The false prophets of growth

Countries don't become richer by listening to Michael Bloomberg

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The key political justification for capitalism is that it creates wealth. Whatever injustice there might have been in the "satanic mills" of northern England in the early 19th century, it couldn't be denied that at least Britain was quickly becoming far richer than its agrarian peers.

This justification has carried forward into present times, in the form of a postulated tradeoff between egalitarian policy (like Social Security or free childcare) and pro-business policy (like deregulation and lower taxes). By this logic, measures to achieve social justice must come at the expense of overall growth.

There's just one problem: it's not true. It is a false dichotomy, put forward by false prophets.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Probably the most prominent false prophet of growth is The New York Times' Thomas Friedman. In a recent column, he counterposed "redivide-the-pie Democrats" like Bernie Sanders with "grow-the-pie Democrats" like Mike Bloomberg, who ''celebrate business, capitalism and start-ups" and "know that good jobs don't come from government or grow on trees — they come from risk-takers who start companies."

He put the case even more strongly in his book The Lexus and the Olive Tree, where he lauded a "Golden Straitjacket" developed by Ronald Reagan and Margaret Thatcher, who "concluded that the old government-directed economic approaches simply were not providing sufficient levels of growth." International neoliberal leg-breakers like the IMF and world bond markets enforced this global economic regime, requiring free trade, deregulation, balanced budgets, and so forth on pain of economic collapse. It meant drastically shrinking the political options available to democratic governments, but at least growth would compensate. The tighter you adhere to the straitjacket, "the more gold it produces and the more padding you can then put into it for your society," he predicted.

As Eric Levitz argues, as a historical matter, countries which largely avoided the neoliberal turn of the 1980s did not see their growth strangled. On the contrary, if we look at productivity per hour worked, the Nordic countries (which mostly preserved their welfare states and extensive regulations) have far outstripped the United States.

But an even starker demonstration of this false prophecy can be seen by simply looking at recent history. The U.S. basically followed the Friedman program from the mid-1980s through 2008, with cuts to welfare and extensive deregulation, especially of Wall Street. The result was a shattering global financial crisis and a lost decade of growth across the entire developed world.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

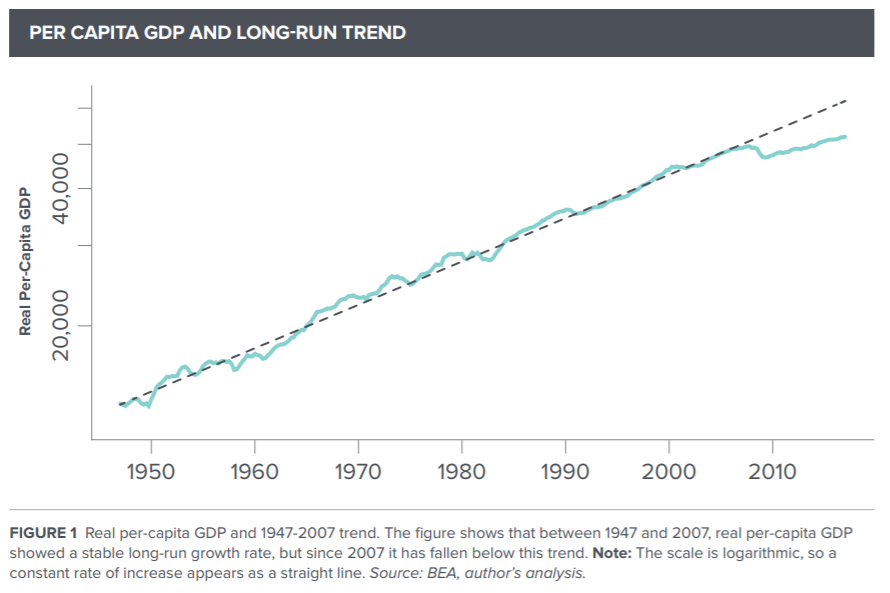

If you plot the GDP per capita trend from 1945-2007, as economist J.W. Mason has done, you find a trend of 2.2 percent inflation-adjusted growth per year on average. Output crashed after the 2008 recession, but did not catch up afterwards — on the contrary, growth slowed dramatically, by about 40 percent. Today output is about 15 percent below the trend — on the order of $3 trillion per year for the nation as a whole, which is more than the current output of California.

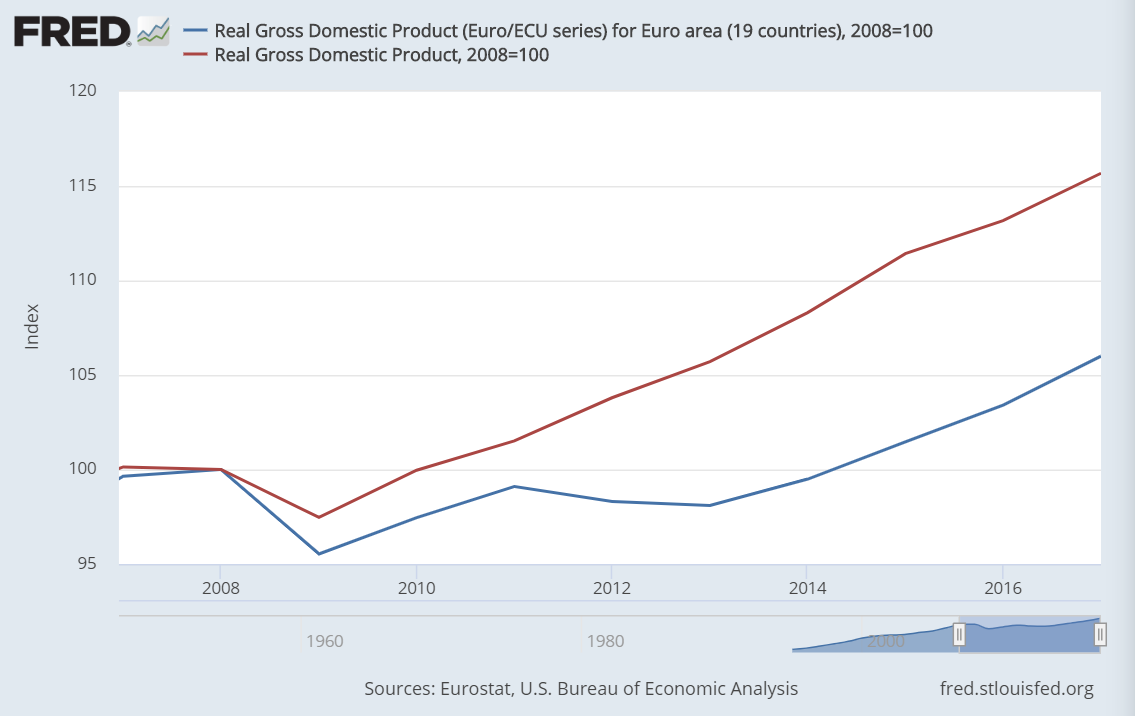

The eurozone, which did even more austerity after the 2008 crash, is doing even worse. Here is inflation-adjusted eurozone GDP (blue line) compared to U.S. GDP (red line), normalized to 2008=100:

What happened? As Mason shows, two things: the premature abandonment of stimulus after 2009, and the ensuing binge of austerity to balance the budget — which Friedman not only supported, but demanded even more of, in line with his Golden Straitjacket logic.

In any case, you couldn't ask for a better demonstration of the false prophecy of the Golden Straitjacket than the economic history of the past 10 years. It's wildly preposterous.

Now, it would also be wrong to conclude that government stimulus, welfare expansions, regulation, and so forth always create growth. (There is no "Golden Sofa" either.) In reality, it depends, but government decision-making is always crucial. Productive jobs are not handed down from genius entrepreneurs like Athena springing fully-formed from the head of Zeus, but through a collective economic system which is underpinned at every point by the state. Entrepreneurs can be part of that process, to be sure, but even unquestionable successes like Steve Jobs are always building on government-created research projects (like the internet and GPS), infrastructure, legal systems, and so on.

It's also worth noting as countries get richer, relentlessly piling up GDP makes less and less sense as a top priority. A rich country can support strictly non-productive activities like generous retirement benefits. But productivity and growth do matter, because they allow the citizenry to have a comfortable lifestyle with less and less work. You just don't get the goods through magic pro-business incantation.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal