It's the yuan, stupid

Why Trump is going about the trade deficit with China all wrong

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

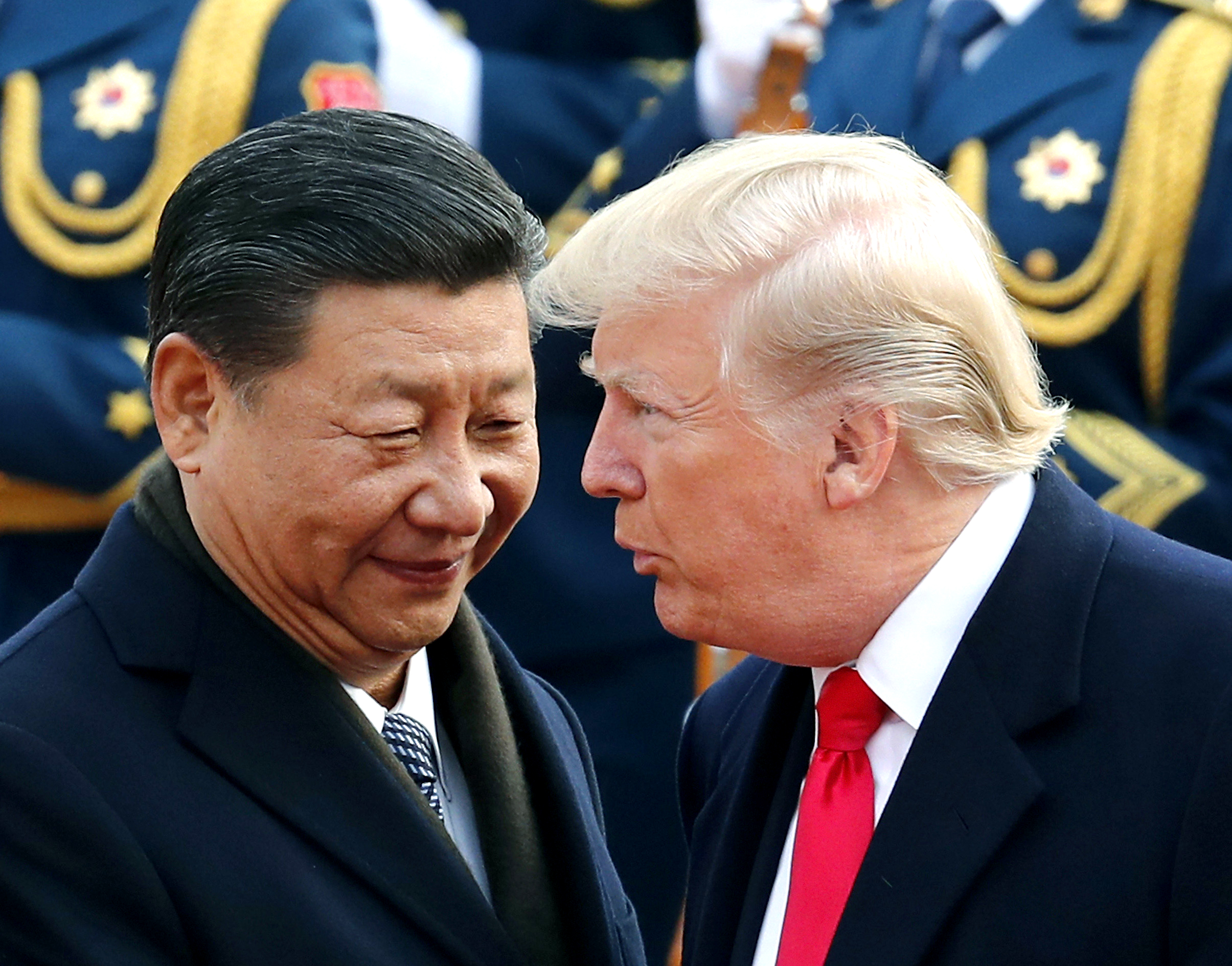

President Trump wants China to buy more American stuff. Late last week, White House officials met with China's chief economic minister Lie He and reportedly discussed a deal in which Trump would drop his various tariff threats in exchange for China buying a lot more American exports. The White House is gunning for $200 billion more, which would reduce the United States' trade deficit with China by well over half. The weekend ended with an agreement for the Chinese to buy something. But no specific number was reached and talks remain open-ended.

Whatever happens, Trump deserves some credit for pushing China to bring the trade deficit down. But he's really going about it all wrong. The way to fix this mess isn't through American exports, it's through the Chinese yuan itself.

Let's begin with the basics.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

All other things being equal, America's trade deficit with China makes it harder to produce enough domestic jobs. Domestic demand that could be fueling American businesses is fueling Chinese businesses instead. And it's not being replaced by an equal amount of Chinese demand for American goods and services.

Now, various economists have claimed that reducing the trade deficit by even $50 billion would be hard, because the U.S. economy is already close to full employment and it just can't produce that much more stuff for the Chinese to buy. But I don't buy it. Judging by better metrics than the unemployment rate, the U.S. economy actually has plenty of room to add more jobs and thus ramp up production. If Trump really can browbeat China into buying significantly more American goods, he could make a difference.

But it's equally important to understand why the trade deficit is happening. Trump loves to bluster about how China is pulling a fast one on America. But there's no great con here. China just stockpiles huge amounts of U.S. dollars, and that makes the dollar more expensive compared to the Chinese yuan (and compared to other currencies on international exchange markets, too). A more expensive dollar means our exports to China become less competitive while their exports to us become more so.

Nor is it some nefarious scheme: The U.S. dollar is the world's premiere currency for international trading, which means everyone stockpiles it to some degree. The Chinese have been unusually aggressive about this, but they aren't the only ones.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Now, you've probably heard that China already stopped devaluing its currency a few years ago. This is technically true, and it reportedly helped convince the Trump administration not to declare the country a currency manipulator in April. But here's the thing: What China did was stop adding to its dollar reserves and start slowly reducing them instead. But those reserves remain enormous. And their sheer size is enough to drastically alter the value of the dollar relative to the yuan and other currencies.

Unfortunately, it doesn't sound like the deal Trump wants with China will address the currency issue.

Imagine you're in a boat that's sinking thanks to a hole in the hull. Trump is basically trying to use a rusty cooking pot to bail the water out. It's not totally useless; you could make genuine progress if you bail fast and hard enough. But it's not fixing the problem, either. The real issue is the hole in the hull — i.e. the extreme difference in value between the U.S. dollar and the yuan. Closing that difference would change the relative competitiveness of all American and Chinese goods, not just the ones Trump can finagle onto China's shopping list. That's the hole we need to plug.

How do you do that?

Well, the Nixon administration actually slapped tariffs on a whole bunch of countries when our trade deficit got too big. That brought all those countries to the negotiating table, and they adjusted their exchange rates a few months later. Then, in 1985, the trade deficit became a problem again, and Congress threatened another round of tariffs. So the Reagan administration sat down with our major trading partners, and everyone negotiated a series of currency purchases that reduced the value of the dollar by 30 percent and closed the trade gap.

The other option is to get more creative with policy. The U.S. government — most likely via the Federal Reserve — could just start buying and stockpiling assets denominated in other currencies, like the yuan, that the U.S. dollar is especially misaligned with. That would counteract the effect of those countries' dollar stockpiles, bringing the value of the dollar down.

"The U.S. simply needs to say that the dollar is misaligned, and that tends to result in large and persistent trade deficits. And we need to realign the dollar to rebalance trade," Robert Scott, an international trade expert at the Economic Policy Institute, told The Week. "So we're going to intervene or otherwise take action to move currency markets."

Trump is already halfway there. He's shown himself willing to play hard ball with tariffs, which brought China to the negotiating table. But Trump is unfortunately failing to follow the example of previous administrations and use his leverage to get China to drastically draw down its dollar reserves. He's just demanding that they buy more U.S. stuff, even as the wider effect of their dollar reserves remains more or less unchanged.

Trump is sticking with his rusty bucket strategy. And the hole in our leaky economic boat remains unplugged.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

Health insurance: Premiums soar as ACA subsidies end

Health insurance: Premiums soar as ACA subsidies endFeature 1.4 million people have dropped coverage