Pain at the pump: A Q&A guide to gas prices

Gas prices are close to their record high. Whose fault is it — and is $3-a-gallon gas gone for good?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Has gas ever cost this much?

Yes, once before—in July 2008, when the national average price of a gallon peaked at $4.11. The national average recently surpassed $4—and in some regions, prices climbed past $4.50. Prices have come down, but are still much higher than January’s average of $3.07. The recent spike in prices has prompted a new rush on high-mileage cars and urgent calls for Washington to do something—from opening up the Alaskan wilderness for drilling, to releasing some of the 727 million barrels of oil in the nation’s Strategic Petroleum Reserve, to imposing an “excess profits’’ tax on oil companies.

Do oil companies control gas prices?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

No one controls gas prices—not the president, not Saudi Arabia, not even ExxonMobil, the world’s largest producer. About two thirds of pump prices reflect the notoriously volatile price of crude oil, which has been driven up by two principal factors: increasing demand from the developing economies of China and India, where millions of people are buying cars; and the uncertainty about supply caused by the political unrest of the Middle East’s Arab Spring. Higher demand and uncertain supply are likely to be permanent. “The age of cheap oil is over,” says International Energy Agency economist Fatih Birol. In addition to these long-term trends, gas prices often rise in the spring for other reasons: More expensive additives are required during warmer months, and many refineries shut down temporarily at this time of year to repair and upgrade equipment.

Do oil companies prosper when prices climb?

Yes, lavishly. The six largest global producers raked in $38 billion in profits for the first quarter of 2011; ExxonMobil’s quarterly profits were 69 percent higher than they were a year earlier. That’s mainly because extraction costs, while rising, are far less volatile than oil prices; they currently stand at an average of about $10 a barrel, or less than a tenth of the world oil price. Big Oil’s high profits moved Sen. Jay Rockefeller, the great-grandson of Standard Oil founder John D. Rockefeller, to call current oil executives “deeply and profoundly committed to sharing nothing.” The Obama administration wants to end tax breaks worth $22.8 billion to oil companies through 2016, but last month congressional Republicans roundly defeated a bill targeting a fraction of that. In the end, there’s no simple mechanism for curtailing the profits companies reap in a complex world market.

Why do prices vary so much?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Partly because of state taxes, which range from a low of 8 cents per gallon in Alaska to a high of 51.9 cents in Connecticut. In California, prices are also raised by the state’s stringent anti-pollution laws, which require that the gasoline sold there contain emissions-reducing additives. And although your local filling station might bear the logo of Exxon or Shell, it’s probably owned and operated by an independent businessperson who purchases gasoline from a wholesaler that may not be affiliated with the name on the sign. Wholesalers charge different customers different prices, depending on traffic density, the surrounding area’s average income, and the number of competing gas stations nearby, among other things.

Where does that leave consumers?

Shopping around and driving less. Roberta Brown of Apache Junction, Ariz., hates it when she gets stuck having to fill up in nearby upscale Scottsdale, where, she says, gas prices are 20 cents a gallon higher. Paying that much “scares me,” she says. “We’re right on the edge of our budget.” Longer-term, the surest way to cut costs is to drive fuel-efficient vehicles or simply to drive fewer miles. But economists say consumers rarely change their gas-consumption habits until rising prices become psychologically painful; $4 a gallon is the generally agreed tipping point. Below that level, consumers compensate for rising fuel costs by skimping on restaurant meals, clothing, or even health care.

What can the government do?

Not much. Some politicians want to open the Arctic National Wildlife Refuge to drilling, but it would be more than five years before any oil could be pumped there, and its price would be subject to the same factors that are driving oil prices up in general. The government has raised some eyebrows by requesting a release of 5 million barrels from the Strategic Petroleum Reserve, but only to repair a storage cavern. A larger release might briefly push prices down by a few pennies per gallon, but they would bounce back up when the government purchased oil to refill the reserve. An ongoing federal investigation into oil-price manipulation might nab some cheaters, but ultimately the oil market is simply too big and complex for even the most determined criminal to wrangle. Americans don’t want to hear it, but President Obama was right when he said, “There’s no silver bullet that can bring down gas prices right away.”

How to rig the price of oil

Can oil prices be fixed? Federal regulators last month filed a civil suit against two oil traders and the firms they worked for, accusing them of trying to do just that. The Commodity Futures Trading Commission alleges that in January 2008, traders Nicholas Wildgoose and James Dyer bought up control of two thirds of the physical supply of West Texas Intermediate to create the appearance of a supply shortage and drive prices up. At the same time, the suit claims, the two men bought futures contracts for an equivalent amount of oil that would pay off big if the price fell. That’s precisely what happened when they dumped all their oil onto the market, generating a $50 million profit for their firms, Parnon Energy and Arcadia Petroleum, which are owned by Norwegian billionaire John Fredriksen. The firms and traders have denied wrongdoing. They stand to pay up to $150 million if the feds prevail in court.

-

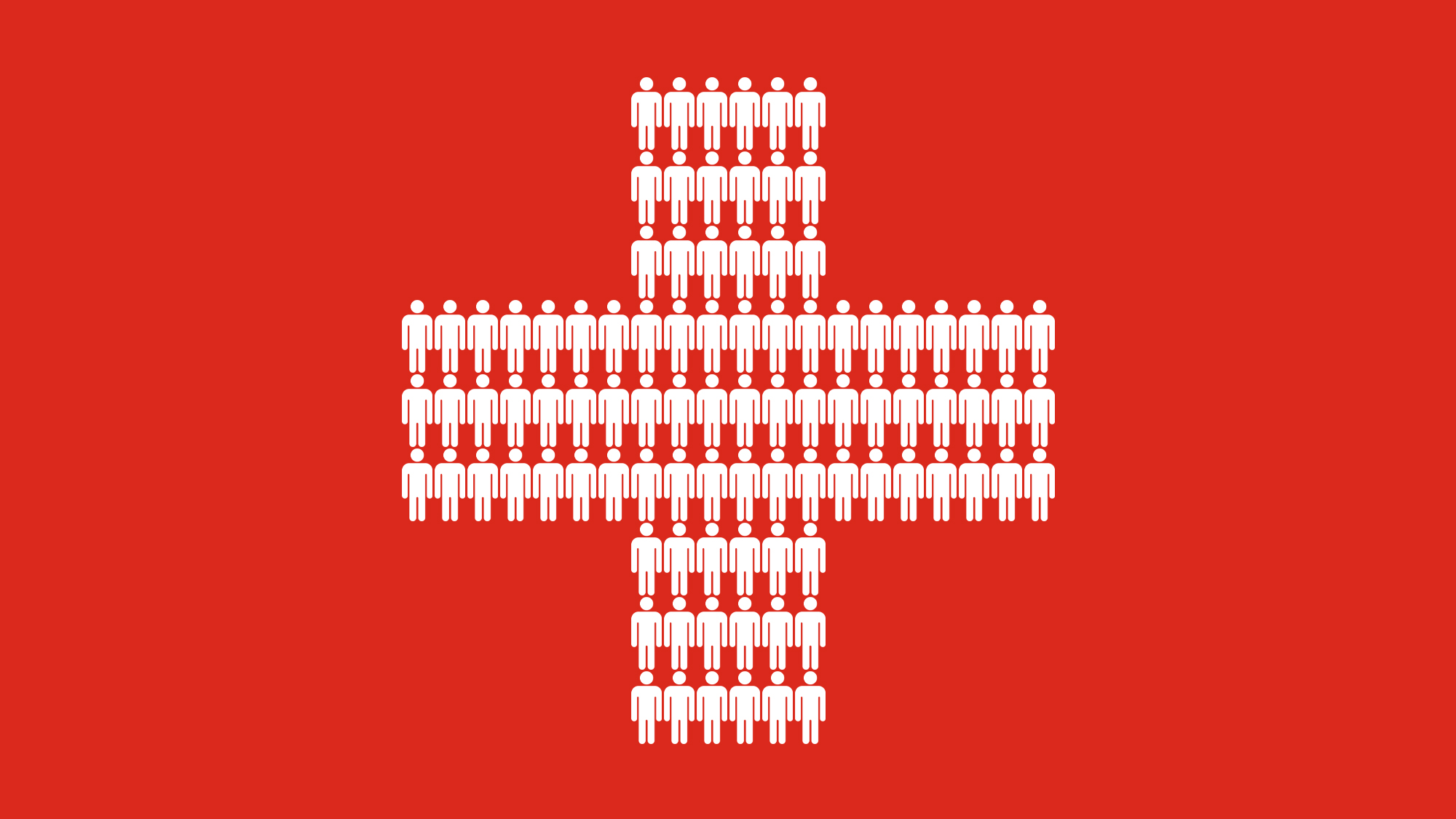

Switzerland could vote to cap its population

Switzerland could vote to cap its populationUnder the Radar Swiss People’s Party proposes referendum on radical anti-immigration measure to limit residents to 10 million

-

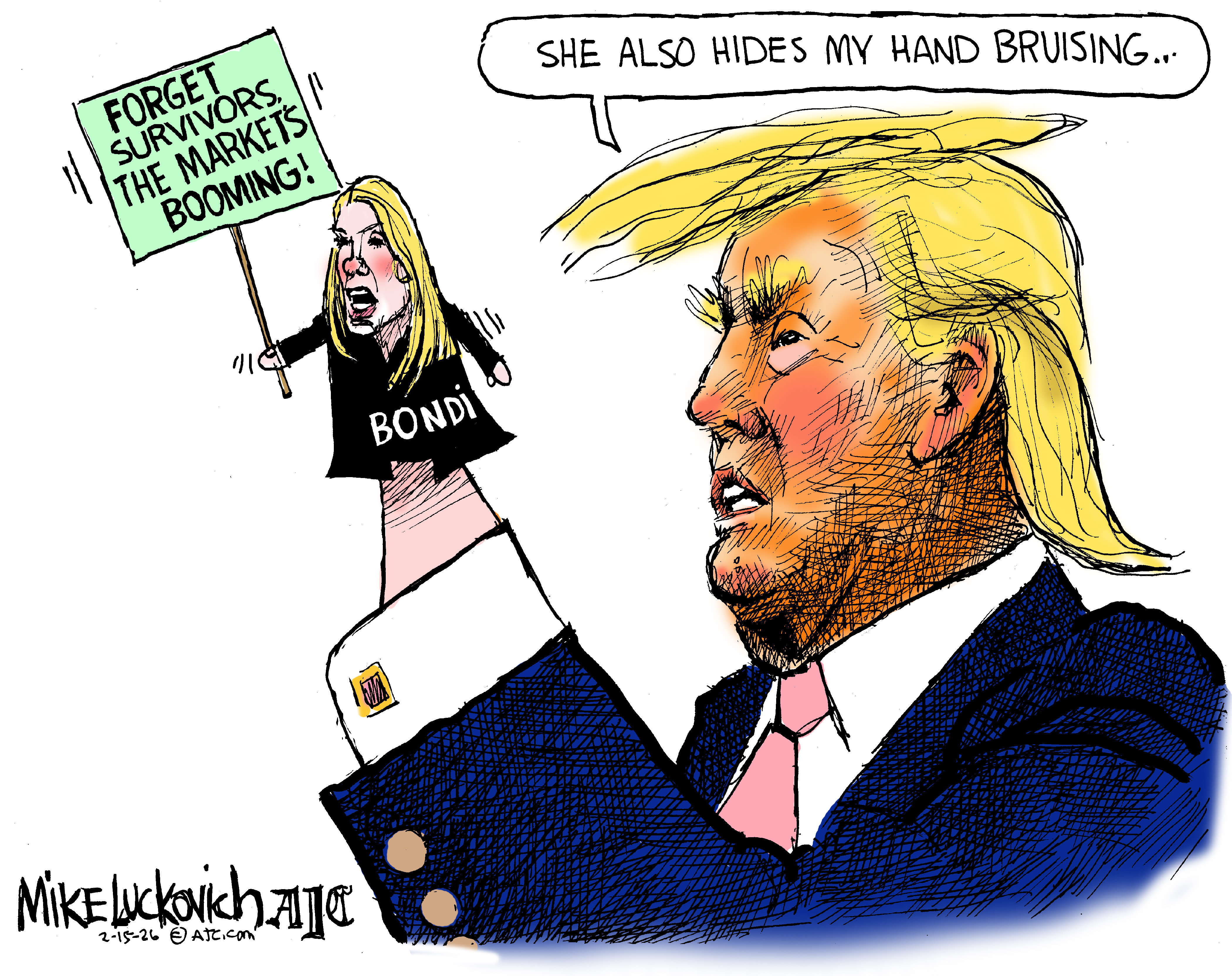

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry