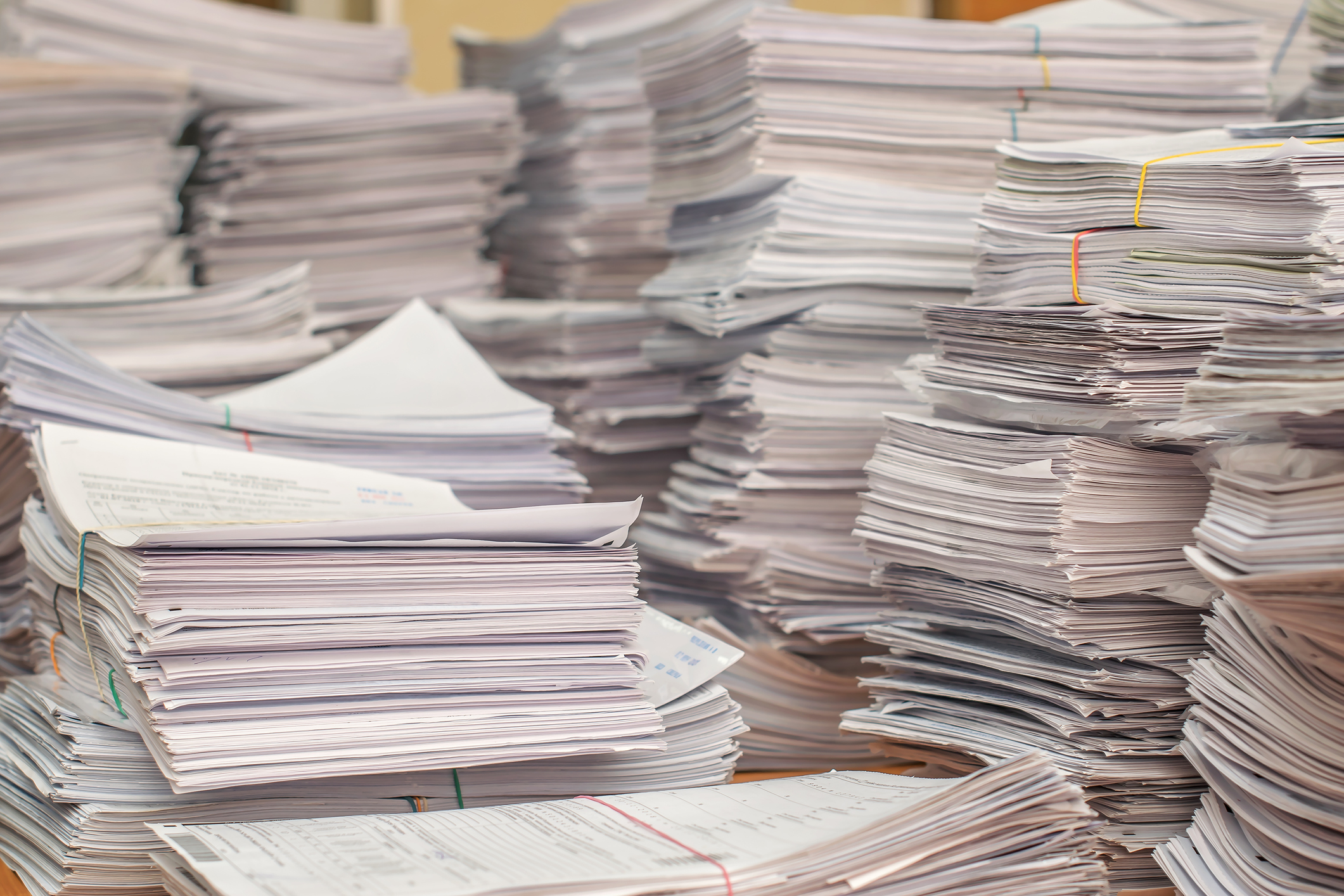

A growing IRS backlog

And more of the week's best financial insight

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Here are three of the week's top pieces of financial insight, gathered from around the web:

A growing IRS backlog

The IRS is still sorting through more than 20 million tax returns from last year, said Alan Rappeport in The New York Times. The agency was "turned into an economic relief spigot responsible for churning out checks and other stimulus payments to millions of Americans" during the pandemic. But its workforce of about 75,000 — the same size it was in 1970 — is struggling to reduce a backlog of about 24 million paper filings that "continue to clog creaky systems." At the IRS's primary paper-processing center in Kansas City, clerks must stamp each filing by hand. According to one employee, "a surprisingly large amount of time" is spent "looking for carts to put files on and staplers for stapling files together."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Leaning back at work

Not everyone is quitting their job. Many workers are just paying less attention to it, said Aki Ito in Business Insider. "The pandemic created ideal conditions" for some to "strategically dial back at work." The hot labor market has ensured job security, while the rise in remote work is making it harder for managers to monitor the effort workers are putting in. "Many Americans would call these employees lazy." But the workers I've spoken with say "they're making a considered, deliberate decision" as a form of resistance against "hustle culture." Executives think hauling people back to the office will make them feel like they are part of a team again. But after getting used to remote work, many employees "don't want to pal around with their co-workers." This new attitude "threatens to upend the all-consuming emphasis on career that has dominated America for decades."

New rules for private equity

"Pay attention to the SEC's overhaul of private capital," said Robert Armstrong and Ethan Wu in the Financial Times. Among a sweeping set of rule changes proposed for hedge funds and private equity is the requirement for public disclosure of large ($300 million) derivatives positions that can have market-wide effects. "Trades that can spread heavy losses to other firms should probably be public knowledge." Other rules aim to increase transparency, giving new protections to institutional investors — clients that up to now were assumed to be capable of "fending for themselves." It's clear the SEC is focused on the theme that "private investments can have public consequences." But for private capital, this is "nothing short of a 1930s moment."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

This article was first published in the latest issue of The Week magazine. If you want to read more like it, you can try six risk-free issues of the magazine here.

-

Political cartoons for February 14

Political cartoons for February 14Cartoons Saturday's political cartoons include a Valentine's grift, Hillary on the hook, and more

-

Tourangelle-style pork with prunes recipe

Tourangelle-style pork with prunes recipeThe Week Recommends This traditional, rustic dish is a French classic

-

The Epstein files: glimpses of a deeply disturbing world

The Epstein files: glimpses of a deeply disturbing worldIn the Spotlight Trove of released documents paint a picture of depravity and privilege in which men hold the cards, and women are powerless or peripheral