Will the Fed repeat its inflation mistake?

If the Federal Reserve overdoes it, jobs will suffer. Again.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Federal Reserve finishes up its latest meeting this afternoon. But the verdict is practically a foregone conclusion: Based on recent statements from Fed Chair Janet Yellen and other Fed officials, markets think the odds of another interest rate hike are more than 80 percent.

In early March, Yellen said that "the committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate." Sure enough, last week's jobs report showed reasonably strong employment growth and an unemployment rate of 4.7 percent. The Fed's inflation target is 2 percent, and its preferred measure of inflation is almost there at 1.7 percent. So observers believe another rate hike is practically inevitable.

So the question now moves to the Fed's long-term strategy. On that score, we should all be worried.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

As I mentioned, the Fed's target for inflation is 2 percent — "target" being the operative word. The Fed should allow the inflation rate to move above or below that target as circumstances require. That's because the Fed's dual mandate instructs it to maximize employment, not just control inflation.

The interest rate hikes the Fed uses to tamp down inflation also slow down job growth, by squeezing credit and forcing people to spend more on debt service rather than consumption and investment. So the Fed has to perpetually strike a balancing act.

Historically, it's done a really bad job.

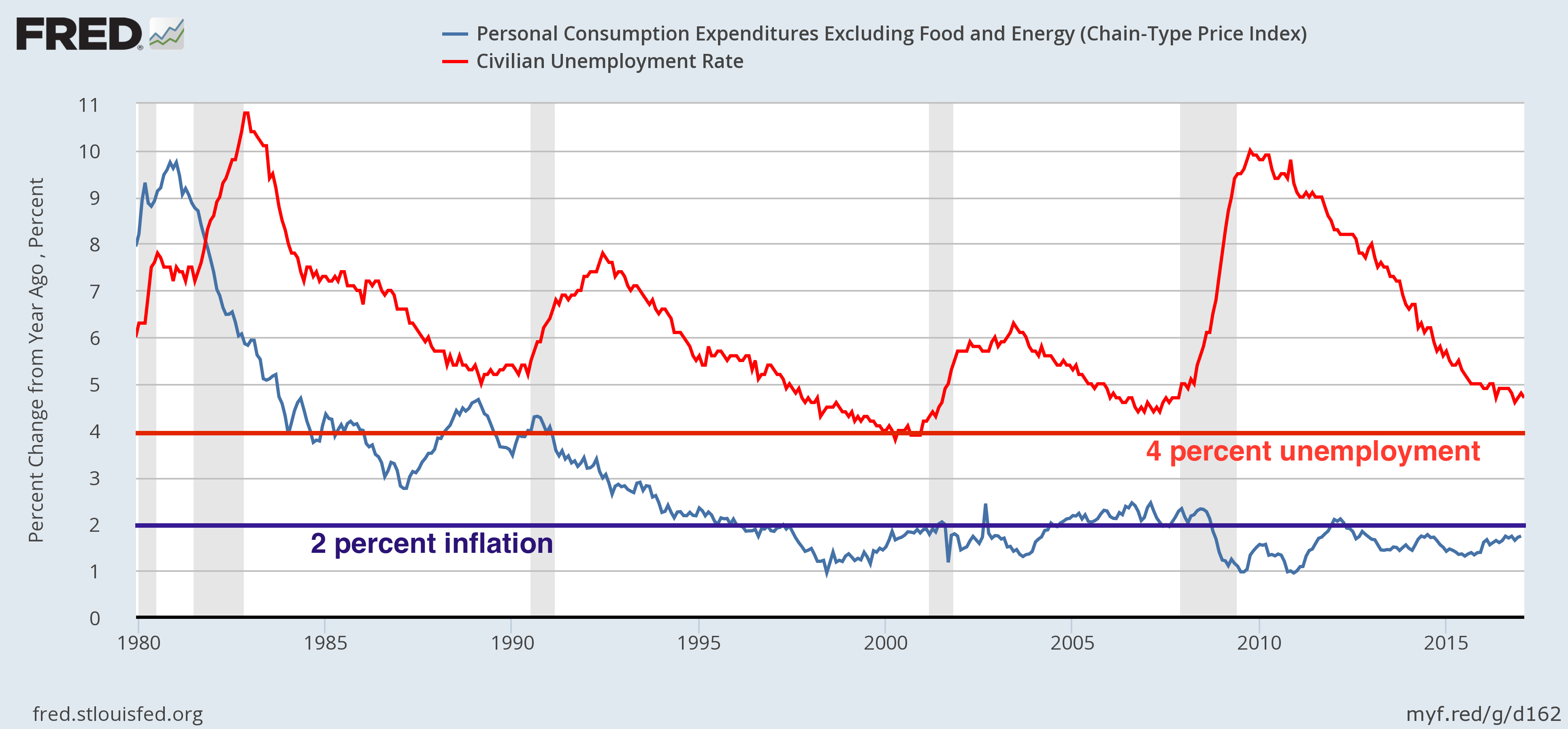

The graph below shows that, ever since the inflation crisis of the late 1970s, the Fed has done a pretty good job keeping inflation to its 2 percent target. But it's done an absolutely terrible one keeping the unemployment rate down.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

One thing we know is that the tight labor markets that come with 4 percent unemployment (or lower) are especially beneficial for the least fortunate Americans. Back in the late 1990s, wage growth was far more evenly distributed across the upper and lower class, and across races. As we approach 4 percent unemployment now, it's finally starting to happen again.

Conversely, when we're well above 4 percent unemployment, income growth primarily goes to the rich and well-off, while everyone else's incomes stagnate.

Plenty of people are tempted to pop the champagne as soon as the unemployment rate gets low, as if that alone solves the problem. But at this point, our country's long-running failure to actually maximize employment has done enormous damage. While incomes have stagnated for the middle class, working class, and poor, prices for things like housing, education, and health care have continued to rise. Huge stockpiles of money have continued to build up in the bank accounts of corporations and the rich. Jobs in less-dense areas of the country have vanished as the incomes to drive consumption there dry up. Unions have collapsed, and employment across the economy has become ever more precarious.

To bring back broadly shared prosperity, we can't just momentarily return to 4 percent unemployment. (Or preferably below it.) We need to get there and stay there for a long time.

To do that, the Fed has to overshoot its inflation target, maybe significantly. Let it reach 3 percent, 4 percent, or maybe even 5 percent for a while. And let it stay there for a long time — at least several years, maybe closer to a decade.

This brings us to the third thing to notice in the graph above. While 2 percent is officially a target, in practice the Fed treats it more like a ceiling — the inflation rate has fallen well below the target, but since the mid '80s, it has never gone much higher. The way the Fed is designed and governed, plus its experience in the late '70s, all bias it toward being super paranoid about inflation. So the Fed is in the habit of hitting the breaks the second inflation moves, sacrificing American jobs in the process.

By itself, a rate hike today will not be significant — a mere 0.25 percentage points, which would only bring interest rates to a range of 0.75-to-1 percent. And since monetary policy operates on a lag, perhaps the Fed just wants to gently nudge interest rates while it can.

But the Fed's sudden hawkish shift could also signal something more long-term: Speeding up when future hikes will arrive, or even adding more rate hikes on top of the three it had planned for 2017. Given how low inflation still is, if an overshoot was in the works, the Fed wouldn't need to get ahead of the curve that much right now. Meanwhile, statements from Fed officials don't show any evidence they'd tolerate an extended stay at 4 percent inflation.

At any rate, the Fed will release its statement at 2 p.m. EST. And Yellen will give a press conference shortly thereafter. Which should give us a better window into the Fed's thinking.

But for now, the smart money is on the Fed repeating its mistakes.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy