What happened to deals?

Why discounts and liquidation sales aren't what they used to be

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

A couple of weeks ago, my local Giant supermarket began a major remodel, which required liquidating large amounts of excess or to-be-discontinued inventory. Among my scores were steaks for under $5 per pound, an 80-pack of dishwasher pods for less than $3, and one (possibly two) cases of wine. We're not talking "Save $2 with your Club Card"; we're talking $40 Napa cabernets for $10 and $15 French rosés for $6. Oh, and beer: cobbled-together six-packs, some containing premium craft brews, packaged in giant Ziploc bags and marked $5 with a Sharpie.

Filling my cart gave me a kid-in-a-candy-shop feeling, but I realized I was also feeling a kind of nostalgia. These closeout bargains activated dim childhood memories of when, it seemed, brick-and-mortar deals like this were everywhere. I remembered video games: sealed Nintendo games for $1 when The Wiz went bust in 2003; a stack of $5 Pokemon Blues for the Gameboy in a rural Vermont general store in the late '90s; a cardboard barrel of discount Sega Genesis games still hanging out in a corner of Toys ‘R' Us some time in the early 2000s. I also remembered when Laneco, a Walmart-style Northeast regional discount retailer, offered a "fill a cart for $5" promo on their last day of operation, back in 2001. Ten or so years before that, my father picked up two Philips Digital Compact Cassette decks, a fascinating failure then being liquidated by the now-defunct J&R Music World in New York City.

Now, that all feels like a world away. Even with the ongoing "retail apocalypse" producing tons of excess inventory, liquidation sales aren't what they used to be, and pallets of unsold merchandise at fire-sale prices don't seem to appear as often in brick-and-mortar venues, or at all.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Like the click of a telephone interlocutor hanging up a landline handset, or the vision of unspooled audio cassette tape along the side of a road, is a true bottom-dollar, in-person liquidation a relic of an older era?

There is, most obviously, a supply dynamic here. Just-in-time inventory management and highly efficient but fragile supply chains, along with nimble custom and contract manufacturing, have reduced the amount of slack in the retail distribution system. There simply isn't as much inventory sitting around as there used to be, either waiting to be sold or left unsold. Excess inventory has been understood for some time in the retail industry as a liability.

There's also a demand issue. Particularly in a tough economy, people are looking for any deal they can get, meaning a more competitive bargain-hunting landscape. Data points like the steady growth of dollar stores in the retail landscape and the lengthening term of car loans attest to the difficult economic situation a great deal of the country finds itself in.

At a slightly more abstract level, there's a broader market dynamic: The rise of e-commerce and the gig economy, as well as the corresponding decline of stable employment, means more people are hustling. Retail arbitrage — buying low in person, selling high online — is a popular side hustle that isn't particularly expensive or complicated to get into. For example, it's common to see Amazon or eBay sellers with price scanning guns in thrift stores. Buyers and sellers alike know a lot. And more people competing for fewer deals means fewer deals for most people.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But for the inventory that does end up left over, and isn't scooped up by bargain hunters, where does it go?

Some of it still ends up in traditional closeout stores, which occupy a niche somewhere between discount department stores and thrift stores. Five Below sells last-generation video games for $5. Chains like Ollie's, Big Lots, and National Wholesale Liquidators sell closeouts and overstock. But most of these discount retailers now sell their own lines of custom manufactured merchandise as well. As early as 2011, Big Lots was working on expanding its private label offerings, which can be stocked and quality controlled more predictably than closeouts or factory seconds acquired as available.

Much of the merchandise that at one time would have been liquidated in store now ends up online, where a national market and cheap warehouse space means excess inventory can be sold for higher prices over longer periods of time, compared to quick sales during a store closure or product discontinuation. Amazon's Fulfillment by Amazon program allows third-party sellers to ship their merchandise to an Amazon warehouse, where it's stored and shipped by Amazon when it sells. In an effort to trim as much operational fat as possible, many retailers, including Amazon, don't even bother processing and restocking returned merchandise. Instead, they sell it in bulk to professional liquidators. It's quite likely that some of these Amazon returns end up fulfilled by Amazon. Most of them probably end up on the internet, or perhaps sold abroad, such that they're never available to consumers the way they would have been a few decades ago.

What this suggests is a hypothesis both fascinating and somewhat obvious: advances in technology and logistics have raised the market's general level of efficiency. If you take economics literally, things like fantastic deals, arbitrage, and even profit itself are indicators of inefficiency. The national market made possible by e-commerce platforms, and the international market made possible by globalization, are unalloyed goods, according to economics. The fact that they squeeze their participants ever more tightly and render them ever more precarious is a feature, not a bug.

In other words, the gradual reduction in serious, near-giveaway liquidation sales over the last 30 or so years is one idiosyncratic symptom of a sea change in retailing and logistics. The pandemic and the resulting explosion in delivery and e-commerce will probably exacerbate this.

However, the pandemic-related disruptions in ordinary supply chains have produced some interesting deals as well as some shortages and price spikes. Lots of bulk food products destined for the ailing food service industry ended up at cut-rate prices in supermarkets. After an initial shortage of hand sanitizer, a glut of it ended up on the market, much of it quite cheap and in non-standard containers, such as liquor bottles or even motor oil containers. Toilet paper and paper towels intended for the Canadian or Mexican markets and imported during the height of U.S. shortages ended up being practically given away.

As long as there's commerce, there will be deals, but they're fewer and farther between. You'll need some serendipity if you're going to bring home a half-price case of wine any time soon.

Addison Del Mastro writes on urbanism and cultural history. Find him on Substack (The Deleted Scenes) and Twitter (@ad_mastro).

-

At least 8 dead in California’s deadliest avalanche

At least 8 dead in California’s deadliest avalancheSpeed Read The avalanche near Lake Tahoe was the deadliest in modern California history and the worst in the US since 1981

-

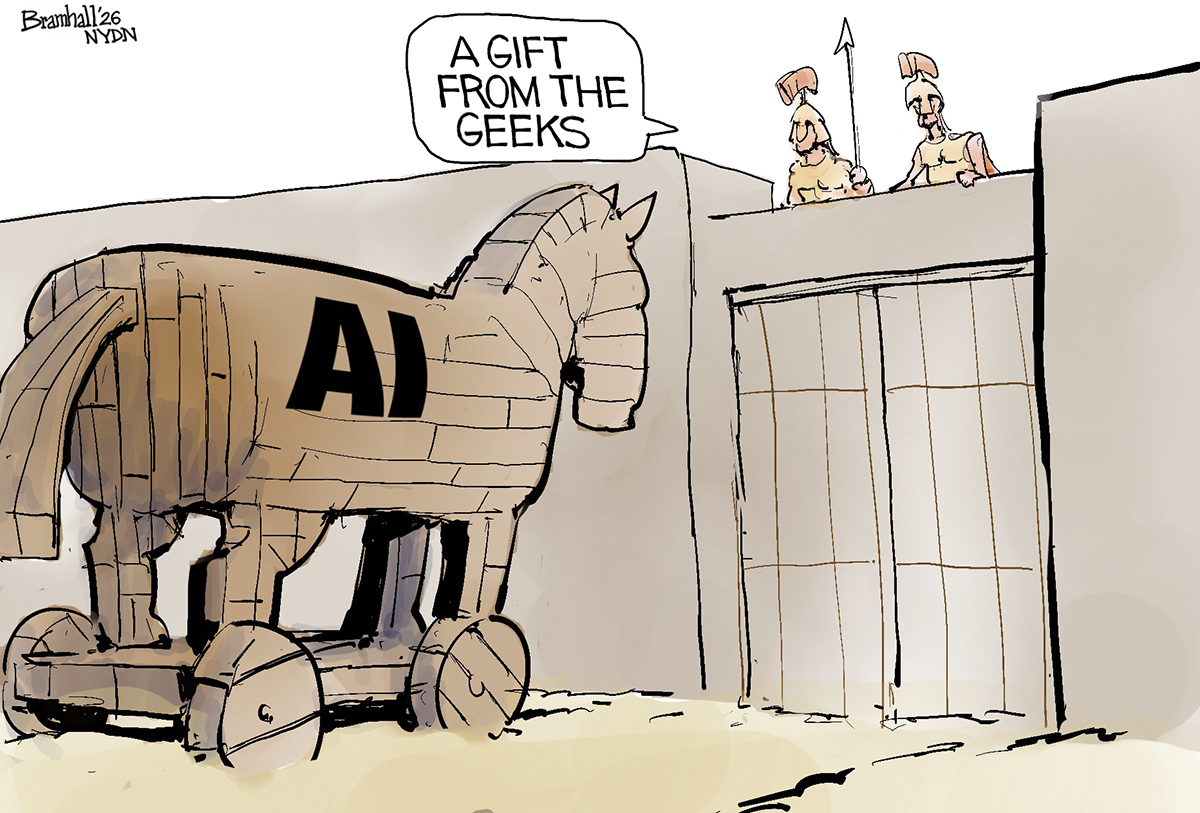

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy