporation over his ties with Jeffrey Epstein and Ghislaine Maxwell

-

Political cartoons for February 17

Political cartoons for February 17Cartoons Tuesday’s political cartoons include a refreshing spritz of Pam, winter events, and more

-

Alexei Navalny and Russia’s history of poisonings

Alexei Navalny and Russia’s history of poisoningsThe Explainer ‘Precise’ and ‘deniable’, the Kremlin’s use of poison to silence critics has become a ’geopolitical signature flourish’

-

Catherine O'Hara: The madcap actress who sparkled on ‘SCTV’ and ‘Schitt’s Creek’

Catherine O'Hara: The madcap actress who sparkled on ‘SCTV’ and ‘Schitt’s Creek’Feature O'Hara cracked up audiences for more than 50 years

-

Bob Weir: The Grateful Dead guitarist who kept the hippie flame

Bob Weir: The Grateful Dead guitarist who kept the hippie flameFeature The fan favorite died at 78

-

Brigitte Bardot: the bombshell who embodied the new France

Brigitte Bardot: the bombshell who embodied the new FranceFeature The actress retired from cinema at 39, and later become known for animal rights activism and anti-Muslim bigotry

-

Joanna Trollope: novelist who had a No. 1 bestseller with The Rector’s Wife

Joanna Trollope: novelist who had a No. 1 bestseller with The Rector’s WifeIn the Spotlight Trollope found fame with intelligent novels about the dramas and dilemmas of modern women

-

Frank Gehry: the architect who made buildings flow like water

Frank Gehry: the architect who made buildings flow like waterFeature The revered building master died at the age of 96

-

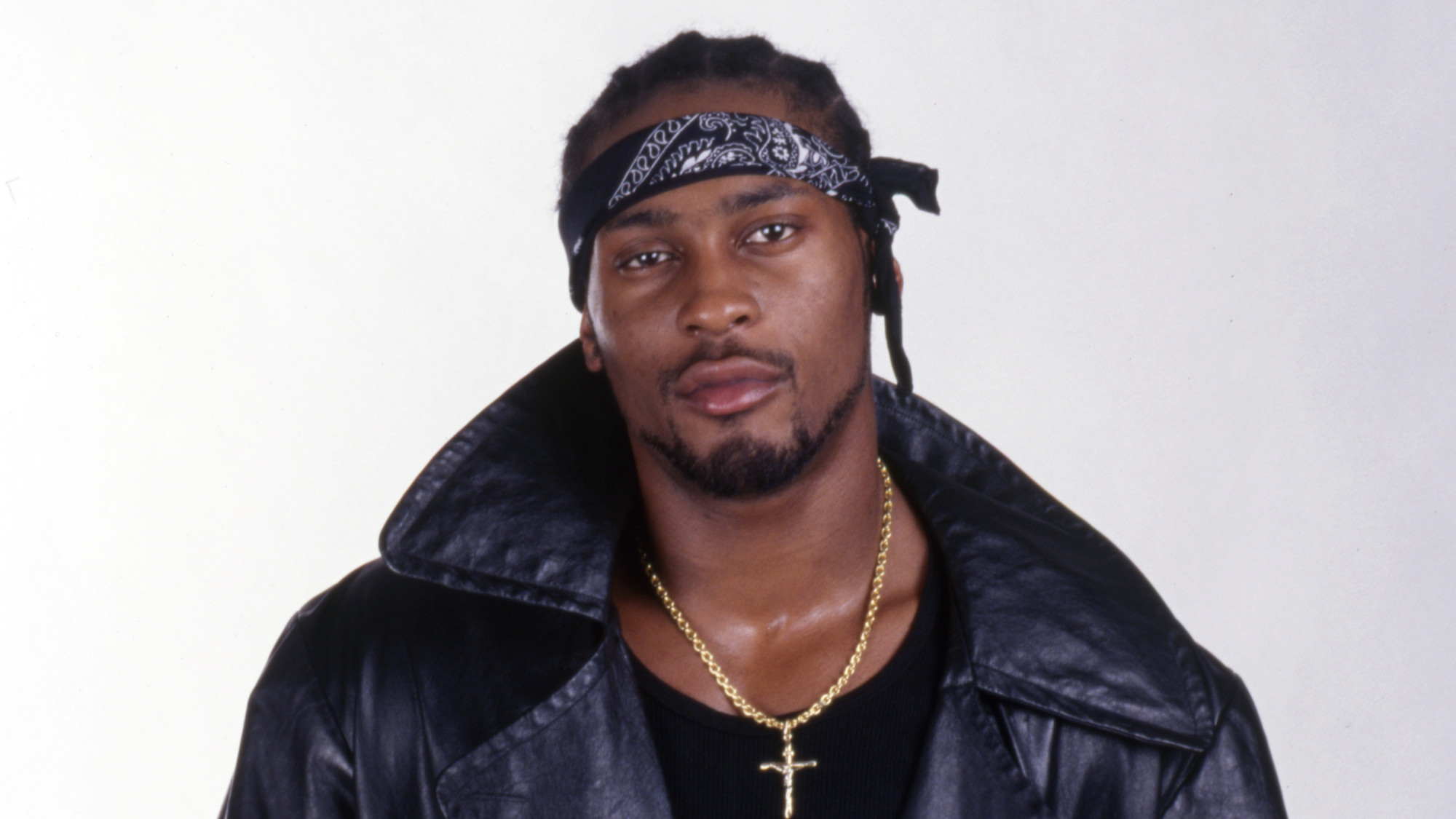

R&B singer D’Angelo

R&B singer D’AngeloFeature A reclusive visionary who transformed the genre

-

Kiss guitarist Ace Frehley

Kiss guitarist Ace FrehleyFeature The rocker who shot fireworks from his guitar

-

Robert Redford: the Hollywood icon who founded the Sundance Film Festival

Robert Redford: the Hollywood icon who founded the Sundance Film FestivalFeature Redford’s most lasting influence may have been as the man who ‘invigorated American independent cinema’ through Sundance