Best columns: Reversing mortgages, Giving credit

“The reverse mortgage sounds like a pretty sweet deal,” says Fortune’s Eugenia Levenson in CNNMoney.com, but it has some steep costs. Credit unions have “a kind of sleepy, backwater

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The deceptive benefits of the reverse mortgage

On its surface, “the reverse mortgage sounds like a pretty sweet deal,” says Fortune’s Eugenia Levenson in CNNMoney.com. With these once-marginal, now-popular products for homeowners 62 and older, you don’t make any loan payments until you move, or die, and you won’t lose any money if your house is worth less than what you owe. But reverse mortgages can actually be a very expensive way to borrow. First there’s the “avalanche of up-front charges,” and while basic rates are lower than for home equity loans, reverse mortgages are compounding “rising debt” loans. If you qualify, you’re probably better off with a regular home-equity loan, or you can sell your house and “trade down or rent.”

Credit to credit unions

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Credit unions have “a kind of sleepy, backwater image,” says Brett Arends in The Wall Street Journal. But they actually offer “some surprisingly good deals.” Since they don’t have to make profits for outside shareholders or spend heavily on marketing, and probably don’t “pay their chief executive $10 million while writing off billions in subprime loans,” credit unions often offer lower loan rates and higher deposit rates than commercial banks. If you’re interested , look around for credit unions you can join—most have membership restrictions—look to see if they’re insured by the FDIC-equivalent NCUA, and look at what they offer. You can always “cherry pick” services, like “leaving your checking account at Greedy Bank, Inc.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Switzerland could vote to cap its population

Switzerland could vote to cap its populationUnder the Radar Swiss People’s Party proposes referendum on radical anti-immigration measure to limit residents to 10 million

-

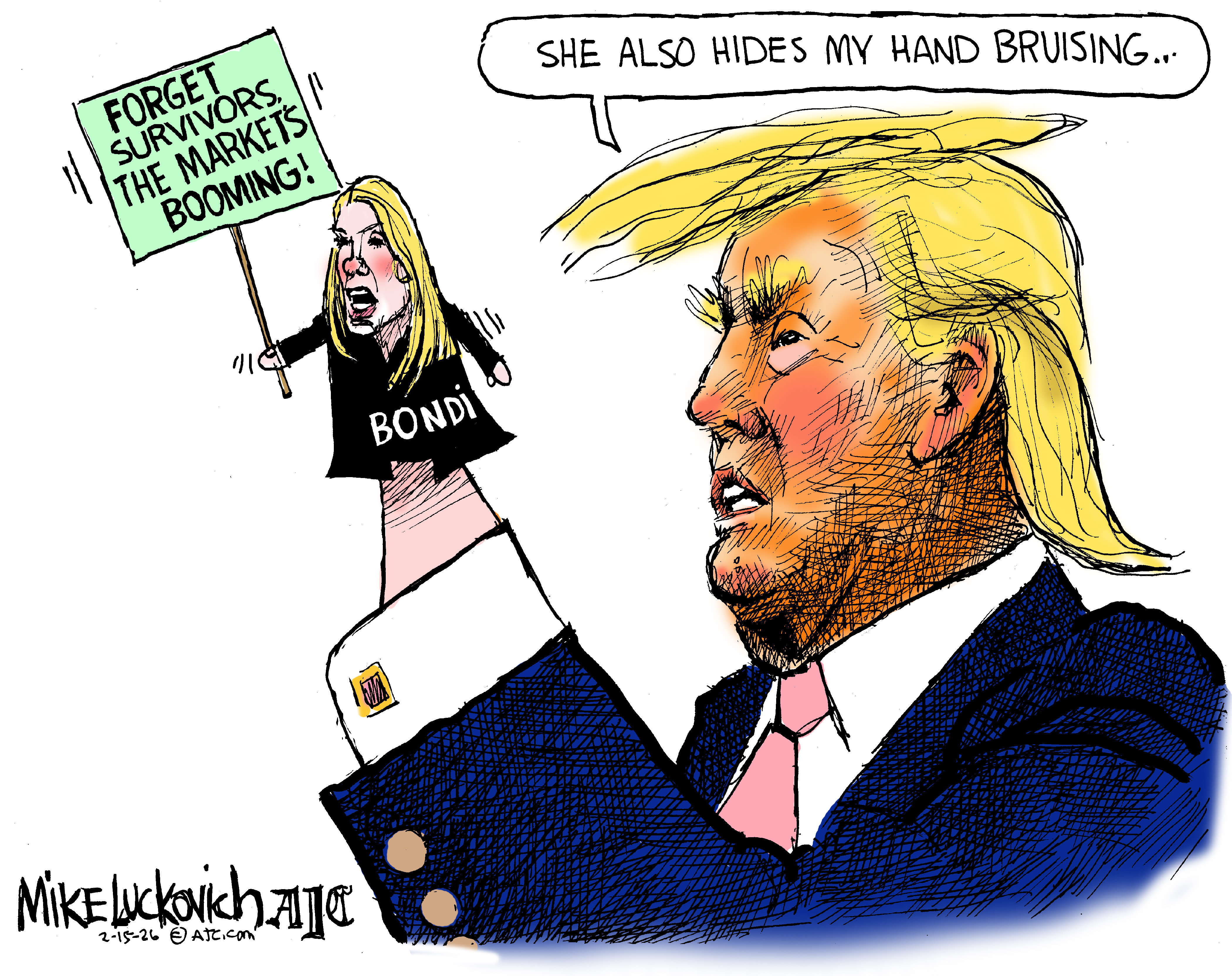

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry