The Internet: Sites to ensure your cash is safe

These sites will tell you the status of federal insurance on all your bank accounts or accounts at credit unions, and show you how to purchase Treasury bonds.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Fdic.gov/EDIE provides the exact status of federal insurance on all your bank accounts. To help allay investors’ fears, the government has temporarily raised Federal Deposit Insurance Corp. coverage to $250,000 per account.

Webapps.ncua.gov/ins serves a similar function for members of credit unions. Like banks, institutions within the National Credit Union Association “are backed by the full faith and credit of the U.S. government.” The site’s Share Insurance Estimator tells you how much deposits in each account are insured for.

Treasurydirect.gov is the Treasury Department’s own site for purchasing ultra-safe Treasury bonds. There’s no fee, and as long as you hold the securities to maturity, you will get your money back—assuming the federal government doesn’t default or restructure its debt.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Source: San Francisco Chronicle

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

What to know before filing your own taxes for the first time

What to know before filing your own taxes for the first timethe explainer Tackle this financial milestone with confidence

-

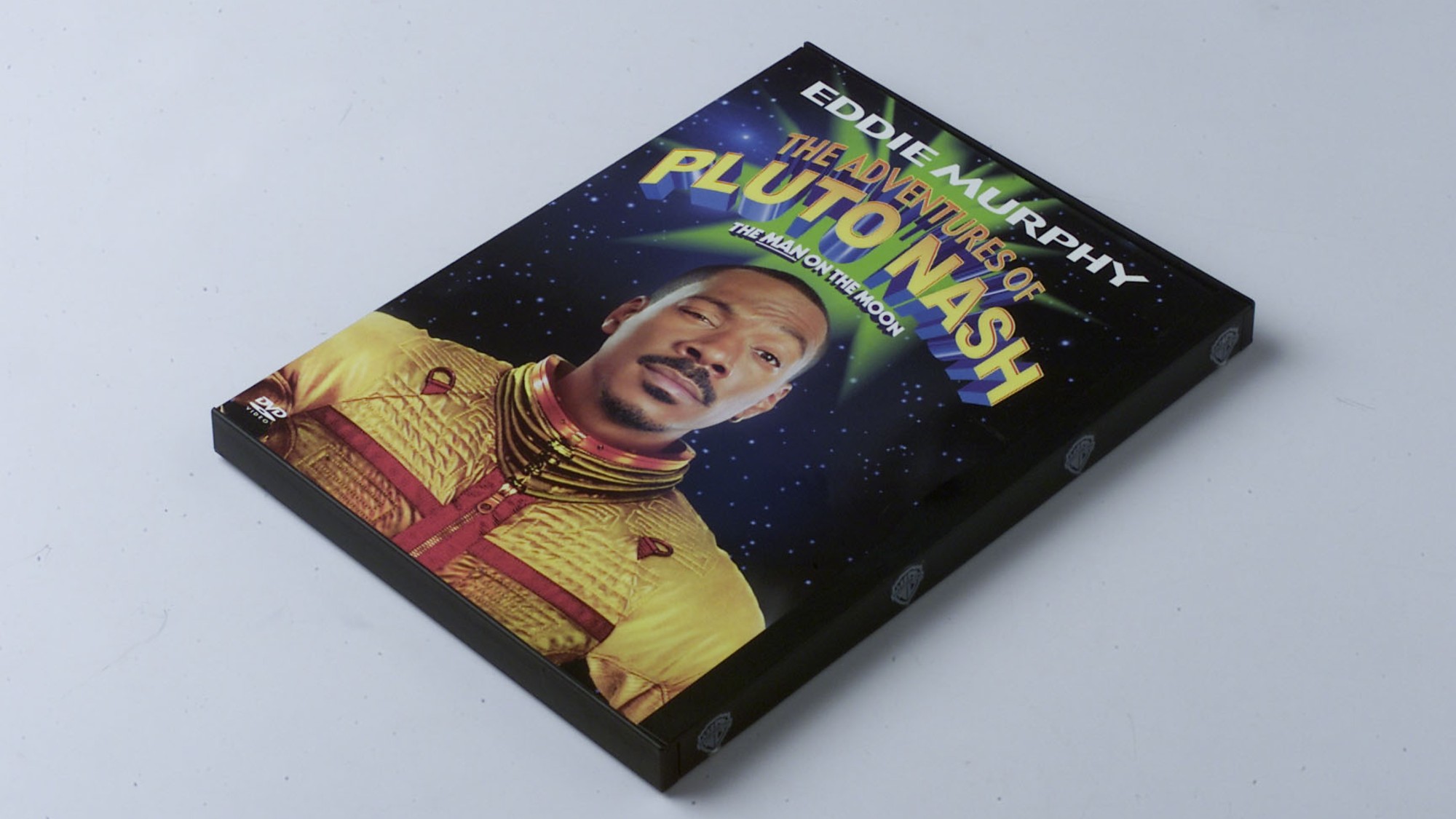

The biggest box office flops of the 21st century

The biggest box office flops of the 21st centuryin depth Unnecessary remakes and turgid, expensive CGI-fests highlight this list of these most notorious box-office losers

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my