Why the car sales boom won't last

Sorry, Detroit: Don't start popping the champagne just yet

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

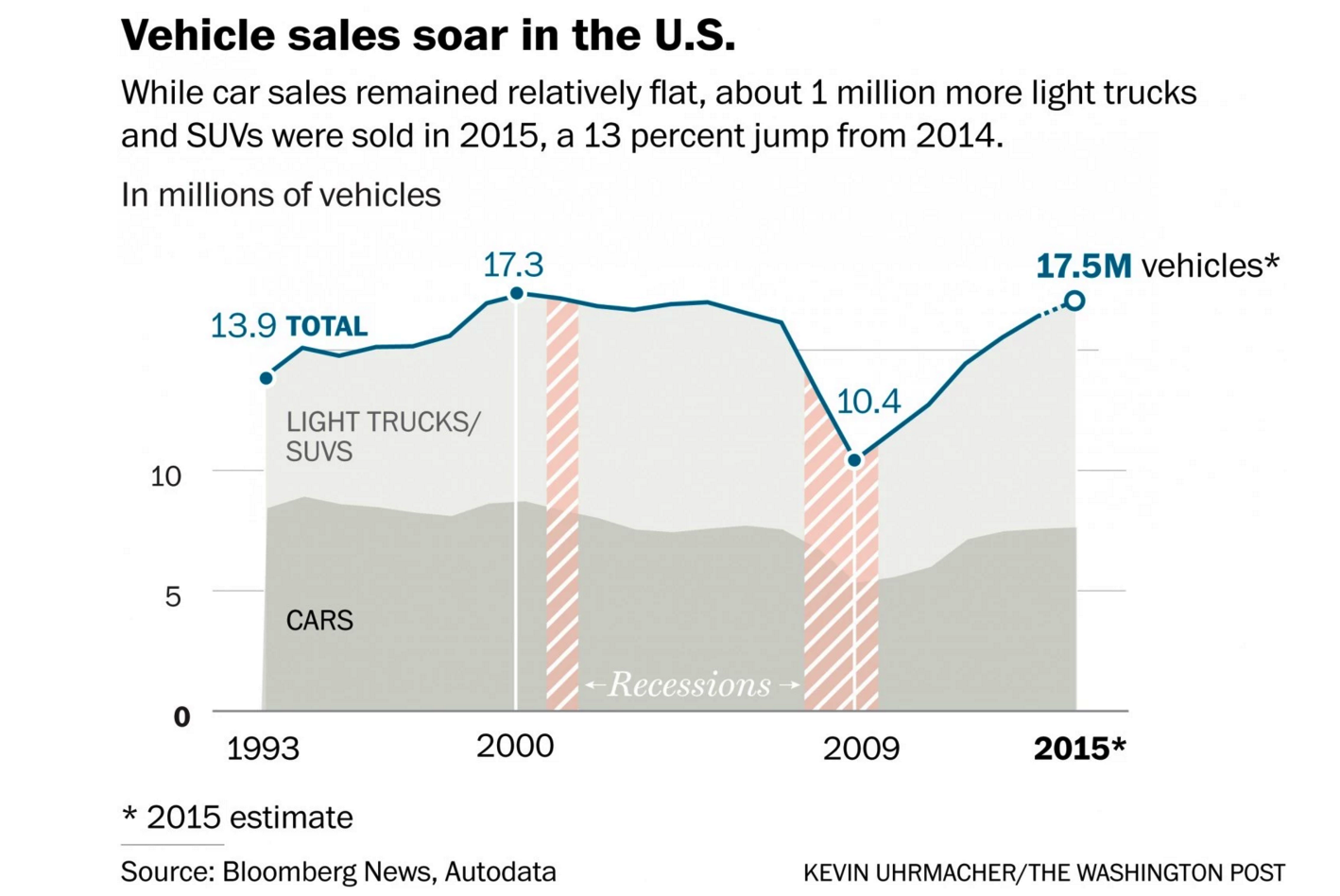

U.S. automobile sales are headed for an all-time high for 2015. Automakers announced on Tuesday that December had pushed sales for 2015 to roughly 17.5 million cars and trucks, breaking past the previous record of 17.3 million set in 2000. Every auto manufacturer (other than Volkswagen) enjoyed record sales in 2015 — Chrysler's sales rose 7 percent, and Ford and GM rose 5 percent — and the whole industry has been on an almost unprecedented 6-year growth streak.

So, time to break out the champagne? (Or the petrol, or whatever?) Well, not exactly.

Certainly, it's a massive improvement over the depths of 2009, when the Great Recession drove sales down to 10.4 million. There's no way this kind of bounce-back could have occurred without rising strength in the economy: more jobs, higher incomes, and more people and families feeling secure in their homes and livelihoods. Improving technology has also played a role, as everything from automatic braking using proximity sensors to cameras that show you where you're going when you reverse has become cheaper and more pervasive.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But the fact that it is a bounce-back also puts things in context: This isn't an all-new burst so much as a return to form.

One aspect of the Great Recession's aftermath is that Americans have been going much longer without buying new cars. They're keeping the ones they already own, so the average age of the U.S. car was now grown to a unusual high of 11 years. “Cars on the roads today are the oldest they’ve ever been... and if people are employed, they feel more comfortable taking on loans for a car,” Michelle Krebs, a senior analyst at AutoTrader.com, told The Washington Post. Throw in the improved access to technological features, "and they’re willing to pay for them." So since 2008 there's been a huge backlog of people who could use a new car, but haven't been in a position to buy one. Now that the economy is improving, they're flooding back into the market. As sales returned to the pre-Great-Recession trend, we were basically guaranteed a temporary overshoot, as that backlog worked itself out.

There are other interesting wrinkles too.

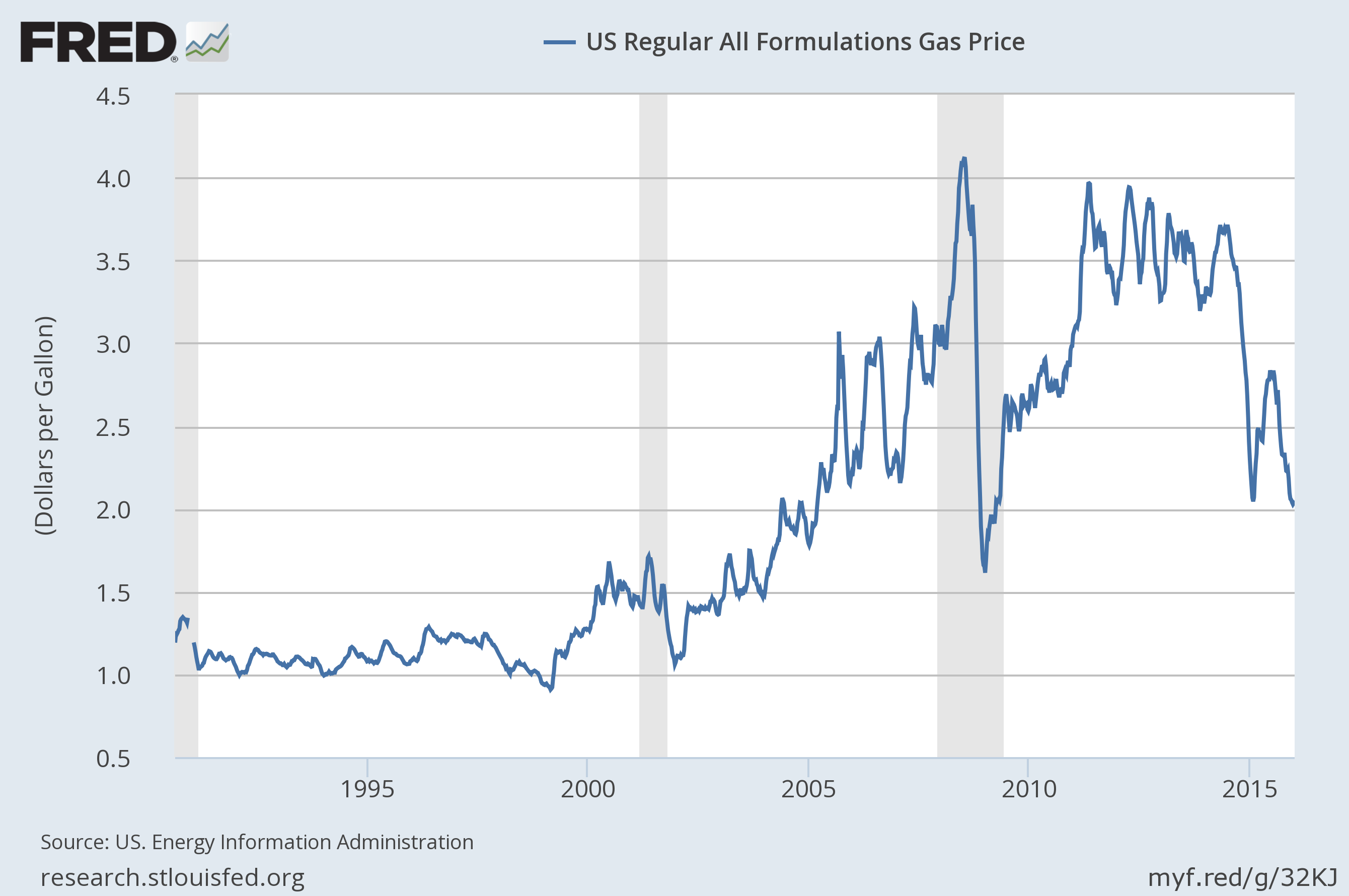

The price of gas collapsed in mid-2014, from around $3.50 to around $2.00 today. That's certainly helped push auto sales higher than they otherwise would go.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Moreover, the plateau in annual car sales that hit between the previous peak in 2000 and the crash in 2009 coincided with the initial run-up in gas prices. The economics of the global oil market are such that gas prices will eventually move back to the $3.50 range, though it may take a few years. Once it does, that will put downward pressure on auto sales as well.

Then there's the Federal Reserve's recent decision to begin inching interest rates back up. Rock bottom rates since 2008 have made auto loans widely affordable, which boosted vehicle sales. Now, the overall interest rates on auto loans have been falling for three decades straight, and historically it's taken considerably larger hikes to affect auto loan rates than what the Fed delivered in December. But the Fed's long-term plan is to get overall interest rates in the economy back to 3.5 percent or so. Which, again, will apply some degree of downward pressure on auto sales.

But there's also leasing — where you never buy the car, you just rent the use of it for an extended period, usually a few years. It has the advantage of lower up-front costs, since there's no initial down payment. Leasing accounted for a whopping 29 percent of all new retail car sales in America in 2015 — up from 27 percent in 2014, and just 16.6 percent a decade ago.

So to some extent the recovery in auto sales has been driven by a broader economic recovery in jobs and incomes. But a good portion of it has also been driven by new ways people get financing for an auto purchase — or some other form of access to car usage — when they otherwise couldn't afford it. This makes sense: Wage growth has been plodding and scant since the Great Recession, and the average price of a car actually ticked up slightly, from $32,386 in 2014 to $33,188 in 2015.

Finally, you can't really talk about automobile sales without at least mentioning environmental concerns. The Obama Administration ratcheted up fuel economy standards, and in particular closed a few regulatory loopholes that allowed some forms of SUVs and trucks to get away with lower gas mileage. As a result, U.S. vehicles overall are converging in terms of mileage standards, which — along with lower vehicle costs — are why lighter SUV models have grown so much as a portion of overall auto sales.

But overall, the average fuel efficiency of all passenger vehicles sold in the U.S. fell slightly in 2015, to 25 miles per gallon, even as gas consumption rose. U.S. sales of fully electric vehicles and plug-in hybrids also stagnated in 2015, at a bit under 100,000. That was after they rose from roughly 50,000 in 2012 to well over 100,000 in 2014. The greater availability of financing, the lower gas prices, and the overall growth in sales may be good news for technical economic figures, but they're also making lower fuel consumption less of a priority for consumers. This will make it hard to hit the White House's 2025 goal of 54.5 miles per gallon on average.

So while a record year for U.S. sales understandably sounds like good news, it's almost certainly a passing thing. Soon enough the forces in the economy will rebalance, and we'll probably return to something akin to the 2000-to-2008 trend line.

In the meantime, if we're driving less, and relying more on public transit, forms of ride starting, and telecommuting, the planet will probably thank us.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

6 exquisite homes with vast acreage

6 exquisite homes with vast acreageFeature Featuring an off-the-grid contemporary home in New Mexico and lakefront farmhouse in Massachusetts

-

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’Feature An inconvenient love torments a would-be couple, a gonzo time traveler seeks to save humanity from AI, and a father’s desperate search goes deeply sideways

-

Political cartoons for February 16

Political cartoons for February 16Cartoons Monday’s political cartoons include President's Day, a valentine from the Epstein files, and more