The outbreak of optimism at Davos

Uniformly bleak predictions have given way to greater cheer. But don’t count your chickens yet

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

After a series of grim surveys preceding the event, the two “surprise guests at Davos” last week were “hope and optimism”, said Aimee Donnellan on Reuters Breakingviews.

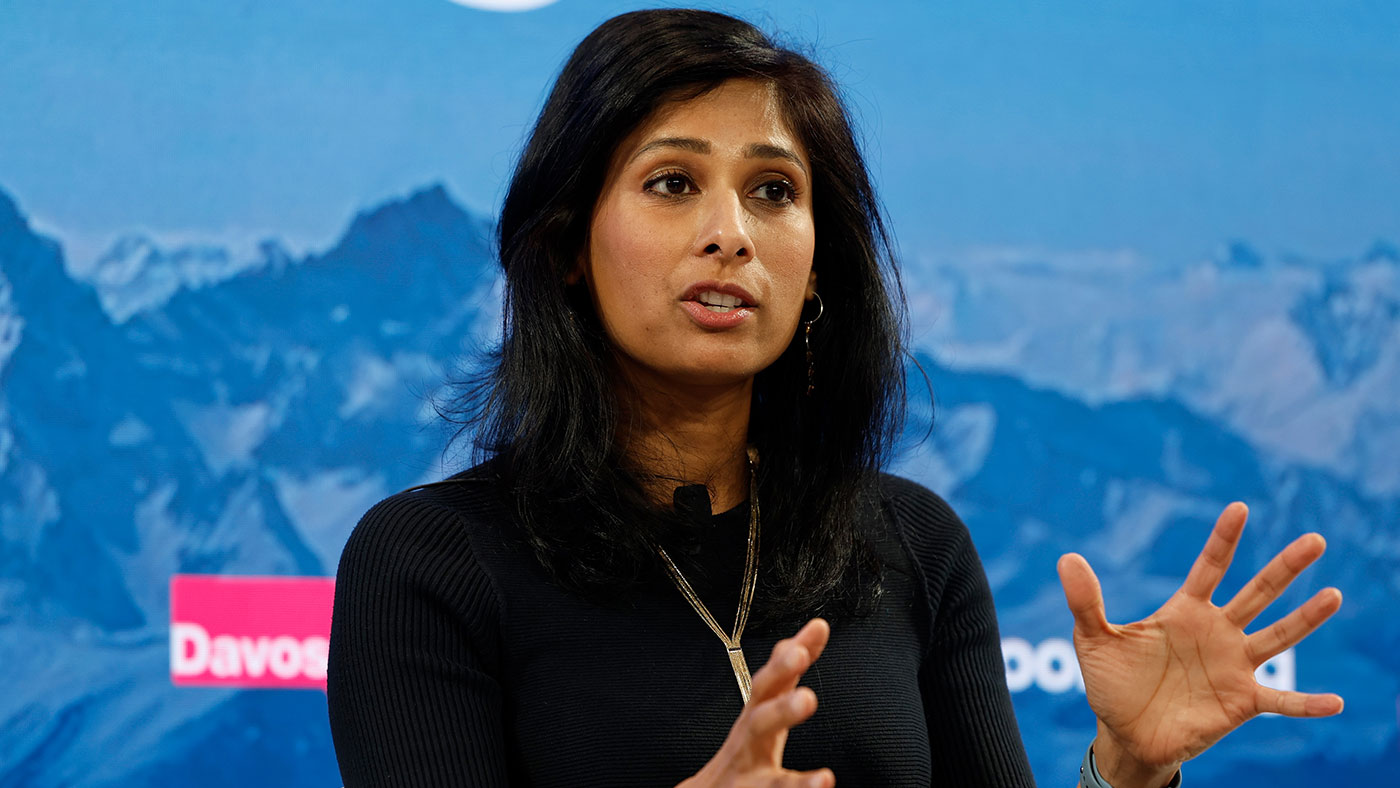

The IMF set the tone, when deputy managing director Gita Gopinath pronounced that China could see a sharp recovery in growth (“in the 4%-plus ballpark”) from the second quarter – and that any global inflationary pressures this might cause would likely be counterbalanced by the slowdown in demand elsewhere.

This balanced picture has prompted the Fund to upgrade its formerly dire global forecast to include a heartening “improvement” in the second half of the year, and into 2024.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

“Immaculate disinflation, a soft landing, the goldilocks economy – call it what you like, but 2023 has started with an unexpected injection of optimism,” said Mehreen Khan in The Times. Economists and business leaders are sounding “increasingly cheery about the chances of central banks engineering slower inflation without crashing their economies”.

One could be forgiven for dismissing “the bonhomie of private sector titans” – who, after all, were back in the Swiss Alps for the first time in three years. But plenty of well-respected forecasters not at Davos have also been adjusting their 2023 expectations.

“Even Britain, on course to be the worst-performing rich economy this year, will not suffer as deep a recession as feared,” according to JPMorgan and Credit Suisse. The Bank of England, which in November pencilled in “a four-quarter recession”, is likely to cement this tentative optimism by upgrading UK growth prospects in early February.

A ‘heaven versus a hell’?

The Czech industry minister, Jozef Síkela, described the difference in mood between now and last autumn as “like a heaven versus a hell”. That might be over-egging things, said Chris Giles in the FT, but three factors have raised hopes of a soft landing: an 80% fall in wholesale natural gas prices, the reopening of China’s economy and the big subsidies provided by the US Inflation Reduction Act for the green transition.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The potential “party poopers” are the central bankers, who, having underestimated inflation in 2022, are now doubling down on tightening. “Their worry is that while headline inflation rates are falling… core measures are not falling as fast.”

Pressure isn’t off

Even if the strain on households from surging inflation is past its peak, it doesn’t mean “the pressure is off”, said Roger Bootle in The Daily Telegraph. Real pay is still falling in Britain, and “the pressure on mortgage-burdened households is still growing”.

And December’s record borrowing figure was a fright. Things are a bit better than seemed likely just a short while ago. But don’t get too optimistic: “what the data gives, it can easily take away”.

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Powell: The Fed’s last hope?

Powell: The Fed’s last hope?Feature Federal Reserve Chairman Jerome Powell fights back against President Trump's claims

-

Taxes: It’s California vs. the billionaires

Taxes: It’s California vs. the billionairesFeature Larry Page and Peter Thiel may take their wealth elsewhere