Why China's stock market slide is (probably) a big nothingburger

The fate of wealthy investors is not the fate of an entire economy

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

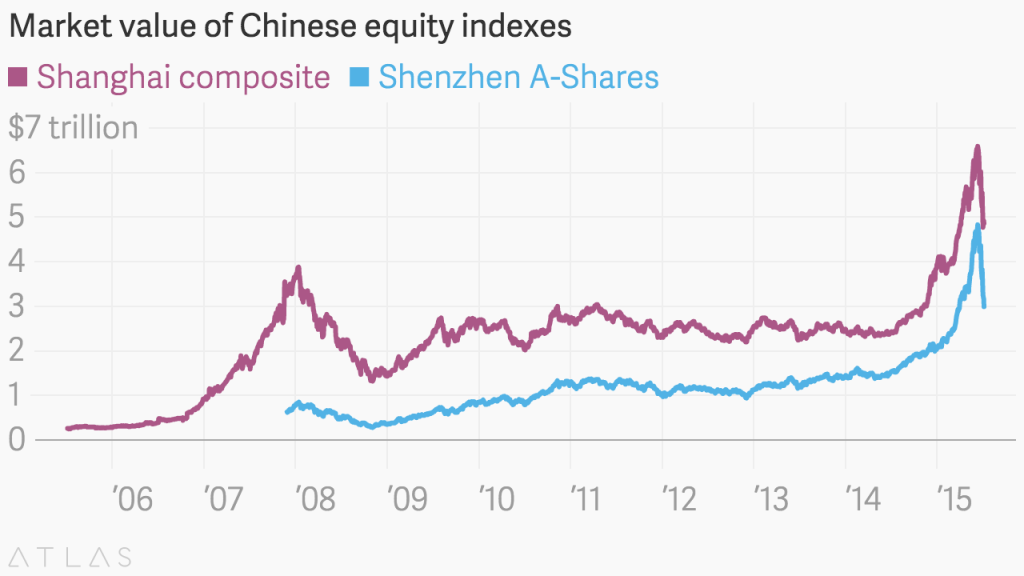

In the last few weeks, the world's second-largest economy has been looking a might bit shaky. After a remarkable run-up that began in mid-2014, China's stock market fell like a rock, losing roughly a third of its value in three weeks. The main Shanghai and Hong Kong indexes both fell 6 percent on Wednesday alone.

The Chinese government has moved away from flat-out communism in recent decades, to a kind of state-run capitalism that would be anathema here in America. And what's especially remarkable is the way the government has thrown the kitchen sink at the problem, from stock buy-ups to massive freezing of stock trades — all to no avail.

The Japanese, Australian, and South Korean stock markets appeared to drop in response, and U.S. stocks were down 1.5 percent on Wednesday.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So, is it time to panic?

Well, first we need to review a few fundamentals, and remember just what a stock market is: namely, a place for buying and selling claims to the surplus revenue companies earn over and above what's needed to pay their expenses. Stock markets don't technically need to exist. Lots of companies get by just fine without offering up ownership shares to be bought and traded by the public. In both America and China, such offerings — known as equity financing — make up a very small portion of how most companies finance themselves. (The best argument for stock markets is probably that they provide needed financing at particular moments in a company's life-cycle.)

So the ups and downs of the stock market are one thing; the health of the actual economy that provides people goods and services and jobs is another. The two aren't always entangled.

For instance, the stock run-up and subsequent burst that preceded America's 2001 recession was enormous. But the stock collapse that accompanied the Great Recession was relatively mild by comparison. It's just that what lay at the bottom of the latter was a massive evaporation of wealth that millions of everyday Americans thought they had. That's the sort of thing that turns a financial sector crisis into a nation-wide depression.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But if we widen our gaze to the long-term, the current slide looks like a return towards modest-but-healthy normalcy after the freak bull market of 2014.

(Graph courtesy of Quartz.)

The Chinese government has been encouraging its citizens to invest more in the stock market as of late. But shareholders are mostly confined to the country's upper class, which is better positioned to take the hit. As Nomura's analysts pointed out, by way of the Financial Times, Chinese households also save a lot more than people in other countries, and stocks represent less than 15 percent of their financial assets. So that should cushion the blow from any wealth loss. (Americans, by comparisons, had enormous amounts of their wealth tied up in the housing market alone.)

Now, one aspect of the problem is that Chinese corporations and the Chinese upper class alike have been taking out more loans using stock as collateral. So when stock prices bust, credit is driven down, which further depresses stock prices, and around and around we go. But even here, only about 1 percent of loans to Chinese companies are backed by other company stock, and they constitute a very small portion of all the loans banks have made in the Chinese economy.

Finally, a fair amount of the equity that's at risk is also held by the central Chinese government, local governments, or state-run corporations. The government still has plenty of room to borrow — yields on Chinese debt have ticked up, but are still below the underwhelming threshold of 2 percent — and of course it controls the currency. China boasts a safety net with unemployment insurance, near-universal public health insurance, and tens and even hundreds of millions of Chinese citizens enjoy public pensions and some sort of minimum income guarantee. So those institutions are better positioned to absorb those shocks.

Now, China's well-to-do provide big tourism business in places like Los Angeles, New York City, and London. They've also been pumping a lot of cash into property markets in many of those same areas. They pay to send their kids to foreign schools, and they buy 12 percent of the world's luxury goods.

So it's not impossible to find links between China's stock market and its real economy that could plausibly result in damage, and even spread to the West and the States. But the U.S. upper class is spending as formidably as anyone. Whatever you make of Chinese economic policy on the merits, there aren't a lot of obvious ways the current stock market downturn could yank the bottom out from under China's economy the way the housing bust did here in America.

The routes by which this could lead to disaster are there, but they're sketchy. Mostly this looks like a painful potential haircut for high-end Chinese investors and high-end industries there and elsewhere. And really, that's mostly all the ups and downs of the stock market ever amount to.

The CNBC crowd has a lot of money, and thus a lot of social capital, and thus their own channel from which to broadcast their occasional panic attacks whenever the prospect of buying a second yacht slips from their grasp. They'd like you to think their outsized cultural bullhorn equals an outsized importance in the real economy, because then they can scare everyone with just-so stories about how all the jobs will go away if their taxes go up or regulations increase or some other such blarney. But by and large wealthy investors' fate is not everyone else's fate.

And it's always worth keeping that in mind.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.