The news at a glance

Insider trading: Rajaratnam found guilty; Telecom: Microsoft plugs a gap with Skype; Chips: Intel’s radical new 3-D architecture; Housing: A market that won’t stop falling; Stocks: High-speed traders are fading fast

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Insider trading: Rajaratnam found guilty

A federal grand jury has convicted billionaire Raj Rajaratnam on all 14 counts in what prosecutors call the largest hedge-fund insider-trading case in history, said Peter Lattman in The New York Times. The Galleon Group hedge-fund founder faces nearly 20 years in prison for orchestrating “a vast insider-trading conspiracy” that netted him an estimated $63.8 million over seven years. The jury reached its verdict after 12 days of deliberations, which were interrupted when a juror fell ill and was replaced. Jurors rejected the defense’s contention that Rajaratnam had based his investment decisions solely on public information. They were swayed by recordings of wiretapped telephone conversations in which Rajaratnam, 53, “brazenly—and matter-of-factly—swapped inside tips with corporate insiders and fellow traders.” The judge ruled that Rajaratnam, who will appeal, be held in home detention until sentencing, on July 29.

“The conviction could strengthen the hand of Manhattan U.S. Attorney Preet Bharara,” said Michael Rothfeld and Chad Bray in The Wall Street Journal. His office is pursuing several other insider-trading investigations, including one against SAC Capital and its founder, Steven Cohen (see Issue of the week). The trial’s outcome is also likely to lead to wider use of wiretaps, which provided crucial evidence in Rajaratnam’s case.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Telecom: Microsoft plugs a gap with Skype

Microsoft this week made its largest-ever acquisition, paying $8.5 billion for Skype, the pioneering voice-over-Internet provider, said Andrew Ross Sorkin in The New York Times. The deal represents yet another attempt by Microsoft to gain a foothold in the mobile communications market, now dominated by Apple and Google’s Android operating system. Microsoft’s own Windows Phone 7 operating system has never caught on with consumers, despite generally good reviews for its technology. Microsoft may integrate Skype into its Xbox gaming and Outlook videoconferencing products.

Chips: Intel’s radical new 3-D architecture

Intel “has unveiled one of the most significant developments in silicon-transistor design since the integrated circuit was invented, in the 1950s,” said Jordan Robertson in the Associated Press. In a revolutionary break from conventional two-dimensional chip design, Intel’s “tri-gate chip” features “minuscule fins jutting from the surface of the typically flat transistors” that improve performance and save power. The new design “opens the way for faster smartphones, lighter laptops,” and a host of as-yet-unimagined inventions. The chips should appear in computers and other devices starting in 2012.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Housing: A market that won’t stop falling

Four years after the worst home-price collapse since the Great Depression, “the devastating flood of resulting foreclosures shows no sign of abating,” said Lisa Myers and Rich Gardella in MSNBC.com. First-quarter housing prices fell 3 percent from the previous quarter, the largest drop since late 2008, leaving an estimated 14 million homeowners owing more than their properties are worth. Economist Mark Zandi says many of those residences will fall into foreclosure, forcing further declines in prices, which have fallen for 57 consecutive months.

Stocks: High-speed traders are fading fast

High-speed computerized stock trading, widely blamed for last year’s “flash crash,” has dropped off sharply this year, said Tom Lauricella in The Wall Street Journal. The market’s declining volatility makes the practice less profitable. Without computerized buy and sell orders flooding the market, daily trading volume on the major exchanges has fallen 15 percent in the first four months of 2011.

-

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’Feature An inconvenient love torments a would-be couple, a gonzo time traveler seeks to save humanity from AI, and a father’s desperate search goes deeply sideways

-

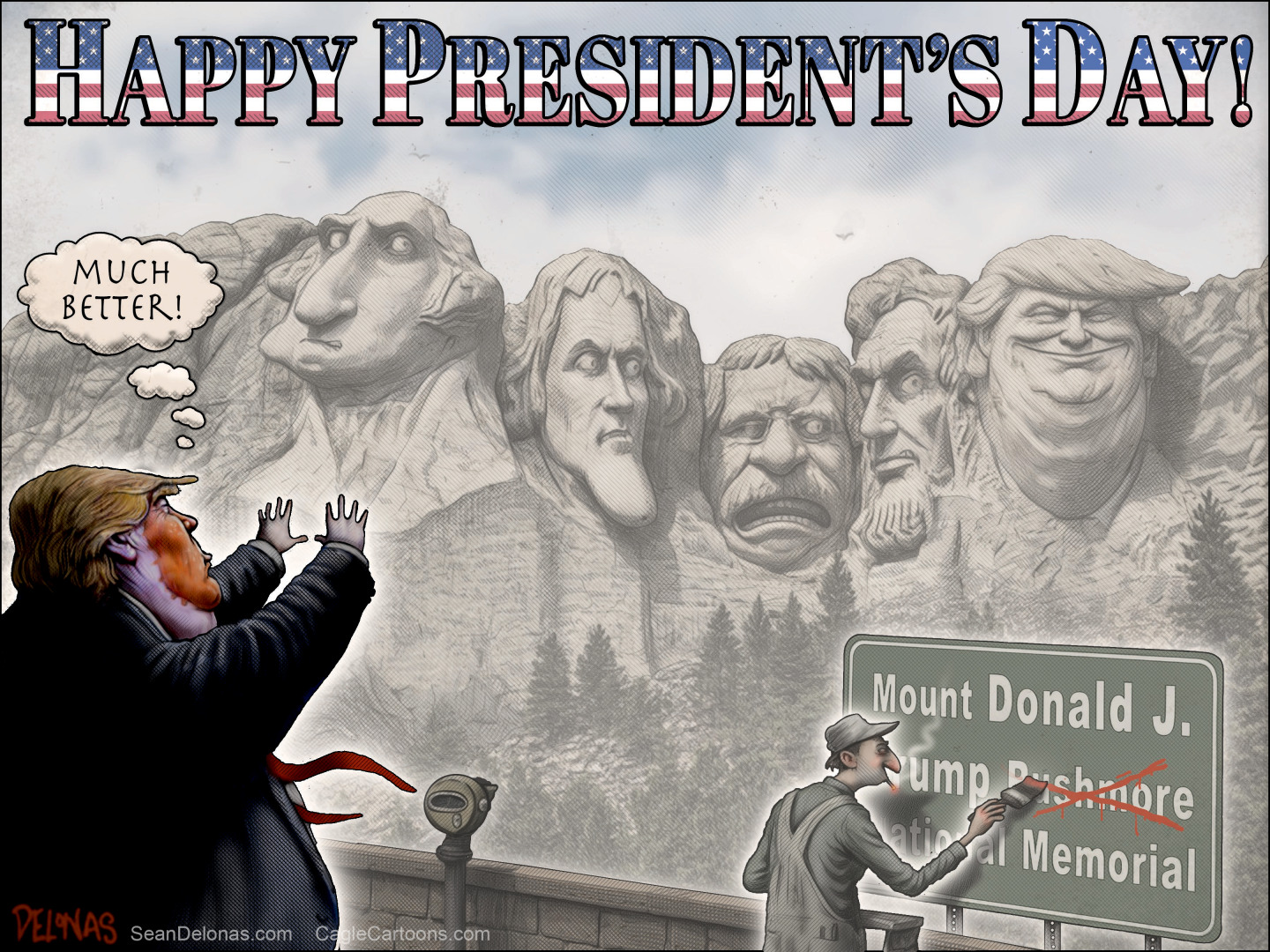

Political cartoons for February 16

Political cartoons for February 16Cartoons Monday’s political cartoons include President's Day, a valentine from the Epstein files, and more

-

Regent Hong Kong: a tranquil haven with a prime waterfront spot

Regent Hong Kong: a tranquil haven with a prime waterfront spotThe Week Recommends The trendy hotel recently underwent an extensive two-year revamp

-

The news at a glance...International

feature International

-

The bottom line

feature Youthful startup founders; High salaries for anesthesiologists; The myth of too much homework; More mothers stay a home; Audiences are down, but box office revenue rises

-

The week at a glance...Americas

feature Americas

-

The news at a glance...United States

feature United States

-

The news at a glance

feature Comcast defends planned TWC merger; Toyota recalls 6.39 million vehicles; Takeda faces $6 billion in damages; American updates loyalty program; Regulators hike leverage ratio

-

The bottom line

feature The rising cost of graduate degrees; NSA surveillance affects tech profits; A glass ceiling for female chefs?; Bonding to a brand name; Generous Wall Street bonuses

-

The news at a glance

feature GM chief faces Congress; FBI targets high-frequency trading; Yellen confirms continued low rates; BofA settles mortgage claims for $9.3B; Apple and Samsung duke it out

-

The week at a glance...International

feature International