What the experts say

Home equity lenders get stingy; Peak hours for power; Clock ticking for tax savings

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Home equity lenders get stingy

During the housing boom, homeowners had easy access to their home equity via loans and lines of credit, said Jane Hodges in MSNBC.com. Now many homeowners—even those with good credit and low balances on their equity loans—are getting word from lenders that home equity lines are being scaled back or suspended. Home prices have fallen so much that many owners don’t have much equity left to tap. At the same time, lenders are far less willing to risk financing 100 percent or more of a home’s value—a practice not uncommon during real estate’s heyday. “This is the pendulum swing, back to the safe side,” says Richard Hagar, an appraiser at American Home Appraisals in Mercer Island, Wash., and an expert on mortgage fraud. Unfortunately, “there’s not much a consumer can do.”

Peak hours for power

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Jennifer and Richard Marynowski cook dinner a day ahead, so that at 5 p.m. it is ready with a quick zap in the microwave, said Anne Kates Smith in Kiplinger’s Personal Finance. This unusual arrangement is meant to save the family not only time but money—about $250 a year on its electricity bill. Utilities typically charge an averaged rate for electricity, but “now, with new, high-tech meters, families can price their electricity usage down to the hour, giving them plenty of opportunities to conserve when prices rise.” Customers of Commonwealth Edison’s Real Time Pricing program pay $2.25 a month for the meters but can save an average of 9 percent a year by turning off energy hogs when prices are at their peak. Stay tuned for similar deals on your own electricity, as “dozens of other utilities” are testing similar programs.

Clock ticking for tax savings

The April 15 deadline for filing federal taxes is fast approaching, said Asa Fitch in Money. If you haven’t hired an accountant yet, “you and your tax prep software are on your own.” Deductions are your best bet for trimming the tab, so don’t assume it doesn’t make sense to itemize deductions. “Some 63 percent of taxpayers don’t itemize—at their financial peril.” Often-overlooked deductions include moving expenses and in-kind charitable donations. There isn’t a lot you can do to lower this year’s bill, other than scour your files for potential write-offs. But here is one thing that would help: “You can fund an IRA for 2007 until April 15.” Taxpayers under 50 can contribute up to $4,000 a year. Those older than 50 can put aside up to $5,000—assuming, that is, that they don’t run into income limits.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

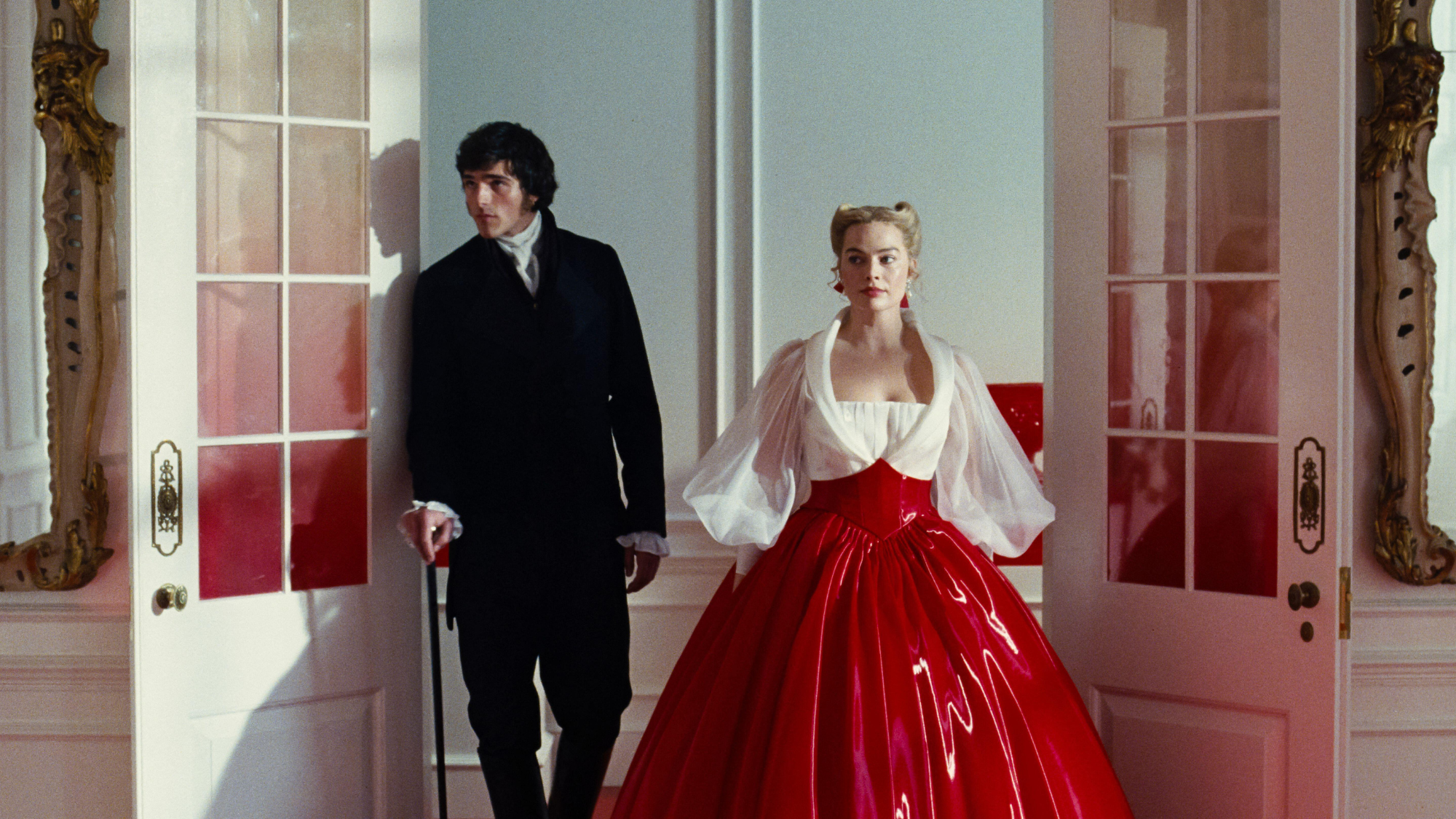

Wuthering Heights: ‘wildly fun’ reinvention of the classic novel lacks depth

Wuthering Heights: ‘wildly fun’ reinvention of the classic novel lacks depthTalking Point Emerald Fennell splits the critics with her sizzling spin on Emily Brontë’s gothic tale

-

Why the Bangladesh election is one to watch

Why the Bangladesh election is one to watchThe Explainer Opposition party has claimed the void left by Sheikh Hasina’s Awami League but Islamist party could yet have a say

-

The world’s most romantic hotels

The world’s most romantic hotelsThe Week Recommends Treetop hideaways, secluded villas and a woodland cabin – perfect settings for Valentine’s Day