Has Europe's debt crisis already infected America?

The Federal Reserve worries some U.S. investors by joining other central banks in an effort to bolster flailing European financial institutions

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Global stocks are being dragged down by fears that Greece won't get a bailout in time to avoid defaulting on its sovereign debt. To prevent Greece's troubles from spreading, the European Central Bank, joined by the U.S. Federal Reserve, promised last week to help European banks, which lent a fortune to now-broke countries, and can't find anyone willing to lend them the money they need to stay afloat. The crisis is frightening investors in the U.S. Is there a danger that Europe's debt woes could deepen America's financial troubles?

The euro crisis has already crossed the Atlantic: Europe's debt crisis has "finally, and officially, washed up on American shores," says Gretchen Morgenson in The New York Times. European banks will be devastated if Greece and other "shaky" governments that owe them money default. But the U.S. will face an "economic hit," too. U.S. institutions that insured all that sovereign debt will pay dearly, and American companies that borrow money from these European banks won't be able to get much-needed loans.

"Suddenly, over there is over here"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And the Fed is only making matters worse: The Federal Reserve's rescue attempt "is not going to solve anything in the long run," says The Economic Collapse. This latest move is "a temporary Band-Aid," at best. "You can't solve a raging debt problem with more debt." Now the U.S. just stands to lose billions more than we otherwise would have when the inevitable reckoning arrives for Europe.

Hold on. This is still mostly Europe's problem: Nobody will be entirely "immune to the effects of the meltdown," says Rick Moran at The American Thinker. But we won't suffer anything like Europe, which is about to see a huge rise in homelessness from Athens to Lisbon. Europe's "fantasy of cradle-to-grave security" was a sham, and what we're witnessing is an entire continent discovering that government just can't pay for everything.

"Break up of the welfare state in Europe will have consequences"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’

One great cookbook: Joshua McFadden’s ‘Six Seasons of Pasta’the week recommends The pasta you know and love. But ever so much better.

-

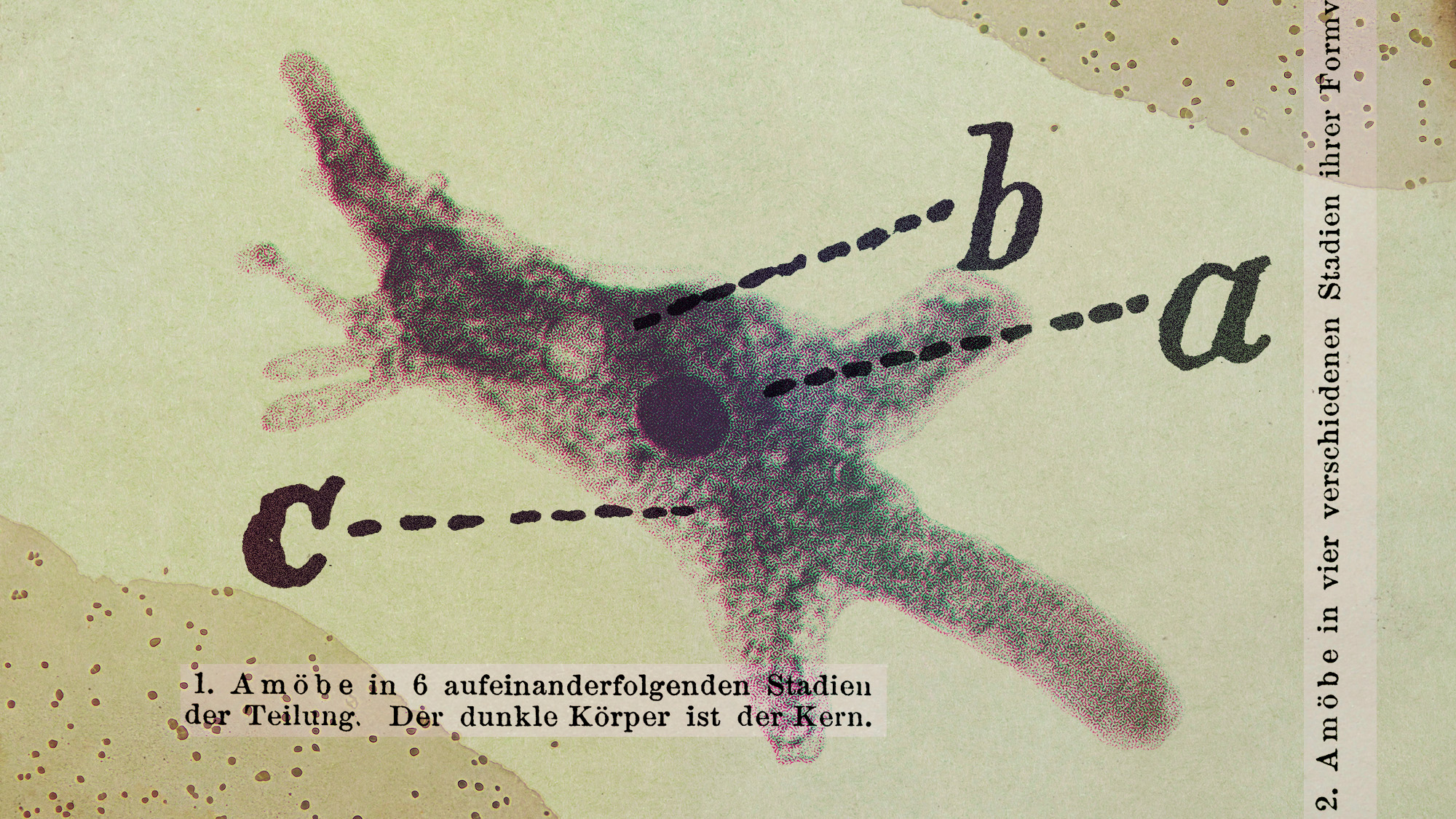

Scientists are worried about amoebas

Scientists are worried about amoebasUnder the radar Small and very mighty

-

Buddhist monks’ US walk for peace

Buddhist monks’ US walk for peaceUnder the Radar Crowds have turned out on the roads from California to Washington and ‘millions are finding hope in their journey’