Issue of the week: A ‘flash crash’ shakes Wall Street

The Dow Jones industrial average and other major market indices went into free fall last Thursday, and no one can explain why or how the plunge occurred, or what reversed it.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

What the heck happened? asked Jacqueline Doherty in Barron’s. For “a brief but terrifying time,” the Dow Jones industrial average and other major market indices went into free fall last Thursday, with the Dow plummeting almost 1,000 points, before recovering somewhat before the trading day closed. No one can yet explain why or how the plunge occurred, or what reversed it, for that matter. But “like detectives reconstructing a crime scene,” said Ben Steverman in Bloomberg BusinessWeek, regulators are poring over trading records. And in the process, they’re shining a spotlight on an obscure corner of the stock market: so-called off-exchange trading. The New York Stock Exchange, despite popular belief, is no longer the main venue for stock trading in the U.S. Instead, “equity markets have become fragmented among different exchanges and trading platforms,” in which a handful of firms use powerful computers to execute tens of thousands of trades a second. It’s within this murky world of “high-frequency trading” that regulators are seeking the source of last week’s mayhem.

High-frequency traders might not have sparked the rout, said Michael Hiltzik in the Los Angeles Times, but their “turbocharged equipment” certainly accelerated it. When the free fall began, the NYSE deployed “circuit breakers” designed to slow trading and put a floor under falling stock prices. But just as quickly, traders shifted their business to the alternative trading platforms, which don’t employ such safeguards. Those platforms, though, are used by a relatively small number of players, and few of them stepped up as buyers when high-frequency traders flooded the market with sell orders. As a result, valuable stocks like Accenture briefly fell as low as a penny a share. “By any rational standard of market performance, that’s a sin,” and the Securities and Exchange Commission bears a large share of responsibility. The agency has allowed high-frequency trading to grow into a monster that threatens the entire financial system, and it has neither the technology nor the expertise to bring it under control.

The problem, said James Angel in Forbes.com, is that “markets now react in milliseconds to events, but are monitored by humans who respond in minutes.” The way to correct this mismatch is not to slow down the market, “but to speed up our protections.” One solution would be to implement automated circuit breakers that operate simultaneously across every trading venue; these could kick in whenever a stock or index suddenly falls by, say, 5 percent. That would give the humans a chance to step in and restore order. Uniform circuit breakers won’t eliminate the “inevitable trading glitches,” but they could keep them from “cascading into monstrous market meltdowns.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The Week contest: AI bellyaching

The Week contest: AI bellyachingPuzzles and Quizzes

-

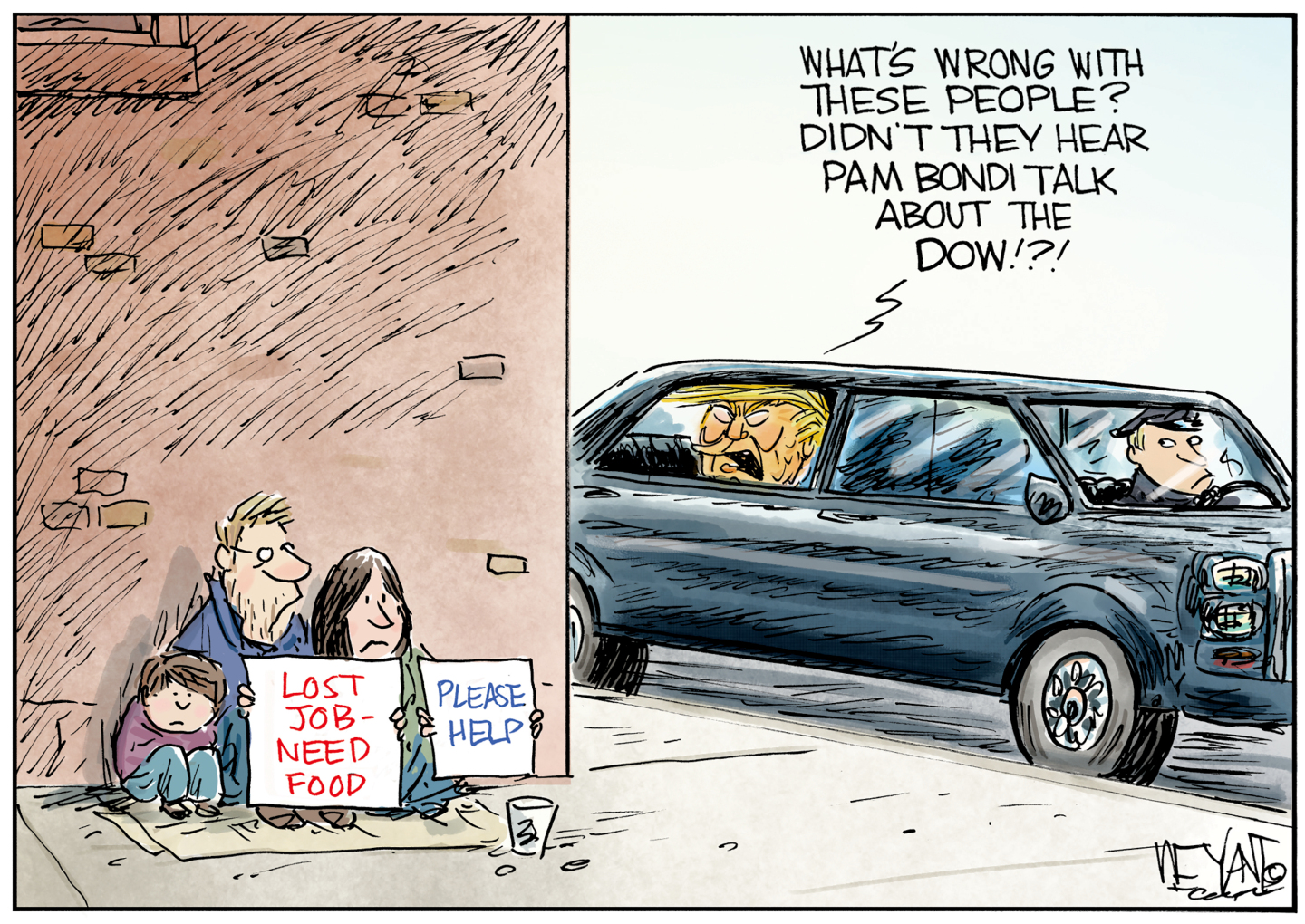

Political cartoons for February 18

Political cartoons for February 18Cartoons Wednesday’s political cartoons include the DOW, human replacement, and more

-

The best music tours to book in 2026

The best music tours to book in 2026The Week Recommends Must-see live shows to catch this year from Lily Allen to Florence + The Machine

-

Issue of the week: Raising the minimum wage

feature How will raising the federal minimum wage from $7.25 to $9 an hour affect the economy?

-

Issue of the week: Breaking up the big banks

feature There’s a growing realization that we need to end the taxpayer guarantees that Dodd-Frank left in place.

-

Issue of the week: The death of daily deals?

feature This is a “winter of discontent” for daily deal companies Groupon and LivingSocial.

-

Issue of the week: CEOs tackle the deficit

feature America’s top business leaders sent Congress an open letter urging immediate action on the $16 trillion national debt.

-

Issue of the week: Does Wall Street need speed limits?

feature High-frequency trading now accounts for as much as 70 percent of market volume.

-

Issue of the week: Victory for a bank watchdog

feature A New York state financial regulator accused a London-based bank of laundering $250 billion for Iran.

-

Issue of the week: A former megabanker’s conversion

feature Sanford Weill, the architect of the modern megabank, now favors the end of too-big-to-fail banks.

-

Issue of the week: Libor scandal rocks banking

feature The interest rate scandal is just beginning and may soon engulf at least a dozen other major banks.