America needs to get serious about the looming recession

It's going to happen at some point, and the Federal Reserve is not prepared

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Is America headed for another economic crash?

From late 2010 through 2014, there was a gradual but steady increase in economic strength, with each year slightly better than the last. It was nowhere near good enough to completely undo the damage of the Great Recession, but it seemed like things were heading in the right direction.

But in late 2015, progress began to plateau. The previous year, new job creation had averaged over 250,000 per month, but 2015 only managed about 229,000. Still, that was strong enough that the Federal Reserve decided it could raise interest rates in December for the first time since the financial crisis, thus slowing the economy to prevent future inflation.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It's looking increasingly clear that this was a serious mistake. The Fed — and the rest of the government — needs to start thinking about what to do when the next recession strikes.

Let's go through some numbers. Job creation has stalled badly in 2016, averaging only 150,000 per month thus far — worse than 2011's figure. May had the weakest jobs number since January of 2010. Other economic data are more mixed (compiled here by Ben Casselman), but overall not very encouraging. The unemployment rate is low, and job openings are up, but actual hires have fallen substantially from their most recent peak. After increasing moderately for most of 2015, wage growth has also stalled, far below a rate consistent with decent productivity growth and a stable labor share of national income.

If you squint, it sort of looks like the economy is bumping up against full capacity. Employers are trying to hire, but they can't find the workers, right? However, the problem with this story is there is not a single whiff of moderate inflation. If the economy is hitting structural constraints, then we ought to see price increases as companies bid against each other for labor and resources. But not only has wage growth stalled, inflation has been consistently below target — for more than three years straight.

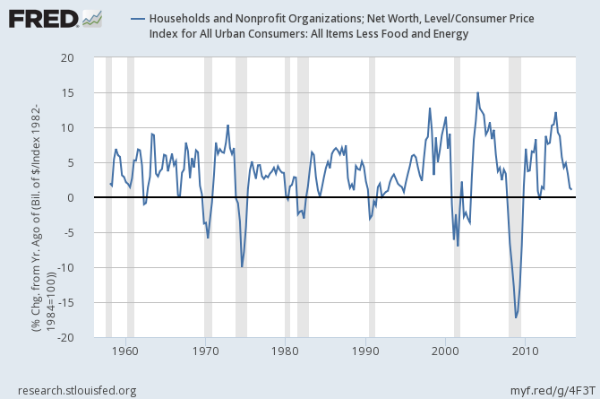

Another window into economic health is that of household balance sheets, which have deteriorated alarmingly of late, as Steve Roth points out. Here's a chart of the yearly change in total household net worth, adjusted for inflation:

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Decreases in household net worth (when the line goes below the x-axis) tend to predict recessions (the shaded areas) because net worth is a key enabler of consumer spending. There is an entire industry that provides purchasing power to households through various debt instruments — credit cards, home equity loans, and so on. But if household net worth starts to decline, creditworthiness will decrease, leading to a decrease in consumer spending and thence to a recession.

The Fed deserves at least partial blame for this. The basic problem with America's central bank, at least when it comes to monetary policy, is that it has confused timidity with caution. Whether a policy is cautious or not depends critically on the surrounding circumstances. If one is trying to enter the ocean on a rocky beach with heavy surf, it may be much more cautious to take a running leap and aim for the deep water than to do it timidly and be sliced to ribbons on the shallow rocks and barnacles.

Similarly, constantly communicating a desire to halt monetary stimulus and to return to normal interest rates could directly bring about the unwanted outcome by creating an economy-wide expectation that the Fed will halt any economic momentum before it even gets going. A much more cautious strategy would be hyper-aggressive stimulus to get some real momentum going, only then followed by a raise in rates once full employment is firmly established.

As Ryan Avent wrote over four years ago, "Try overshooting for once. Try it!"

At any rate, it's clear that the Fed is completely incorrigible on this point. Absent new personnel or structural reform, they simply aren't going to listen to this reasoning. And that should be worrisome indeed.

If a new recession strikes, the Fed will be in an even worse position than it was in 2008, when at least interest rates were fairly far from zero. Today, one minor hiccup and we'll be straight back in the zero lower bound sandpit we were stuck in from 2008-15. All that's left at that point is quantitative easing, and that manifestly doesn't work very well — particularly when done timidly, as the Fed has done.

Help from other quarters is also hard to imagine. After the Great Recession, we were lucky enough to have some big Democratic majorities that could pass a large Keynesian stimulus that staved off the worst. But it's highly likely that Republicans will maintain control of the House of Representatives, and they loathe Keynesian reasoning.

Economic expansions never last forever. Another recession is coming, probably sometime in the next presidential term. And this time there could be no real government response.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.