The daily business briefing: February 8, 2023

Powell says the Fed might have to raise rates more if hiring surges again, the U.S. trade deficit reached a record $948.1 billion in 2022, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

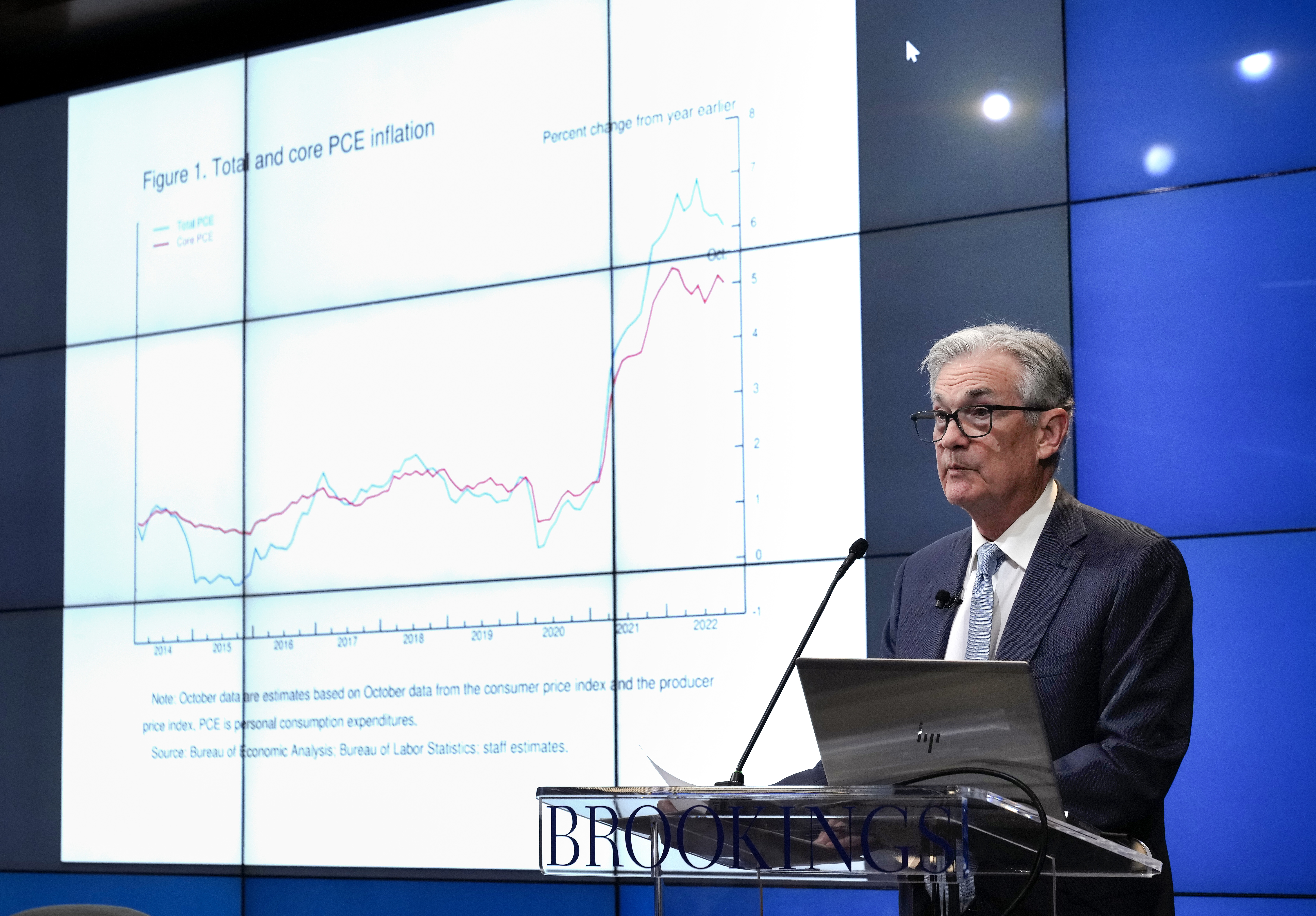

1. Powell says hiring surge might force more Fed rate hikes

Federal Reserve Chair Jerome Powell said Tuesday that the central bank might have to raise interest rates higher than currently planned if inflation accelerates again or the labor market shows further strengthening. The remarks came after the January jobs report showed that U.S. employers added 517,000 jobs, shattering expectations. The gains pushed the unemployment rate to a 53-year low of 3.4 percent. "The reality is if we continue to get strong labor market reports or higher inflation reports, it might be the case that we have to raise rates more," Powell said in a speech at the Economic Club of Washington. He said he expects a "significant" drop in inflation this year, but warned that there's still "a long way to go."

2. Trade deficit hit record $948.1 billion in 2022

The U.S. trade deficit increased by 12.2 percent last year to a record $948.1 billion, according to Commerce Department data released Tuesday. The $103 billion increase from the previous year came as Americans bought more machinery, medicines, car parts, and other goods from foreign suppliers. High inflation and energy prices also contributed to the increase. The data also indicated that disruptions from the coronavirus pandemic have shifted global supply chains. The trade deficit in goods exchanged with Mexico, Canada, India, South Korea, Vietnam, and Taiwan grew significantly as the U.S. government tightened rules on trade with China and businesses sought to diversify their sources.

Article continues belowThe Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Fox Business The New York Times

3. Microsoft builds ChatGPT into its Bing search engine

Microsoft announced Tuesday it is incorporating ChatGPT artificial intelligence technology into its Bing search engine. The effort to "reimagine" Bing marked a "major escalation of the AI arms race," according to The Washington Post. The move signals "by far the biggest threat Google has seen to its dominance in web search," according to BBC News. "The race starts today," Microsoft CEO Satya Nadella said. The new version of Bing is designed to give users more direct, comprehensive answers to search queries typed in conversational language, using deep-learning technology to provide responses that seem like they were made by humans. Microsoft's news came a day after Google announced it was testing its new AI chatbot, Bard.

4. Zoom to lay off 15 percent of its workers

Zoom Video Communications, which boomed when meetings, classes, and socializing shifted online early in the pandemic, announced Tuesday it will lay off 1,300 employees, or 15 percent of its workforce, as life returns to normal and its videoconferencing service loses traffic. CEO Eric Yuan said he is cutting his $300,000 salary and giving up his $13,000 bonus. Shares of the San Jose, California, company jumped 10 percent on Tuesday after falling more than 40 percent over the last 12 months. Yuan said the company went from 2,500 employees in early 2020 to nearly 6,800 a year ago to keep up with its pandemic-fueled growth. Zoom "didn't take as much time as we should have to thoroughly analyze our teams or assess if we were growing sustainably," he added.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Stock futures slip after latest Fed comments

U.S. stock futures fell slightly early Wednesday following Federal Reserve Chair Jerome Powell's comments that further surges of inflation or hiring could force the Fed to hike interest rates more than previously anticipated. Futures tied to the Dow Jones Industrial Average and the S&P 500 were down 0.3 percent and 0.4 percent, respectively, at 7 a.m. ET. Nasdaq futures were down 0.2 percent. The three major U.S. indexes posted strong gains on Tuesday at the end of a volatile session. The Dow and the S&P 500 rose 0.8 percent and 1.3 percent, respectively. The tech-heavy Nasdaq jumped 1.9 percent. Markets fell on two straight days after the monster jobs report, but were encouraged that Powell "avoided ramping up the hawkish rhetoric," according to Barron's.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.