The evil of stock buybacks: How corporations became ATMs for the superwealthy

Corporations are no longer engines for shared prosperity and growth

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

To appreciate the rot at the heart of corporate America, look no further than stock buybacks.

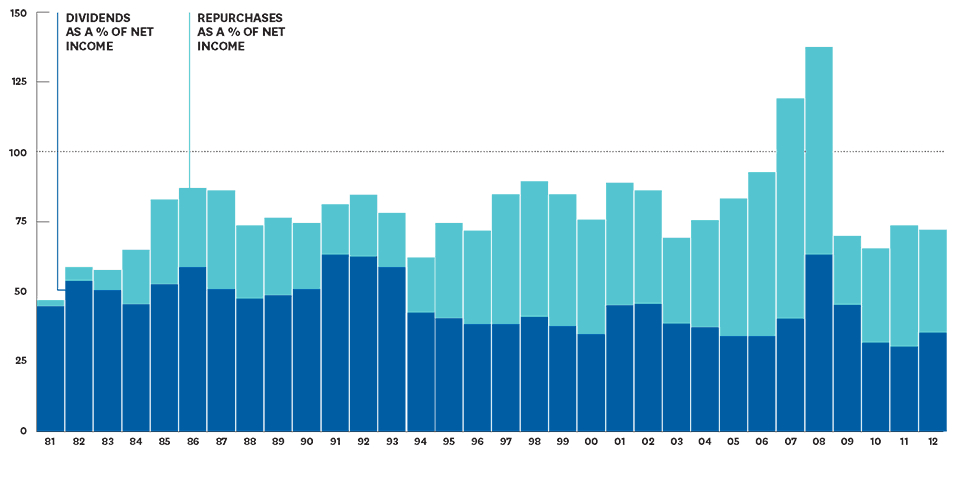

Otherwise known as repurchases, they're instances in which corporations use their profits to buy back their own stocks, resulting in a big payout for shareholders. Prior to 1980, they were a minor occurrence. Since then, buybacks have become a massive phenomena; from 2003 to 2012, the 449 publicly listed companies on the S&P 500 devoted $2.4 trillion — a whopping 54 percent of their earnings — to buybacks.

Unraveling how this happened can provide a key insight into why the American economy remains so broken.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Nick Hanauer wrote a good introductory piece a few days ago. And this deeper dive by William Lazonick in 2014 is worth reading. But the situation, in brief, is this: Selling stocks — or raising equity — is one of the ways corporations can finance new jobs and capacity. The other two routes are borrowing money and using the income they make doing business. What income a corporation doesn't reinvest, it takes it out as profit. Then it can use those profits to do things like pay dividends — the regular payments shareholders get from a business as long as they keep their money invested — or for stock buybacks.

As long as companies are plowing a large share of their income back into new jobs and capacity, they're helping to lower unemployment, increase worker bargaining power, and drive up wages. But the explosion in stock buybacks has created a money firehose, sucking up cash that could go into those new jobs and pumping it out to the country's wealthy elite instead.

It's important to realize that corporations can offer as many or as few stocks on the market as they like. The only limit is supply and demand. So when companies buy them back, the stocks effectively disappear, and the money paid out just churns at the top of the economy instead of going into growth. The buybacks also raise companies' earnings per share, making them effectively a form of stock market manipulation.

Hanauer and Lazonick both attribute the buyback frenzy to a rule change instituted by the Securities and Exchange Commission in 1982, which made the definition of stock manipulation more lenient and opened the regulatory doors to more buybacks. And that's certainly a big part of the story.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

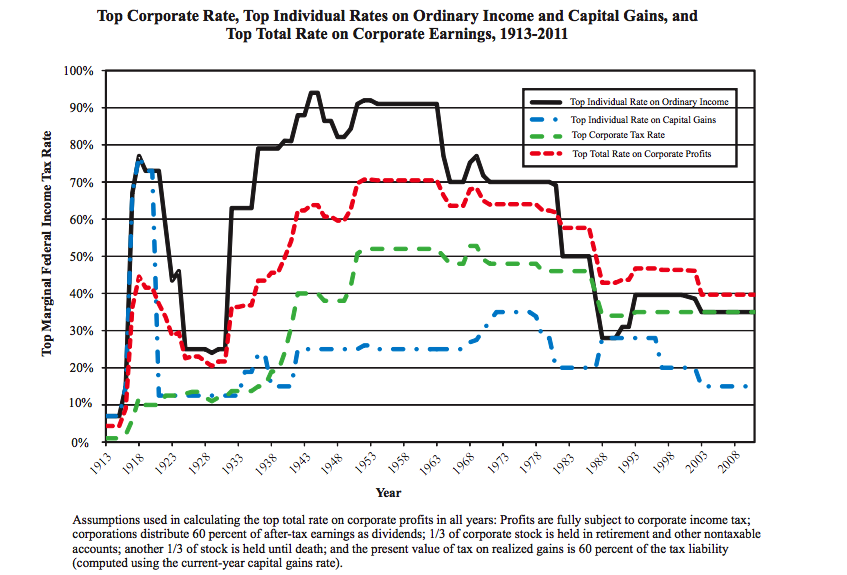

But also important is the way tax changes over the last few decades increased both the supply of and demand for buybacks.

This involves several moving parts: corporate taxes, short-term capital gains taxes, long-term capital gains taxes, and dividend taxes. Capital gains are what investors get when they sell off a stock, including to a corporation in a stock buyback. "Short-term" means capital gains from an investment that lasted less than a year after it was sold off — these have traditionally been taxed as ordinary income, so the standard progressive income tax brackets apply. Long-term capital gains, however, have traditionally been taxed at a special lower rate, currently no higher than 20 percent.

The argument for keeping the long-term rate low — and it's a fair one — is it encourages long-term investment.

Dividend taxes have been all over the place — some taxed as ordinary income, some as long-term capital gains, with changes over time. Again, the argument for keeping dividend taxes low is that you're encouraging investors to keep their money parked in one place for a while rather than make a quick buck.

Finally, there's the tax rate on corporate income, and this is where things get interesting. Critics argue that taxing corporate income and taxing dividends amounts to "double taxation" because you're hitting the same stream of revenue twice. But a high corporate tax rate also encourages business to reinvest as much of their income as possible in new jobs and capacity, growing the economy. Because as long as they do that, they're not taking the income as profit, and they won't pay the tax on it.

But the United States' corporate tax rate is high in name only. It's shot through with loopholes, so the actual amount of money companies pay can be quite lower, and even the headline rate has dropped considerably since the 1960s.

Think of these various taxes as a series of financial walls that channel the flow of money through corporations and back into economic growth, more jobs, and shared prosperity. Since 1980, we've broken those walls down, creating a feeding frenzy — a massive disgorging of corporate cash to the elite at the expense of American workers.

The crucial thing to realize here is that how you adjust the dials compared with one another matters. You don't want dividend and long-term capital gains taxes so high they discourage investment, yet not so low they let inequality run rampant. But more important, you want to keep the wall of either the capital gains tax or the corporate tax high enough to drive money into reinvestment and growth.

As it stands, investors are plenty incentivized to buy stocks, and corporations are incentivized to make those stocks pay off. But we’ve broken the mechanism that makes sure that exchange leads to the actual creation of jobs and capacity.

As for CEOs, they've been roped into supporting this trend through changes to corporate governance law, and the fact that two-thirds of their compensation in the last decade has come via stocks and options. Meanwhile, carve-outs in the corporate tax rate make business financing via debt much cheaper than business financing via equity. So companies have been borrowing more since the 1980s to provide capital, while shareholders have, on balance, actually been extracting capital from companies.

All this should make it clearer why the stock market seems to keep performing fine even as the economy barely sputters along: Corporate stock performance has entirely disengaged from the underlying health of the economy.

Business investment has ticked down noticeably from midcentury. Research and development spending is down since the 1980s. Corporate profits are way up, CEO compensation has taken off, inequality is up, wages have stagnated and disengaged from productivity, and the share of total income that goes to workers is at a historic low.

We've dismantled corporations' role as engines for shared prosperity and growth, and turned them into ATMs for the wealthy.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.