What the experts say

The interest-rate blues; How to reduce child-care costs; How to trim a fat wallet

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The interest-rate blues

The recent announcement that the Fed will keep interest rates near zero through 2013 briefly sent the stock market soaring, but it is “crushing news for anyone on a fixed income,” said Dan Kadlec in Time.com. Retirees who rely on income from short-term investments are getting “another punch to the gut” after three years of low interest yields. With interest rates on many savings instruments stuck at about 1 percent, a $100,000 deposit in a one-year bank CD produces just $1,200 a year of income, and a one-year Treasury bill generates just $110. That’s why many investment advisers are “breaking the mold” and telling their retired clients to keep more wealth in the stock market. To minimize risk, advisers say, pick a diversified portfolio of large-cap, quality companies. The dividend yields of such stocks can be far higher than Treasurys and bank CDs.

How to reduce child-care costs

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

As kids head back to school, there are plenty of ways to lower the cost of after-school child care, said Kimberly Lankford in Kiplinger.com. If you work and your child is younger than 13, you qualify for a tax credit of 20 to 35 percent of your child-care expenses, including nannies, babysitters, and after-school programs. The amount of credit depends on your income: If you make more than $43,000 and pay $5,000 on care for two or more children, your tax bill will shrink by $1,000. An even better option may be a dependent-care flexible spending account, if your employer offers it. You can avoid federal, Social Security, and Medicare taxes on up to $5,000.

How to trim a fat wallet

A fat wallet could be sinking your bank account, said Charles Passy in SmartMoney. Many Americans’ wallets have turned into “roving filing cabinets” crammed with credit and debit cards, IDs, and gift and rewards cards for “everything from airlines to neighborhood frozen-yogurt joints.” All that plastic makes it easier to spend money recklessly and harder to track spending. “The more cards you have, the more likely it is that you’ll forget to pay one of them,” says financial adviser Peter J. D’Arruda. The best solution is a simple purge: Leave the loyalty cards at home (businesses can usually confirm that you are a member with just your name), and whittle the wallet down to just a few credit and debit cards with good rewards.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Colbert, CBS spar over FCC and Talarico interview

Colbert, CBS spar over FCC and Talarico interviewSpeed Read The late night host said CBS pulled his interview with Democratic Texas state representative James Talarico over new FCC rules about political interviews

-

The Week contest: AI bellyaching

The Week contest: AI bellyachingPuzzles and Quizzes

-

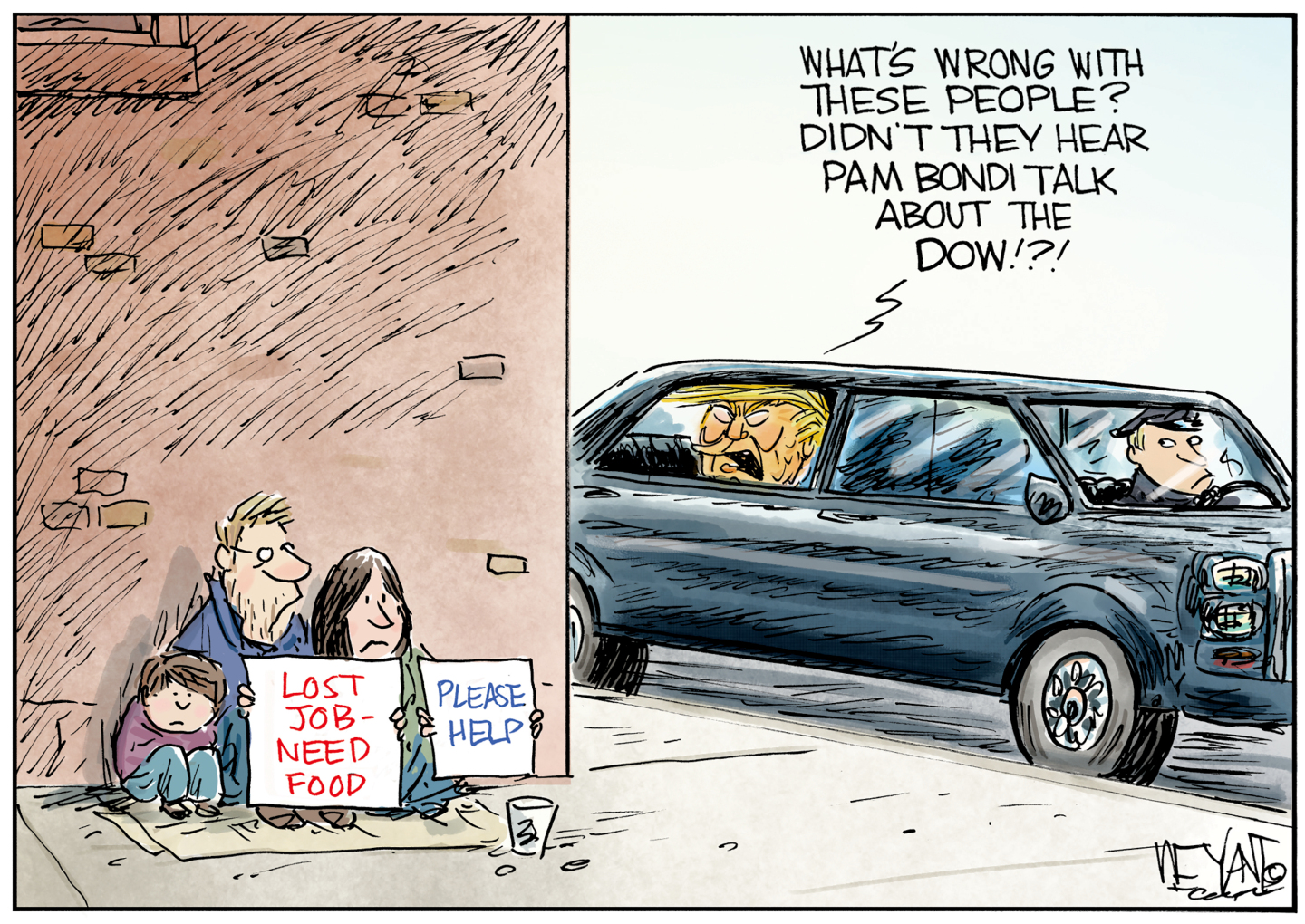

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more