Making Money

Real estate: The foreclosure boom

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The number of homes entering into foreclosure hit an all-time high during the second quarter, said Les Christie in CNNmoney.com. According to the Mortgage Bankers Association, 0.65 percent of loans are in foreclosure proceedings, the highest rate in the organization’s 55-year history. Overall, foreclosures are not expected to hit their peak until sometime next year, and if “the housing-market slump deepens, delinquencies and foreclosures could worsen.” Pending foreclosures in Arizona, California, Florida, and Nevada drove the national increase, according to MBA chief economist Doug Duncan. In these formerly red-hot markets, many buyers had purchased homes as a speculative investment, with no intention of actually living in them. “Many investors simply do not have the same level of interest in retaining their properties than do owner-occupiers who have, historically, always strived to keep their properties.”

All those foreclosed mortgages could become bargains for anyone still willing to take a chance on real estate, said Lauren Young in BusinessWeek. “Until lately, most foreclosed properties were snapped up at auction.” But with so many houses currently moving back on the market, you can shop around and save between 5 percent and 15 percent off the market value. A real estate agent who specializes in so-called real estate owned properties, or REOs, can point you toward such properties. (Find one at Nrba.com.) Just make sure you have financing lined up ahead of time. “In this dicey market, not just anyone can swoop in and snag a bargain.”

A few ruthlessly savvy individuals may actually be rooting for more foreclosures, said Kelly Greene in The Wall Street Journal. A “little-known tool known as a self-directed individual retirement account” lets individual investors make direct loans to homeowners using the funds they’ve accumulated for retirement. In effect, they’re providing “bridge loans” to people with dodgy credit. If the borrower can’t pay the loan, the lender gets to take possession of the property, often at a steep discount. Charlie Adams, a Houston investor, has made about 20 such loans over the past decade, typically charging 15 percent interest for one-year loans. “You don’t want them to pay you,” Adams explains. Yet not all of Adams’ fellow private lenders agree, and some may actually prove more forgiving than a bank would. Foreclosure can be an expensive process for both parties, and legal bills and repair fees add up fast. “If I choose to foreclose, I could,” said Dennis Galbraith, who also lives in Houston. “But I’m personally willing to work with the borrowers.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’

-

Kia EV4: a ‘terrifically comfy’ electric car

Kia EV4: a ‘terrifically comfy’ electric carThe Week Recommends The family-friendly vehicle has ‘plush seats’ and generous space

-

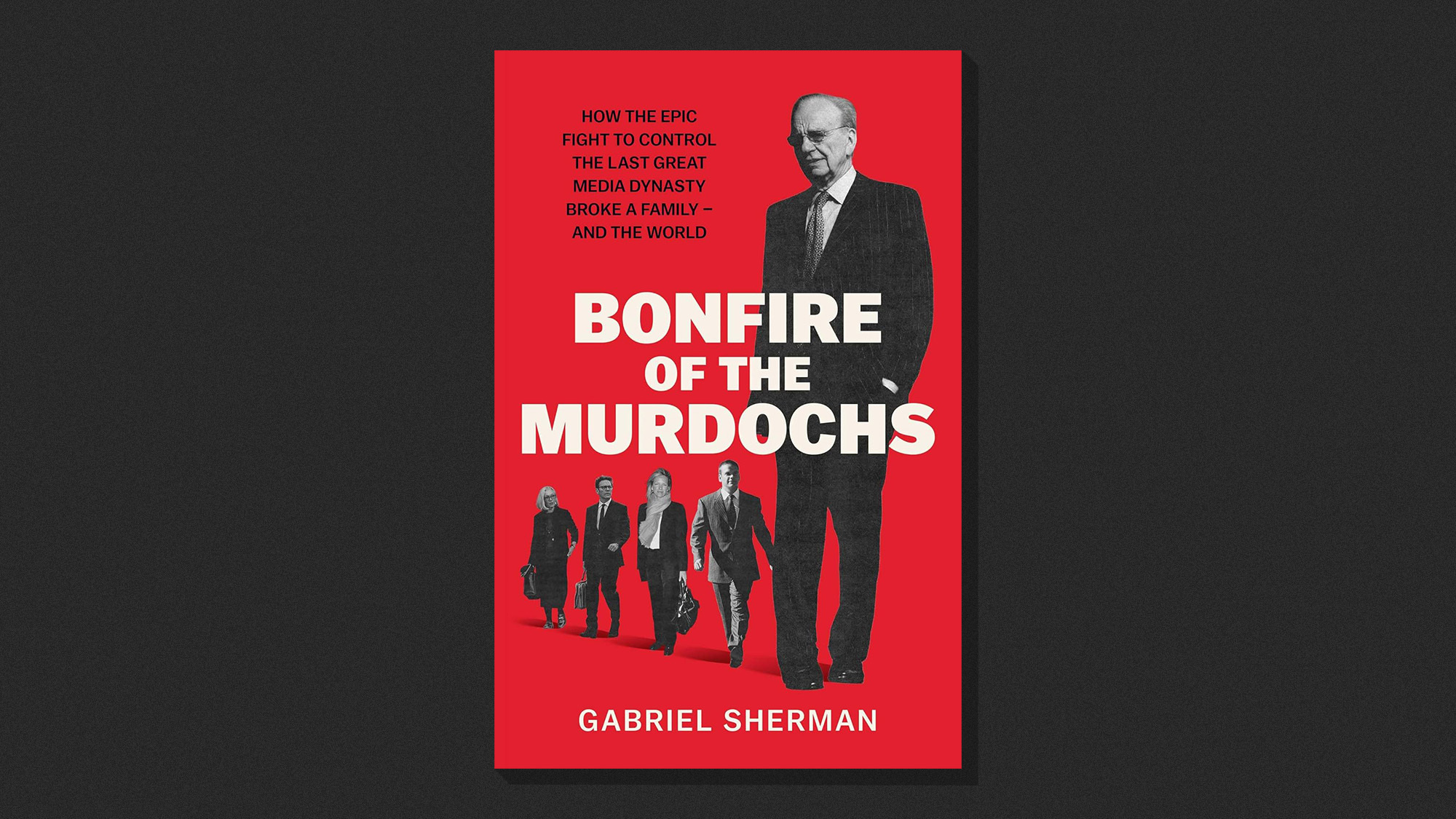

Bonfire of the Murdochs: an ‘utterly gripping’ book

Bonfire of the Murdochs: an ‘utterly gripping’ bookThe Week Recommends Gabriel Sherman examines Rupert Murdoch’s ‘war of succession’ over his media empire