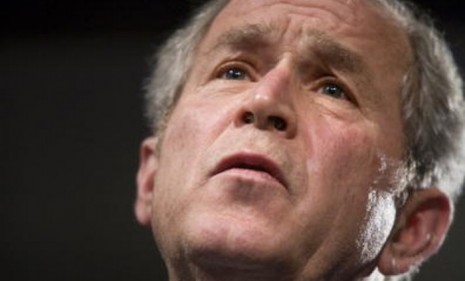

Extending the Bush tax cuts: Who's for it — and against?

Unless Congress acts, the tax cuts from 2001 to 2003 will expire. Here's what both sides are saying in Washington's newest dust-up

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The fate of the so-called "Bush tax cuts" that date back to 2001 and 2003 is prompting intense debate. While President Obama is pushing Congress to extend the cuts aimed at "the middle class," he wants to let the tax breaks that wealthier Americans (individuals earning at least $200,000, couples earning $250,000) expire. Most Republicans want all the tax cuts extended, or made permanent. (Watch Nancy Pelosi give her take.) Here's a rundown of who's for — and against — extending the entire set of Bush tax cuts:

FOR

Mark Zandi, chief economist for Moody's Economy.com

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Argument: Letting the tax cuts for the affluent die now could stunt the economic recovery and send us into a new recession, where our already serious "problems would become overwhelming." The top-tier cuts could perhaps be phased out over three years.

Key quote: "Raising taxes on anyone now, when the economic recovery is so fragile, would be a mistake."

Douglas Holtz-Eakin, former Congressional Budget Office director and McCain 2008 economic adviser

Argument: Business are hurt as much by the uncertainty over tax law as they are by the threat of higher taxes. To drive growth we should extend all the tax cuts permanently and then reform our "disaster" of a tax code.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Key quote: "To date, the debate over the 2001 and 2003 tax laws has been dominated by the tired rhetoric of 'tax cuts for the rich'... Temporary extensions of these [marginal tax rates, dividend taxes and capital gains tax] rates do not resolve the uncertainty over the tax policy outlook, while actual rate increases would have an immediate economic downside and impair the long-run outlook."

Sarah Palin, politician and Fox News commentator

Argument: Letting the tax cuts expire would amount to "the largest tax increase in U.S. history," hitting everyone who pays income tax but especially small businesses, the engine of economic growth.

Key quote: "My palm isn't large enough to have written all my notes down on what this tax increase, what it will result in."

AGAINST

Alan Greenspan, former chairman of the Federal Reserve

Argument: If Washington can't pay for the tax cuts (and it can't), extending any of them would be "disastrous."

Key quote: "I'm very much in favor of tax cuts but not with borrowed money and the problem that we have gotten into in recent years is spending programs with borrowed money, tax cuts with borrowed money. And at the end of the day that proves disastrous."

David Stockman, President Reagan's Office of Management and Budget director

Argument: We're approaching a Greece-style fiscal crisis, and the wealthy can do their part by eating a 3 percentage point tax increase.

Key quote: America's 40-year "debt explosion has resulted not from big spending by the Democrats, but instead the Republican Party's embrace, about three decades ago, of the insidious doctrine that deficits don't matter if they result from tax cuts."

Alan Blinder, Princeton economist and former Fed vice chairman

Argument: There's no good reason to extend the tax cuts for the affluent, and plenty of good reasons to put that pool of tax revenue to work actually helping the economy.

Key quote: "Should the Bush tax cuts be made permanent, extended for a while or allowed to lapse? Actually, I'd prefer a fourth option: that Congress had never enacted them in the first place. We couldn't afford them then (and knew it), and we can't afford them now (and know it)."

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day