‘Value’ stocks: Wall Street’s blue-light special

Investors have already started combing through the bargain bin, but there are still plenty of deals to be found in value stocks.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Value stocks are the mainstay of many investors, said Jack Hough in SmartMoney. But they lost a lot more than growth stocks did during last year’s sell-off and were slower to recover earlier this year. There’s no hard-and-fast definition for what qualifies as a value stock, since “stocks exist in a spectrum between growth and value, not on either side of a fence.” Yet the Standard & Poor’s Pure Growth and Pure Value indexes provide a convenient gauge. In April, Pure Value stocks jumped 32 percent, suggesting that investors have already started digging through the bargain bin. Still, there are plenty of deals to be had in value stocks.

Some of the best finds are among “punished” industry leaders with strong long-term prospects, said Andrew Leckey in the Chicago Tribune. Microsoft Corp., for example, has been dragged down by lower personal computer sales due to the recession, but it’s still a “software powerhouse.” Pfizer Inc. is another “giant” name recently relegated to the clearance rack. Stock in this cash-rich pharmaceutical maker currently has been priced “as though it is never again going to come out with a new drug,” says Thomas Forester, manager of Forester Value Fund. There are even some safe bargains among financial firms. “Travelers Co. is a conservative insurance company that didn’t swing for the fences with its investments and doesn’t have the same concerns as banks.”

To see what’s truly a deal, look beyond a stock’s price-to-earnings ratio, said Joe Light in Money. Start by comparing the company’s P/E ratio against that of its peers. “Just as shoppers pay different prices for Italian wingtips and flip-flops, the market sets different valuations for different types of firms.” If a stock is underpriced relative to its sector, “either something is wrong with the firm or investors think there is.” The difficult part of value investing is determining whether other investors are, in fact, overreacting. “If you don’t want to do the legwork, there are plenty of portfolios that follow value guidelines.” T. Rowe Price Equity Income and Weitz Hickory, two funds with solid track records, have fees low enough to satisfy the price-conscious investor.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

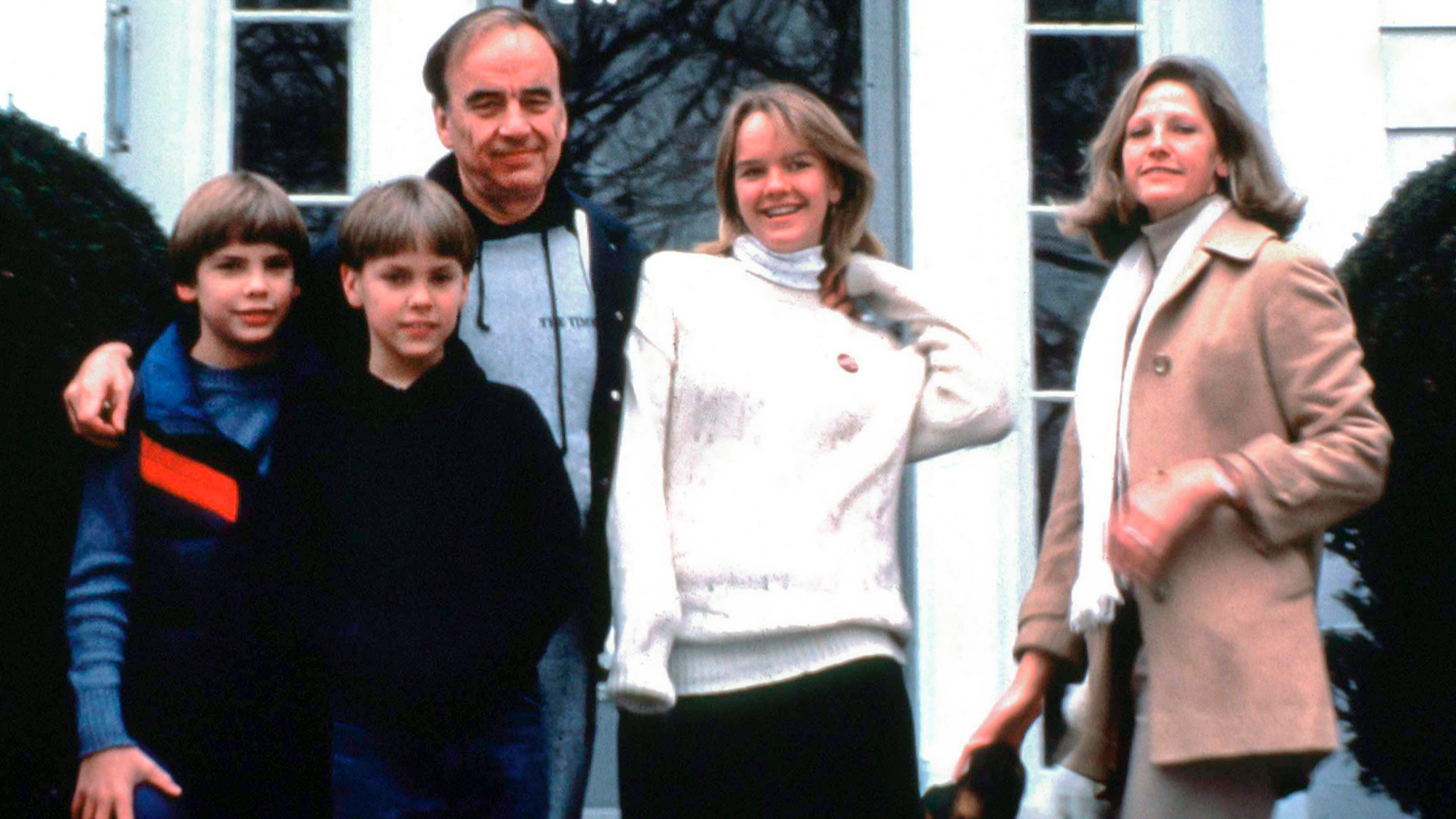

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’

Book reviews: ‘Bonfire of the Murdochs’ and ‘The Typewriter and the Guillotine’Feature New insights into the Murdoch family’s turmoil and a renowned journalist’s time in pre-World War II Paris

-

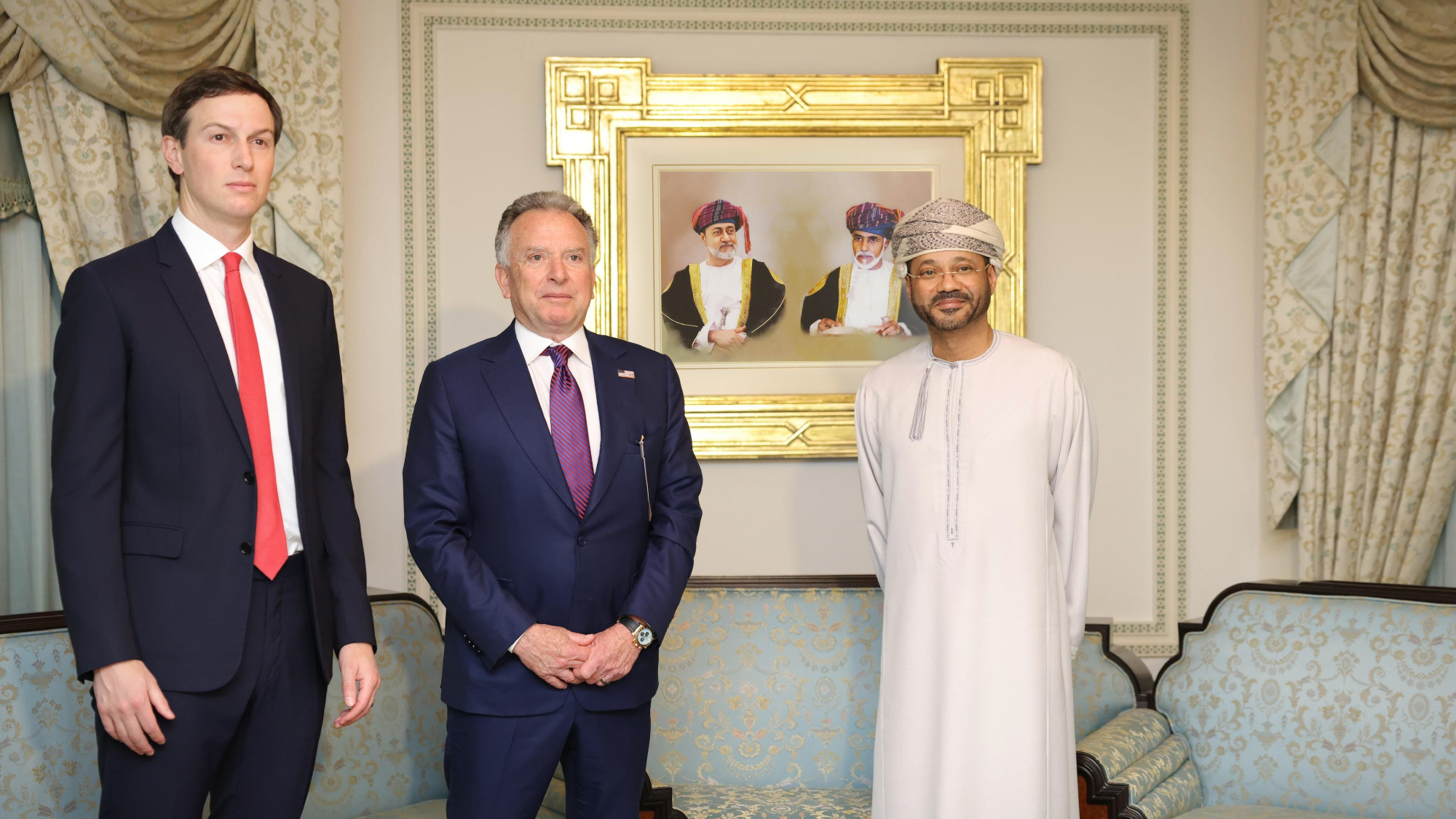

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine