The Federal Reserve is still wrecking America

It's now clear that the Fed's rate hike was extraordinarily stupid

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Another month, another entry in the long record of the Federal Reserve failing the American people.

It was the winter of 2015 and genuine full employment was obviously still a long way off. But out of a fear of inflation, the Fed began tightening monetary policy anyway, thus preventing people from getting jobs. A year and a half later, it is more obvious than ever that this was highly premature. There is no sign at all that the maximum of employment has been reached, and strong circumstantial evidence that premature tightening has weakened the economy.

In any country, there is at some point a trade-off between inflation and unemployment. Allow unemployment to get extremely low, and inflation will begin to tick up, as cash-rich workers bid against each other for scarce resources. Allow unemployment to get high, and you risk a deflationary spiral, as happened during the Great Depression. Very roughly, that's the basic framework which governs the boundaries of the Fed's thinking about monetary policy.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Since the 2008 crisis, the Fed has made the latter error, failing to achieve both full employment and stable prices. It defines its price stability target as 2 percent inflation — meaning it should go above 2 percent as often as below. During the immediate crisis, price growth crashed to near zero; but after the crisis, the Fed failed to make up the ground with a period of overshooting. After a few years of clearly hesitant experiments with unconventional stimulus, it gave up, and then soon started raising interest rates.

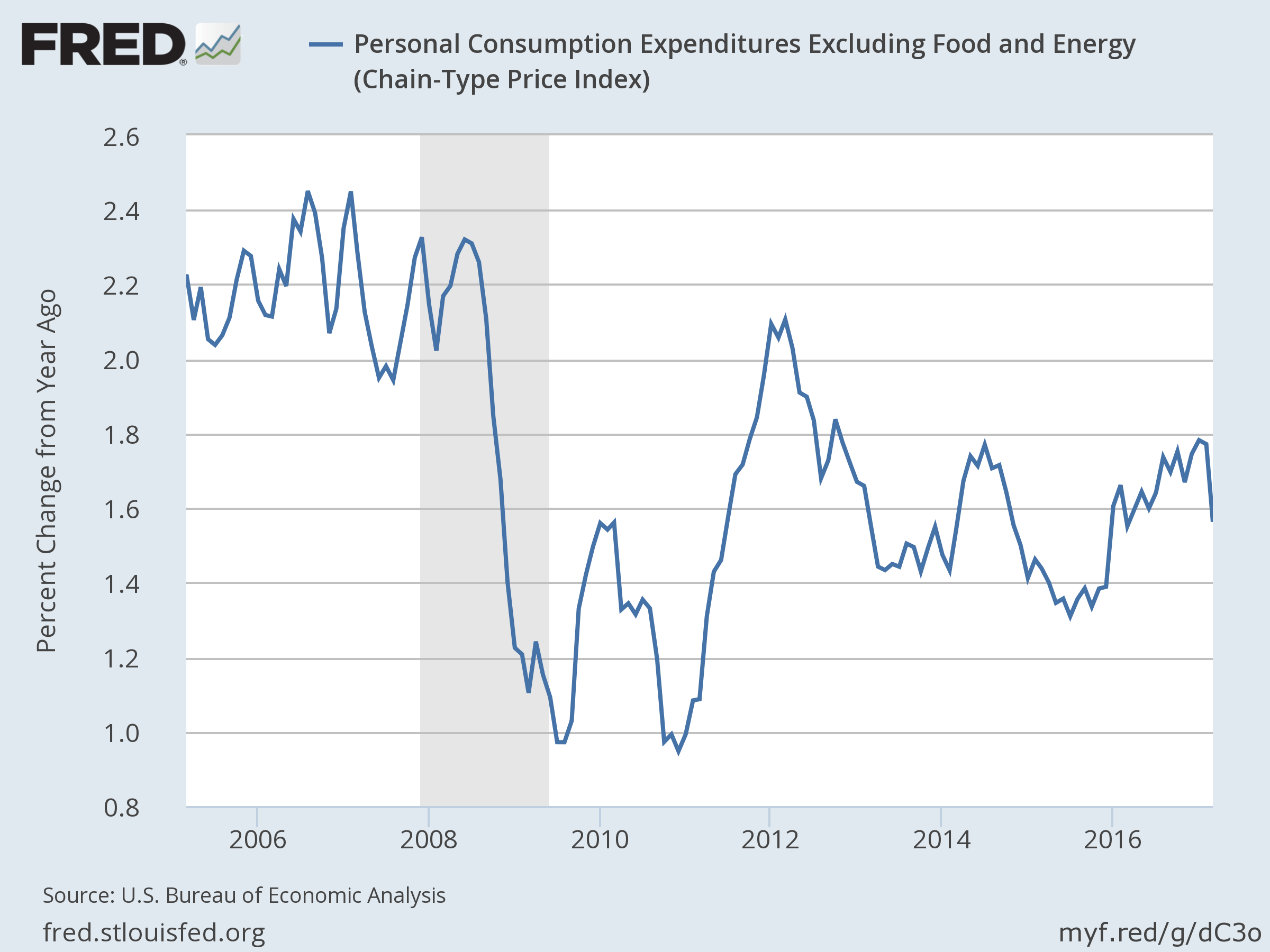

As a result, it has undershot its inflation target for the last five consecutive years — which clearly implies the possibility of further room for more employment and growth without price increases:

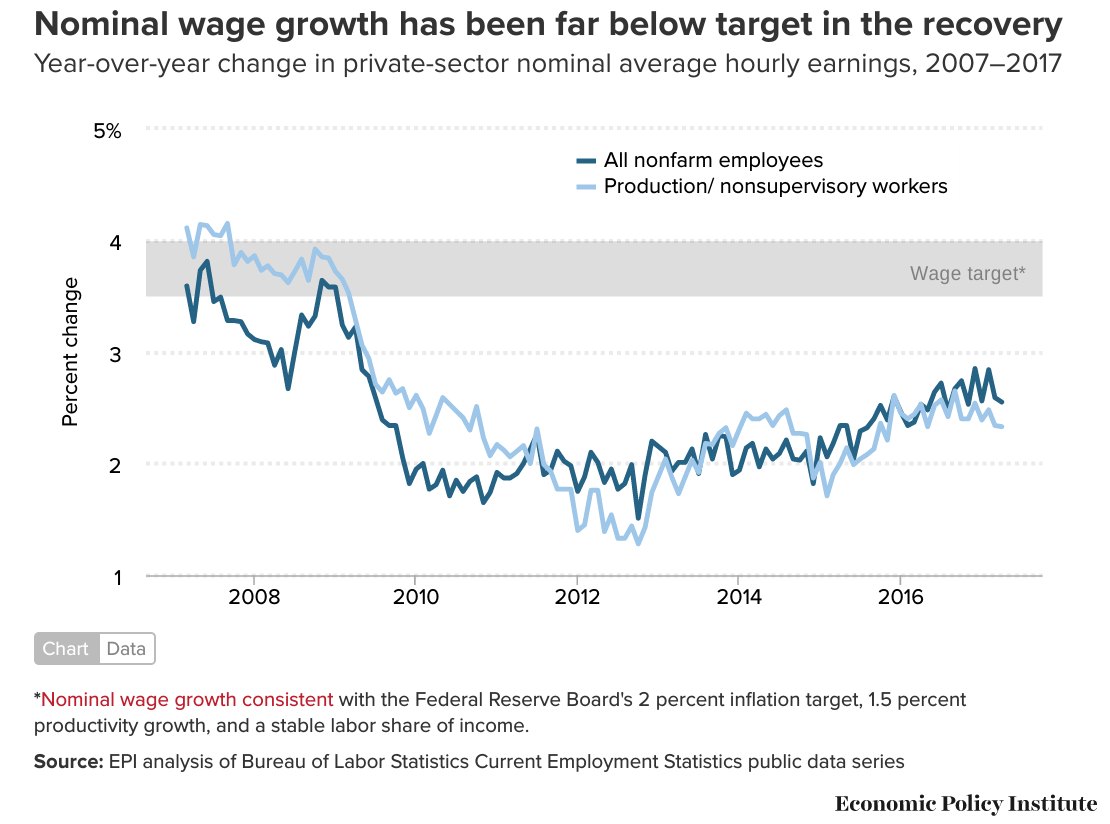

Worse, recent economic reports have come in distinctly soft. Not only has inflation ticked down, wage growth — which appeared to be finally rising — has flattened out over the last year, still well short of the level consistent with the Fed's price target and a stable labor share of national income:

Now, there are real questions about whether more aggressive stimulus would have worked. But there is no question that the Fed — under pressure from inflation paranoiacs on the Fed's governing board — has not tried nearly hard enough to return the country to economic health.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The stubborn resistance of the inflation paranoiacs to full employment is baffling at first glance. They have deployed an ever-shifting series of rationalizations: First it was that the Fed's unconventional stimulus would cause high inflation. When that didn't happen, they shifted to (highly underpowered) arguments that low rates would cause financial instability. Then when that didn't happen either, unemployment had finally gotten low enough that they could argue with a straight face that this is simply as good as things are going to get. The very obviously correct argument that we should do aggressive stimulus until we start to see sustained inflation pressure and only then start raising rates is simply ignored.

The only explanation for this I have seen that makes any sense is class influence. Full employment and associated wage growth means lower corporate profits and hence less money available to be kicked out as dividends and share buybacks to the investor class. (When American Airlines gave its employees a raise recently, a Citibank analyst wrote: "This is frustrating. Labor is being paid first again. Shareholders get leftovers.") Financiers have tremendous sway over the Fed, both because some of them actually sit on the Fed board and because of heavy cultural influence. But since the raw class bias can't be expressed, there is a constant demand for a more palatable reason to hide behind. As Michal Kalecki writes, "obstinate ignorance is usually a manifestation of underlying political motives."

That demand is satisfied in part by libertarian billionaires, who have been buying up economics departments by the score. It's a neat division of labor: Bankers work hand-in-glove with Fed officials to keep the working class down, while Chicago School economists back them up with the most convincing-sounding rationalizations that money can buy.

At any rate, if we are to get monetary policy that works on behalf of the majority of American citizens, the idea of the independent central bank has to go. The Fed is a political institution, like any piece of government. Posing as an apolitical technocratic agency is merely cover for an agenda of class warfare, waged by and for the ultra-rich.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.