The daily business briefing: October 24, 2022

Chinese stocks dive in Hong Kong after Xi tightens grip on power, Tesla cuts prices in China as demand weakens, and more

- 1. Chinese markets dive after Communist Party cements Xi's power

- 2. Tesla slashes prices in China as demand softens

- 3. Jury selection kicks off Trump company's tax fraud trial

- 4. Stock futures fluctuate after last week's gains

- 5. 'Black Adam' leads the domestic box office in weekend debut

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

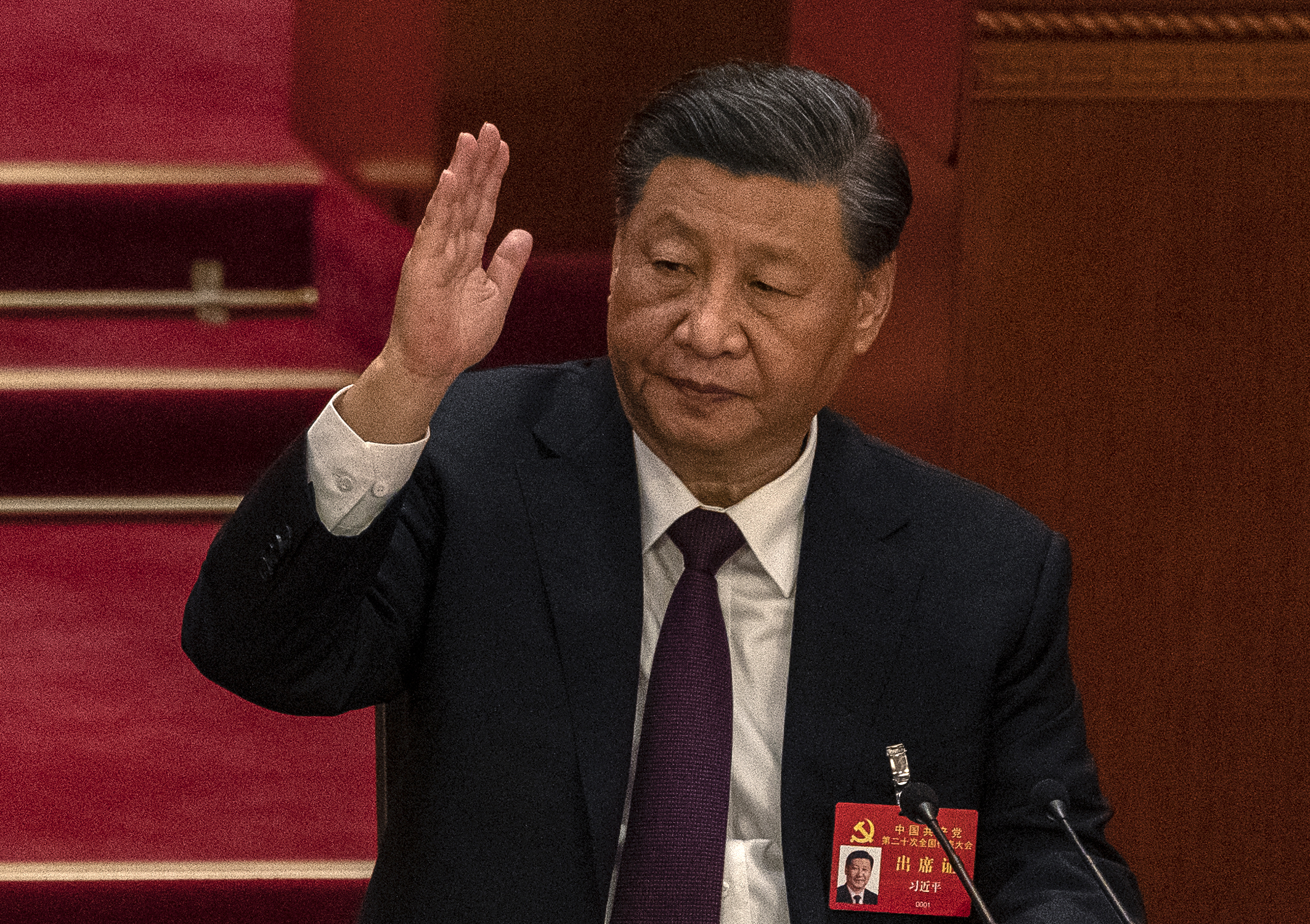

1. Chinese markets dive after Communist Party cements Xi's power

Stocks in Hong Kong plunged Monday in their worst day since the 2008 global financial crisis after China's ruling Communist Party solidified President Xi Jinping's grip on power. The Hang Seng China Enterprises Index of Chinese stocks listed in Hong Kong dropped 7.3 percent, its biggest plunge after any Communist Party congress. China's currency, the yuan, fell to a 14-year low. Xi stacked top leadership positions with loyalists, including backers of the "zero COVID" policy that seeks to prevent coronavirus infections with costly lockdowns. "The market is concerned that with so many Xi supporters elected, Xi's unfettered ability to enact policies that are not market-friendly is now cemented," Justin Tang, head of Asian research at United First Partners, told Bloomberg.

2. Tesla slashes prices in China as demand softens

Tesla is cutting prices for its Model 3 and Model Y electric cars by up to 9 percent in China, the world's largest auto market, according to price listings posted Monday on the EV maker's website. Tesla CEO Elon Musk said last week that the company would fall short of its delivery target this year as China and Europe go through "a recession of sorts." China Merchants Bank International (CMBI) said Tesla's price changes, reversing an upward trend, showed that weakening demand is a threat for EV manufacturers in China. "The price cuts underscore the possible price war which we have been emphasizing since August," said CMBI analyst Shi Ji.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Jury selection kicks off Trump company's tax fraud trial

Jury selection begins Monday in the Trump Organization's tax fraud trial in New York. Former President Donald Trump wasn't indicted, but he signed some of the checks at the center of the case, which is part of a web of legal problems he, his children, and their businesses face. Prosecutors accuse the Trump family's Manhattan-based real estate company of giving executives "off the books" compensation such as cars, apartments, and private-school tuition payments in lieu of pay raises to dodge payroll taxes, and changing property valuations to defraud the government and lenders. The Trump Organization's 75-year-old former chief financial officer, Allen Weisselberg, recently pleaded guilty to conspiracy in the alleged scheme. He has agreed to testify in the company's trial.

The New York Times PBS Newshour

4. Stock futures fluctuate after last week's gains

U.S. stock futures rose early Monday, shaking off an overnight dip, coming off Wall Street's best week since June. Futures tied to the Dow Jones Industrial Average and the S&P 500 were up 0.3 percent at 6:45 a.m. ET. Nasdaq futures were up 0.1 percent. The Dow gained 2.5 percent on Friday to close a volatile week up 4.9 percent. The S&P 500 gained 2.4 percent on Friday to finish the week up 4.7 percent. The tech-heavy Nasdaq also surged Friday, and gained 5.2 percent on the week. The volatility came as corporate earnings reports were mixed, with bank stocks Goldman Sachs and JPMorgan Chase rising after strong results but Snap plunging by 28 percent after disappointing earnings.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. 'Black Adam' leads the domestic box office in weekend debut

The superhero adventure film Black Adam, starring Dwayne Johnson, led the weekend box office, bringing in $67 million in its domestic debut. The Warner Bros. comic book movie also piled up $73 million in international ticket sales, bringing its global total to $140 million. Johnson, in his first superhero role, plays a villain aiming to alter the "hierarchy of power" in the DC universe, Variety says. "As a spin-off, this is a strong opening," says David Gross, head of the movie consulting firm Franchise Entertainment Research. Its opening was similar to fellow DC movie Aquaman (2018), starring Jason Momoa. Black Adam is the sixth Warner Bros. film out of six to open at No. 1 this year.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more