New perks for the pandemic age

And more of the week's best financial insights

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Here are three of the week's top pieces of financial insight, gathered from around the web:

Amateurs get burned in Kodak frenzy

Kodak's wild stock-market ride offered "a warning for investors who ignore company fundamentals and focus instead on a potential pandemic connection," said Geoffrey Rogow and Michael Wursthorn at The Wall Street Journal. The Trump administration's announcement that it was lending $765 million to Kodak — yes, Kodak — to make drug ingredients set off a market frenzy, with the stock price soaring "as high as $60 over the following two sessions" and more than 100,000 users on Robinhood jumping in. Professional investors got out as amateurs "were running blind into shares." One financial adviser bought 162,000 Kodak shares in May at roughly $2.50 per share and wound up booking a 19-fold return. But Alex Olson, who opened his first brokerage account earlier this year, "bought 2,710 shares at an average of $35 a share" and lost $30,000 when the stock sank. "I guess what I learned is trading is just gambling," said Olsen.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How much is a quarter of a Birkin?

If you "can't afford a Birkin bag or a racehorse," you can still invest in them, said Paul Sullivan at The New York Times. An uptick in fractional investing allows anybody to purchase shares in luxury items. Buyers can't sell those fractions until after a lockup period, nor do they get to actually hold the products they invest in. That doesn't faze memorabilia fans such as John Cochran, who "invested in shares of 76 different collectibles, including a shirt Michael Jordan wore in a basketball game." Investors in Birkin bags can get a share in a $140,000 gray Himalaya. And if you've always wanted to feel like a prince, MyRacehorse sells small shares in racehorses.

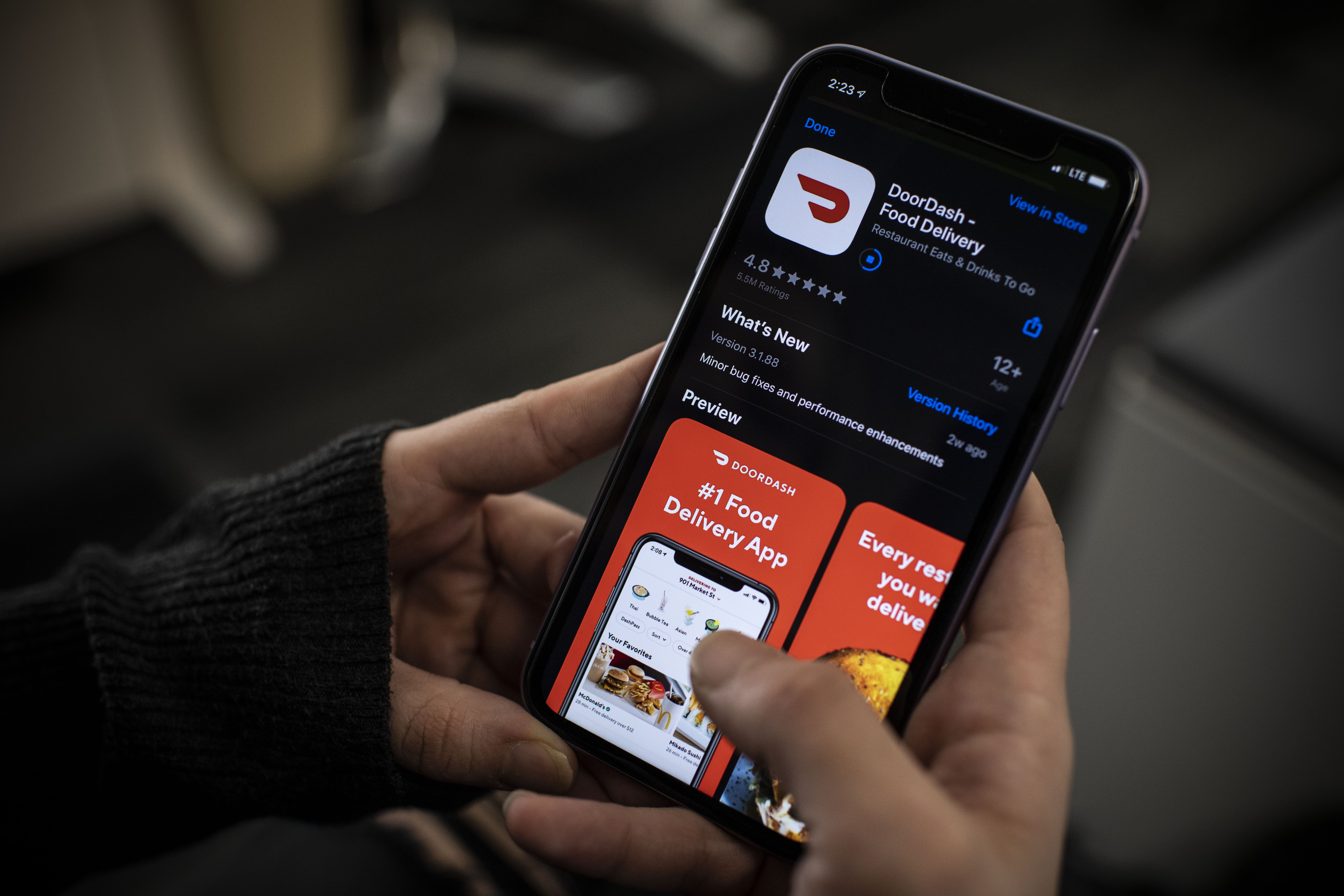

New perks for the pandemic age

Businesses are getting creative at trying to retain their company culture while working remotely, said Emma Jacobs at the Financial Times. DoorDash says it has seen increased demand for gift cards that can be used to buy real food for a virtual work lunch. Some companies are "rewarding professionals working from home with food and drink deliveries" — with one ad agency even throwing in its traditional Friday round of after-work beers. One executive there says "drinks would have been the obvious cost to cut, but he wanted to lift morale." But some employees say they have little need for office-style perks and would prefer "well-being benefits like mindfulness apps" and "access to online therapy."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.