The daily business briefing: May 24, 2021

Bitcoin selloff resumes as prices fall by 13 percent, stock futures rise after S&P 500's second straight week of losses, and more

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

1. Bitcoin falls by 13 percent as selloff resumes

The bitcoin selloff resumed on Sunday, with the volatile cryptocurrency dropping by 13 percent. Ether, the cryptocurrency linked to the ethereum blockchain network, fell by 17 percent. Bitcoin has been through dramatic price swings recently, and it came under renewed pressure last week after Tesla CEO and longtime cryptocurrency booster Elon Musk posted a series of tweets in which he said the electric-car company was reversing plans to accept bitcoin as payment. "Many point to bitcoin's volatility as untenable," wrote RBC Capital Markets' Amy Wu Silverman in a research note published over the weekend. "Indeed, Bitcoin makes severe and dizzying swings."

2. Stock futures rise after last week's losses

U.S. stock index futures gained early Monday, struggling to bounce back after Wall Street's second straight week of losses. Futures tied to the Dow Jones Industrial Average were up by 0.4 percent several hours before the opening bell. S&P 500 and Nasdaq futures rose by 0.5 percent and 0.7 percent, respectively. The Dow fell last week for the fourth negative week in the last five, while the S&P 500 had its second straight down week. Several retail companies report earnings this week. Some analysts expect more rough days ahead as concerns about inflation and the economic recovery from the coronavirus pandemic continue. "We think the choppy/sideways trend will continue for a bit longer, and the market will experience sell-off scares along the way," said Adam Crisafulli, founder of Vital Knowledge.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Reuters poll: House price inflation rate to rise

U.S. house prices are expected to continue rising this year, even faster than forecast three months ago, according to a poll of analysts Reuters released Monday. The S&P CoreLogic Case-Shiller 20-metro-area house price index has risen steadily over the last year, averaging 11 percent this year. Reuters' May 11-24 poll of 40 property analysts found that house prices were expected to gain at an average 10.6 percent pace this year, nearly twice the 5.7 percent forecast in February. That would be the fastest annual house-price increase since 2013. "The housing market is in line with fundamentals as interest rates are attractive and incomes are high due to fiscal stimulus, making debt servicing relatively affordable and allowing buyers to qualify for larger mortgages," said Nathaniel Karp, chief U.S. economist at BBVA.

4. Ever Given owner blames Suez Canal Authority for blockage

The Japanese company that owns the Ever Given — the container ship that blocked Egypt's Suez Canal in March — blamed the Suez Canal Authority for the incident, a lawyer for the company said over the weekend. Lawyers for the company, Shoei Kisen Kaisha, said the canal authority was at fault because it let the ship enter the canal despite poor weather conditions. The Ever Given became wedged between the canal's banks, and blocked traffic through the vital waterway from March 23 to March 29, delaying about 400 ships and disrupting global supply chains. The ship has been held in an artificial lake along the canal pending talks on compensation for Egypt's losses. The Ever Given's owners now are seeking $100,000 for losses stemming from the ship's detainment.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. Senators agree on bipartisan proposal to hike funding for roads, bridges

A bipartisan group of senators unveiled a transportation proposal over the weekend seeking a 34 percent increase in funding for highways, roads, and bridges. The legislation package released by the Senate Environment and Public Works Committee would bring baseline spending on the basic infrastructure to $300 billion over five years. The agreement came as Congress tries to work out compromises between Republicans and Democrats on repairing U.S. infrastructure. The White House on Friday cut its original $2.3 trillion infrastructure proposal to $1.7 trillion as a counteroffer to Republican senators, who released a $568 billion infrastructure proposal in April. The office of the Senate committee's ranking member, Sen. Shelley Moore Capito (R-W.Va.), said in a press release that the White House proposal was still "well above the range" of what Republicans would accept.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

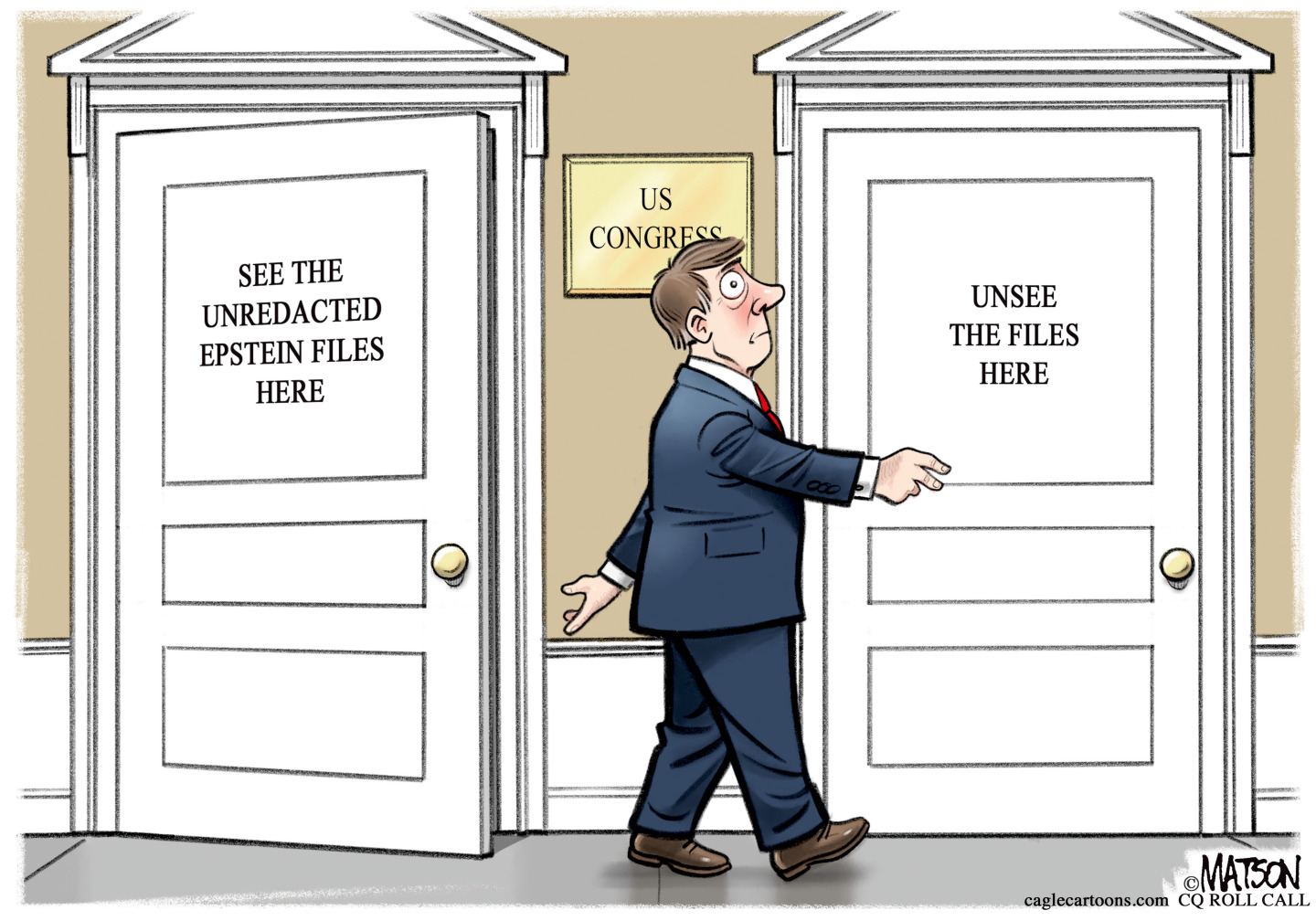

Political cartoons for February 11

Political cartoons for February 11Cartoons Wednesday's political cartoons include erasing Epstein, the national debt, and disease on demand

-

The Week contest: Lubricant larceny

The Week contest: Lubricant larcenyPuzzles and Quizzes

-

Can the UK take any more rain?

Can the UK take any more rain?Today’s Big Question An Atlantic jet stream is ‘stuck’ over British skies, leading to ‘biblical’ downpours and more than 40 consecutive days of rain in some areas

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

-

The daily business briefing: January 12, 2024

The daily business briefing: January 12, 2024Business Briefing Inflation was slightly hotter than expected in December, Hertz is selling a third of its EVs to buy more gas cars, and more