Should retirement saving be mandatory?

Democrats and the AARP want private employers to automatically open retirement accounts for new workers. Smart or intrusive?

In a bid to urge more Americans to start saving for retirement, Democrats are preparing a proposal to automatically set up new workers with Individual Retirement Accounts. The policy would only apply to workers at businesses that don't offer 401(k) retirement plans, and employees would be able to opt out. The AARP's Cristina Martin Firvida supports the plan, saying it will help overcome "this inertia that keeps people from taking advantage of saving opportunities." But should the government be pushing people to plan for retirement?

Anything that builds retirement savings is worth considering: Auto-IRA plans might seem like a lot of trouble for little benefit, says Dallas Salisbury of the Employee Benefit Research Institute, as quoted in Investment News. But even if an additional 10 million Americans "are building savings in a changed IRA system," it will boost economic security. This proposal won't solve the retirement crisis, but every little bit helps.

"Automatic IRAs would help retirement security, says Treasury's Iwry"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The government has no business hijacking our paychecks: First President Obama and the Democrats took the liberty of forcing people to buy health insurance, says David C. White at The Political Class, and now they want to force people to contribute to retirement plans? Don't forget, the federal government already takes 7.5 percent of your salary for Social Security, and now Democrats want "even more for an IRA." This "boondoggle" is about feeding "the ever growing blob of federal bureaucracy," not helping retirees.

"Democrats and AARP want to make IRA enrollment automatic"

Automatic saving has been tested, and it works: The bottom line is Americans aren't prepared for retirement, says Walter Hamilton in the Los Angeles Times. Even 13 percent of the wealthy are at risk of running out of savings within 20 years of their last day on the job. "On the bright side," the percentage of early baby boomers in danger of depleting their savings in retirement has fallen from 59 percent in 2003 to 47 percent today, and much of that improvement came thanks to automatic enrollment and other improvement in many companies' 401(k)s. The effectiveness of automatic saving is "what passes for good news in the retirement game these days."

"Even the wealthy can't count on their retirement years being golden"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

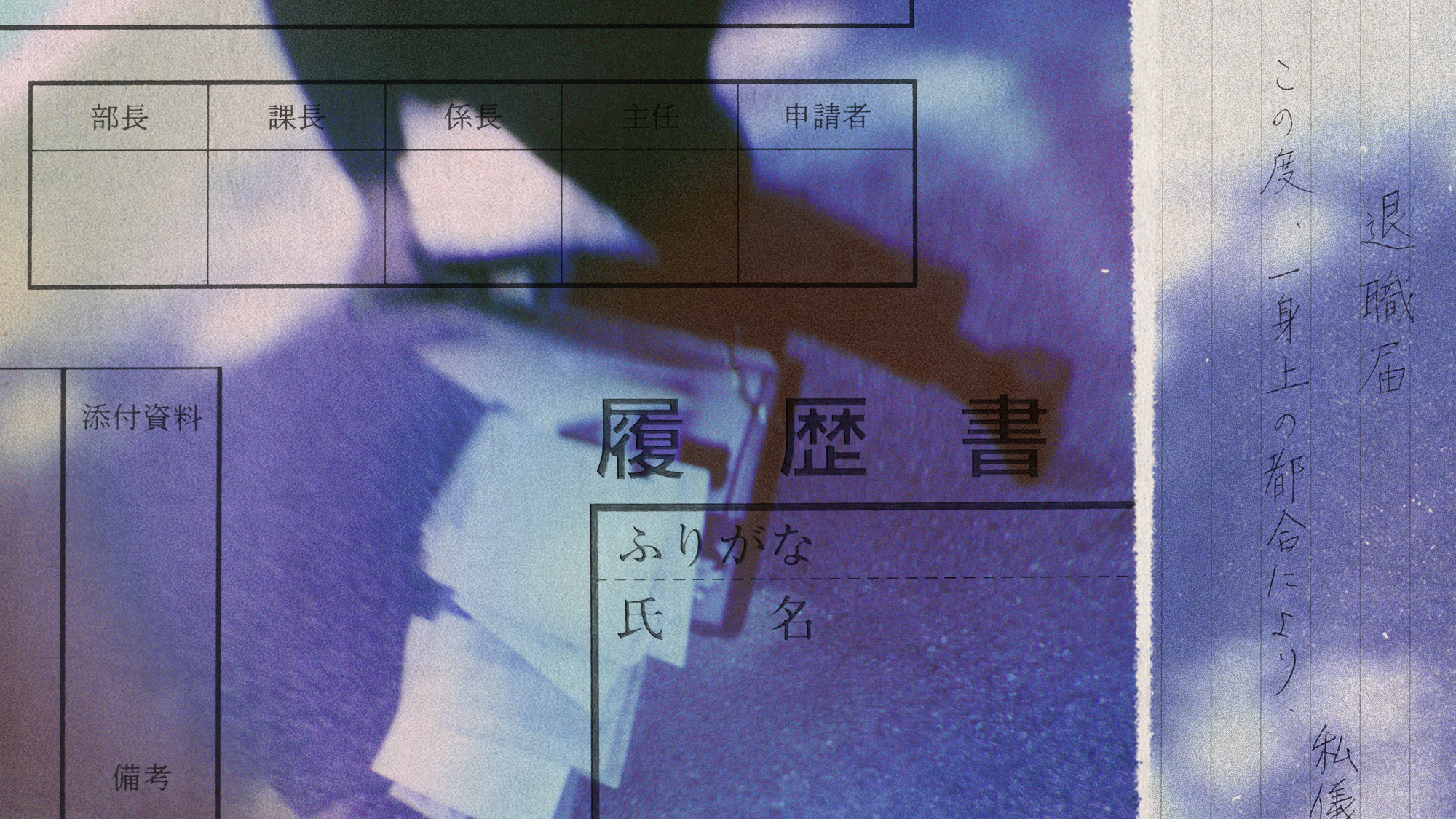

Why quitting your job is so difficult in Japan

Why quitting your job is so difficult in JapanUnder the Radar Reluctance to change job and rise of ‘proxy quitters’ is a reaction to Japan’s ‘rigid’ labour market – but there are signs of change

-

Gavin Newsom and Dr. Oz feud over fraud allegations

Gavin Newsom and Dr. Oz feud over fraud allegationsIn the Spotlight Newsom called Oz’s behavior ‘baseless and racist’

-

‘Admin night’: the TikTok trend turning paperwork into a party

‘Admin night’: the TikTok trend turning paperwork into a partyThe Explainer Grab your friends and make a night of tackling the most boring tasks