Why interest rate hikes are a crummy way to pop financial bubbles

This hot new idea is just a bad new idea

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Most arguments over what the Federal Reserve should do with interest rates hinge on the risks of inflation versus the need for more job and wage growth. Higher interest rates mean less risk of inflation, but also less job and wage growth. Lower rates mean more risk of inflation, but also more job and wage growth.

But there's another newly popular argument for higher interest rates: popping asset bubbles before they get dangerously big. The idea is that lower interest rates make risky behavior more attractive. And risky behavior leads to bubbles. So if you raise interest rates, you prevent bubbly behavior.

Starting in 2013, Jeremy Stein championed this argument as a member of the Fed's board of governors. Kansas City Fed President Esther George was calling for higher interest rates to prevent bubbles as recently as April.

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But a new paper from Josh Bivens, director of research and policy at the Economic Policy Institute, and Dean Baker, co-director for the Center for Economic and Policy Research, suggests that interest rates aren't a good tool for popping bubbles at all.

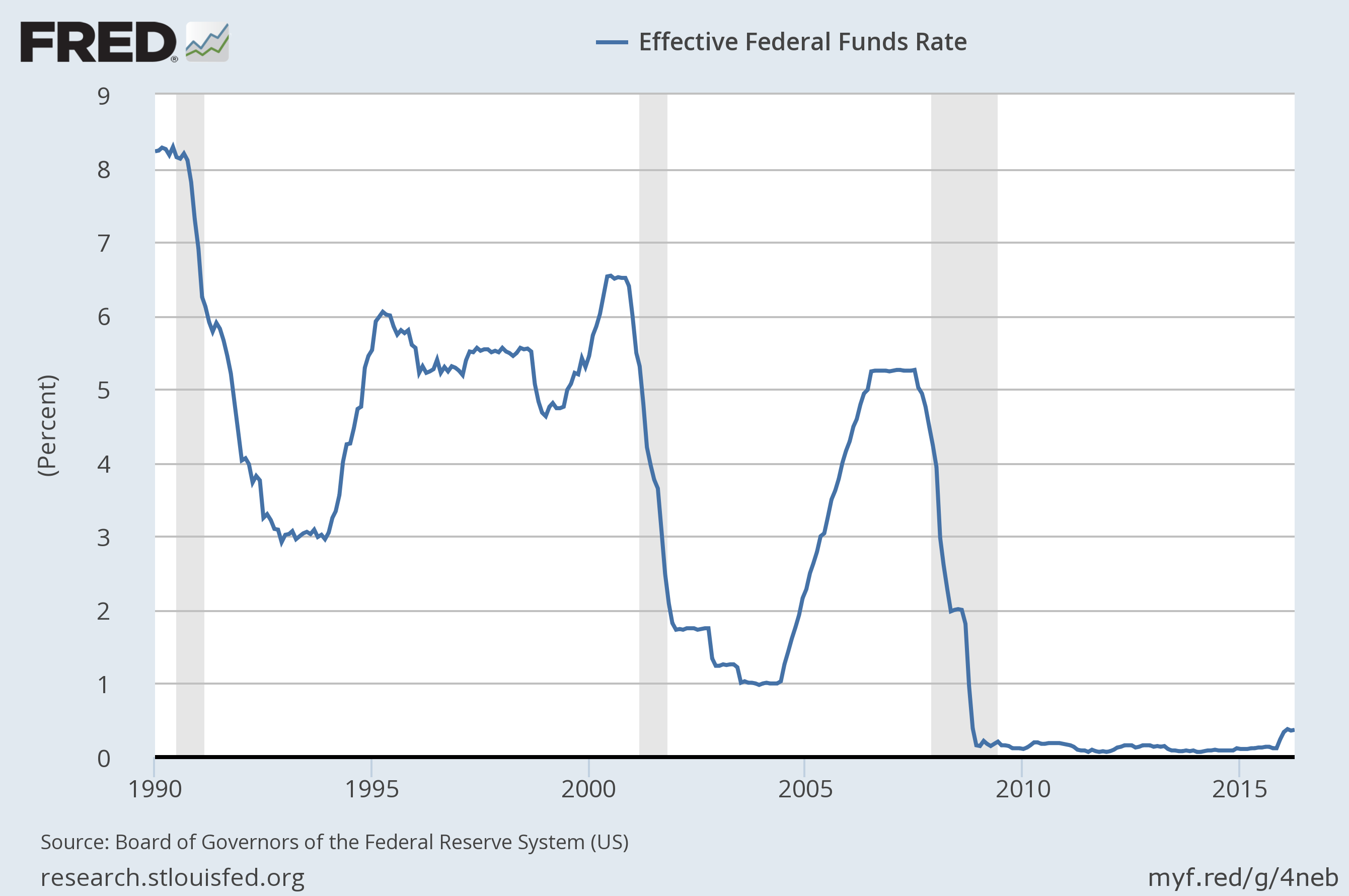

Consider the housing bubble: Home prices started rising in the late 1990s when the Fed's interest rate target was quite high — around 5 or 6 percent — as you can see in the graph below. Home prices kept rising in the early 2000s, when interest rates dropped. And then house prices just kept rising even as the Fed hiked interest rates back up. Where's the correlation between the housing bubble and interest rates? Oh, there isn't one.

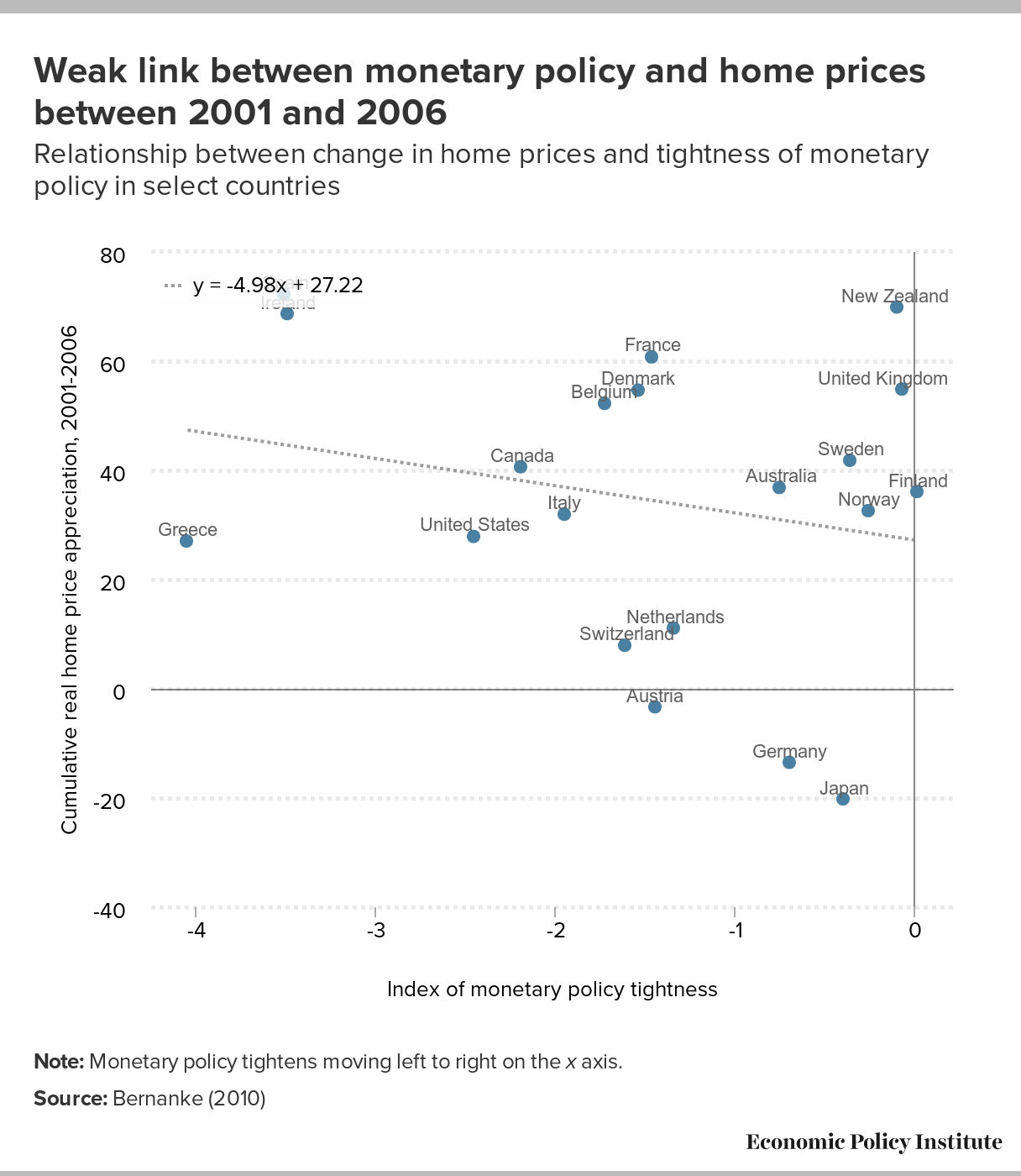

Or consider the experience of other countries, which you can see in the graph below. The vertical axis tracks the cumulative rise in housing prices, and the horizontal axis tracks monetary policy tightness — getting tighter as you move to the right. There's a little bit of a relationship between higher rates and a lower total increase in prices, but it's pretty weak.

"The housing bubble was an international phenomenon," Bivens tells The Week. "You had a lot of different countries with quite different monetary policy tightness see very large increases in home prices. So it's a little hard to say it was all about the interest rates."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

And then there's the issue of collateral damage. Higher interest rates slow down job growth. And really high interest rates drive the economy into recession. When the Fed hiked its target to over 17 percent to kill inflation in the early '80s, it created a short-but-massive recession where unemployment briefly hit 10 percent. Jacking up interest rates to pop bubbles would have much the same effect. Bivens and Baker estimate interest rates would've needed to hit at least 10 percent in the mid-2000s to deflate the housing bubble.

Now, you could make an argument that the collateral damage would be worth it if interest rates were the only tool at the Fed's disposal. But they aren't. America's central bank also has considerable regulatory powers, and it even has more informal or diplomatic abilities to guide financial markets.

For instance, the Fed has the power to run stress tests on banks and financial institutions to force them to acknowledge if they've got possible asset bubbles on their books. It can raise capital requirements so those firms have bigger equity cushions against bubbles and less incentive to get caught up in them. The Fed can even impose higher capital requirements for firms that have gotten into specific financial assets regulators think are unusually dangerous. On top of all that, the Fed can impose stricter limits on how much people can borrow to buy houses, or to buy stock and other kinds of financial assets. These are all powers the Fed has now.

The Fed also has the tool of simple communication. Fed officials go to conventions, hold regular press conferences, and give speeches — and the people who work in financial markets pay very close attention to what Fed officials say. So if the Fed has spotted an asset bubble it's worried about, it should say so. Bivens specified "that doesn't mean you make one speech and walk away, like Alan Greenspan did in 1996, with 'irrational exuberance.'" It means pounding the point repeatedly, over and over in multiple venues, to get financial markets to recognize an impending bubble and thus hopefully deflate it.

In fact, the Fed is already applying this principle when it comes to setting expectations for future inflation and interest rates, so clearly officials there think they have the ability to influence the markets. They just need to extend that logic to spotting and warning about asset bubbles.

The big takeaway from Bivens' and Baker's paper is that these tools have been woefully underutilized as alternatives, while the debate has focused on the one tool — interest rates — that might work, but will cost everyday American workers dearly even if it does.

"Bubbles are serious enough that we should worry about them," Bivens concluded. "But we should at least try the low-cost, low-damage tools first before we bring out the huge shotgun that will do all the collateral damage."

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.