What would a Greek default mean for Americans?

Greece's financial troubles could soon spread across Europe, but the shockwaves may be felt on this side of the Atlantic, too

A meeting of European Union finance ministers Sunday failed to ease fears that Greece would default on its debt. The EU put off releasing the first chunk of a $155 billion aid package until mid-July, by which time Greek leaders must pass an austerity program. The news dragged down stocks in Europe and unnerved investors in the U.S. How could Americans be affected by Greece's debt crisis? Here, three theories:

1. Your safest investments could be at risk

Even "plain-vanilla investment accounts in the U.S. could be challenged if Greece defaults on its sovereign debt," says John Carney at The Christian Science Monitor. That's because U.S. money market funds have lent $360 billion to European banks that have, in turn, made massive loans to Greece. About 12 percent of the money in those U.S. funds is tied up in loans to the French banks — Crédit Agricole, BNP Paribas, and Société Générale — who are Greece's main lenders.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

2. Mortgage rates could sink

Investors nervous about putting their money into European banks are looking for safe places to put their funds, and one of the safest is U.S. Treasury bonds," says Liz Freeman at ShopRate. As demand rises, the government can get people to snap up the bonds at lower and lower interest rates, and that "should help drive down the rates on mortgages" in the U.S.

3. More Americans may lose jobs

If Greece can't pass the austerity measures, which slash government jobs and benefits, it won't get more foreign aid, and it will default on its $165 billion debt this summer. That would scare investors from buying government bonds from other European countries, sparking crises in other debt-laden countries, such as Ireland and Portugal, and then even pushing bigger economies, such as Spain and Italy, to the brink. Of course, if all goes well, a Greek bailout will prevent that catastrophe. But either way, our important European trading partners "will have less money to spend on American goods, causing job losses here," says Michael Murray at ABC News.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sources: Wall St. Journal, NY Times, Shoprate.com, Christian Science Monitor, NPR, ABC News

-

Syria’s Kurds: abandoned by their US ally

Syria’s Kurds: abandoned by their US allyTalking Point Ahmed al-Sharaa’s lightning offensive against Syrian Kurdistan belies his promise to respect the country’s ethnic minorities

-

The ‘mad king’: has Trump finally lost it?

The ‘mad king’: has Trump finally lost it?Talking Point Rambling speeches, wind turbine obsession, and an ‘unhinged’ letter to Norway’s prime minister have caused concern whether the rest of his term is ‘sustainable’

-

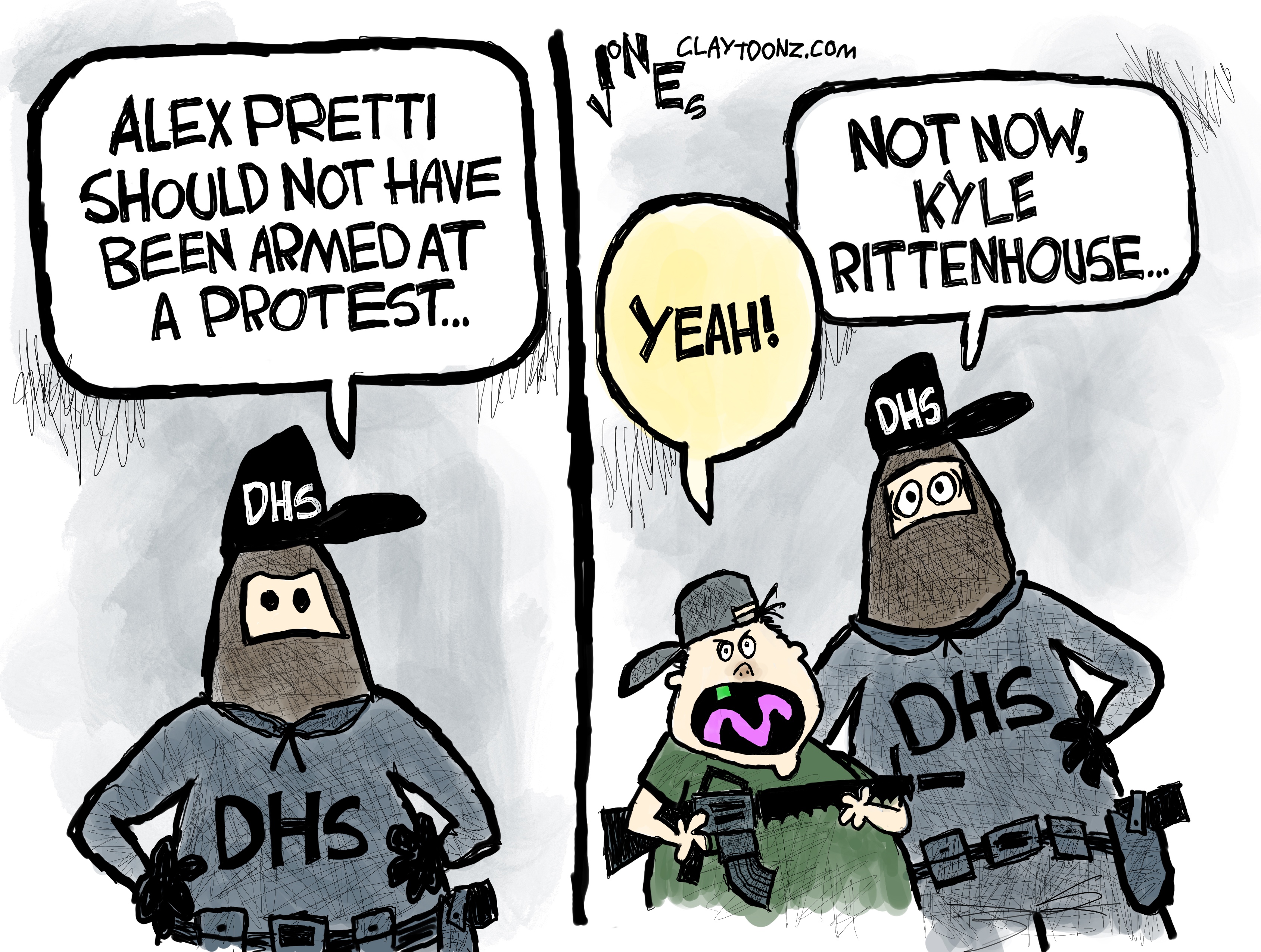

5 highly hypocritical cartoons about the Second Amendment

5 highly hypocritical cartoons about the Second AmendmentCartoons Artists take on Kyle Rittenhouse, the blame game, and more