Expensive oil means expensive airfare. So why doesn't cheap oil mean cheap airfare?

This is what happens when competition goes away

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Watch out, American Airlines' CEO Doug Parker warned on Sunday: Higher oil prices could lead to higher ticket prices.

Oil is still way down from its pre-2014 high. But it has also risen about 50 percent in the last year. "If it becomes clear this is the new normal you would see over time less capacity and growth in the industry and therefore higher prices," Parker told reporters. He's been repeating a similar theme since at least April: "Oil is our second largest expense," Parker told an earnings call in April. "So when it increases, the cost of air travel increases."

Parker's probably not wrong. But what's going on here isn't a simple Econ 101 story, either.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Most people probably think that when the price of oil falls, airlines pass those savings onto customers in the form of lower prices. If they don't, a competitor will pass them on, and thus steal their customers. Conversely, when the price of oil jumps, airlines will have to jack up ticket prices to ensure they make money. But even here, a market with robust competition should prevent ticket prices from increasing too much. The airlines don't want to be undercut by rivals, so they have an incentive to just eat the oil price as much as possible.

The problem is what happens when competition goes away.

Airline deregulation in the 1970s was supposed to unleash competition. And for a while it did, as ticket prices fell considerably. But it was also a temporary, race-to-the-bottom shift, Airlines lowered prices by simply ending service to rural and far-flung markets, and providers who did service those markets were competed out of existence. The price decline leveled out by the mid-2000s.

At the same time, enforcement of antitrust law went through a radical shift, becoming far more lax. When the 2001 and 2008 recessions hit, the airlines protected their profits by merging like crazy: After 2005, U.S. Air merged with America West, then got gobbled up by American Airlines, while Delta joined Northwest and United merged with Continental. In the last 10 years alone, the airline industry has gone from six legacy carriers to three.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

A new paper by the Roosevelt Institute's Marshall Steinbaum looked into how this shift changed the interplay between oil prices and airfares.

Steinbaum's data runs from 1993 to 2016. The price of oil went through big changes in that time: First a slow-burn run-up through the 1990s and 2000s that culminated in a spectacular fall in 2008. Then prices recovered and stabilized, before falling off a cliff again in 2014. The paper investigates how airline ticket prices reacted to both events.

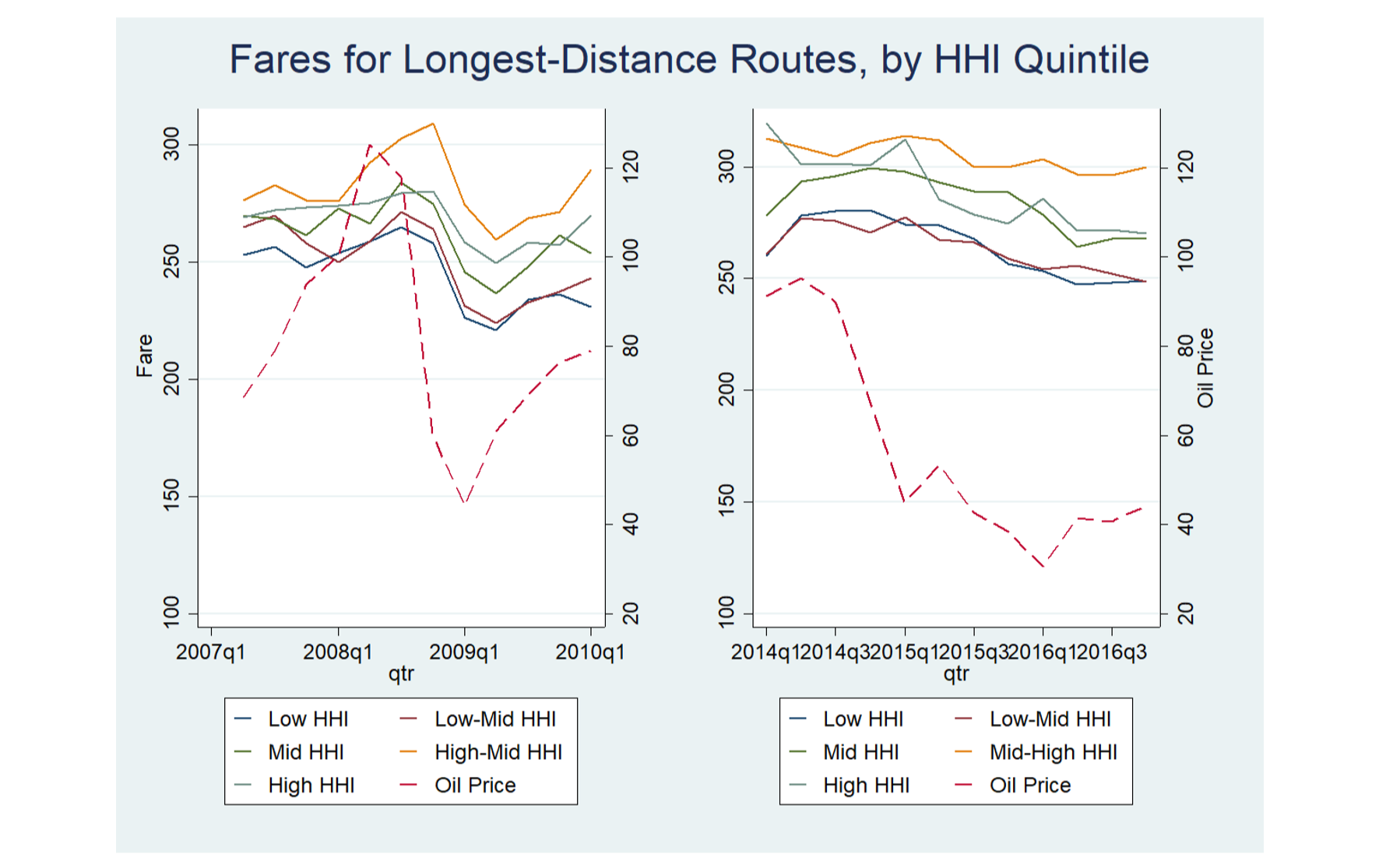

The graph below covers the 2008 and 2014 episodes in the left and right boxes, respectively. The price of oil is the dotted red line. The other five lines show ticket prices for various airline routes, grouped by level of airline concentration on the route. The graph also focuses on long-distance routes, since those are the ones most seriously affected by fuel costs.

In 2008, there's a jump and a fall in ticket prices that mirrors the path of oil. But in 2014, airfares barely reacted to oil at all.

Interestingly, the lines representing the airline routes all behave basically the same way, even though they're grouped by different levels of concentration. And there are many factors that could explain that. But as concentration increased in the industry overall, the reaction to oil prices clearly became more muted. The paper also includes a series of statistical tests showing a tight correlation with an increase in airline concentration over time, and a corresponding decrease in the pass-through of oil prices. "Those routes that experienced the largest increase in concentration between the two oil price decline events, net of controls, are also the routes where the change in pass-through was largest," Steinbaum wrote.

Another possible complication is fuel hedging, which allows airlines to lock in oil prices over time. But it's also a roll of the dice that varies widely across the industry. Parker had American Airlines stop hedging way back in 2008, for instance. Also, given how long the post-2014 oil price slump has lasted, it's a real stretch to attribute ticket prices' lack of decline solely to hedging.

Like most goods and services in the economy, the price of an airline ticket represents an implicit bargain between companies and consumers. Part of that bargain is who benefits when oil prices are low, and who suffers when they're high. Robust competition between providers tilts that balance in consumers' favor: They receive more of the savings and eat fewer of the costs. But an oligopoly of a few big airlines shifts that balance in the opposite direction.

Furthermore, airlines already enjoy the healthiest profits they've seen in years. If they do hike prices as Parker predicts, they'll be doing it to protect those unusually high margins, not to merely ensure the survival of their business model.

Nor is this all just about oil. More and more, airlines nickel-and-dime passengers for everything from bag fees to seat assignments to leg room. They cram passengers into stuffed planes, and treat them like garbage — up to and including having security violently drag them off the plane. Common sense says you should bend over backwards to give your customers a pleasant ride, lest they abscond with a competitor. But these days, they are few competitors to abscond to.

So, yes, Parker is right in a narrow sense. If oil prices keep rising, ticket prices will probably increase too.

But if the airlines do raise their prices, it won't be because they have to. It'll be because they can.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.