Nvidia: unstoppable force, or powering down?

Sales of firm's AI-powering chips have surged above market expectations –but China is the elephant in the room

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

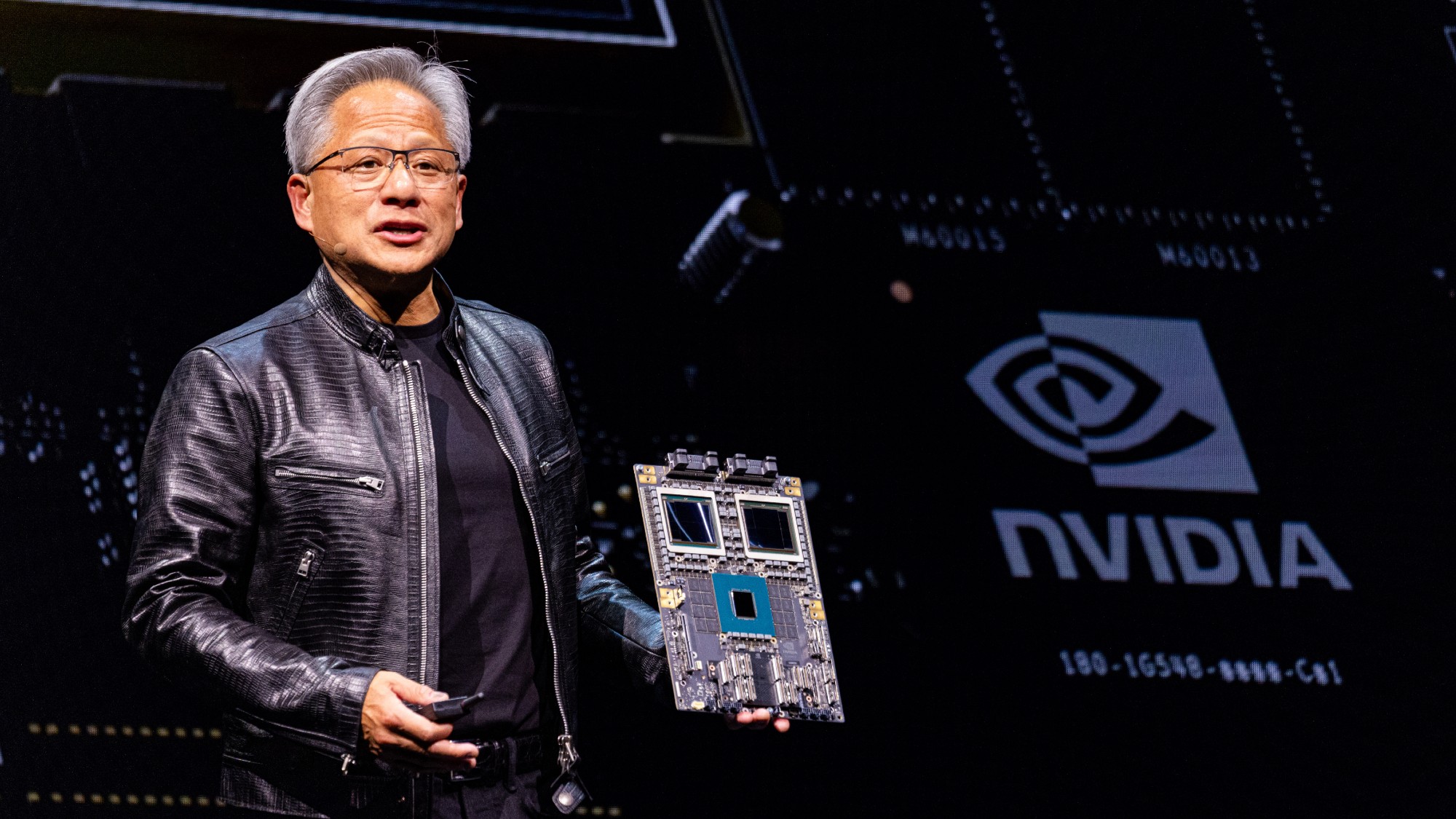

In the run-up to last week's quarterly update from the world's most valuable listed company, there were fears that lacklustre results might trigger a traumatic tech-sector correction. In the event, said Dan Gallagher in The Wall Street Journal, Nvidia's boss Jensen Huang trumpeted yet another period of record revenues and profits.

Sales of Nvidia's world-leading, AI-powering chips surged 56% year-on-year to almost $47 billion – above market expectations. It's Nvidia's slowest growth rate in two years, but it's far more than what other "megacap tech companies are currently managing". And that's with sales of AI chips to China "effectively shut off owing to national security concerns".

China is the big unknown here, said Dewardric L. McNeal on CNBC. What worried me most was the zero revenue from Nvidia's China-specific H20 chip. Alas, US-China tensions are holding it back, just as one of China's challengers, Cambricon Technologies, is "surging". Another likely brake on Nvidia's growth is the vast amount of electricity required to power the AI revolution, said The Economist. An "unstoppable force" is about to come up against "an immovable object. Or at least an object that has not moved much in decades – America's power grid."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Nvidia now trades at a price-to-forwardearnings multiple of 33, a little more than Microsoft or Oracle, but with faster-growing profits, said Lex in the FT. On the PEG ratio (price to earnings, adjusted for growth) it "looks positively cheap". The snag is that the bulk of its current $4.4 trillion valuation rests on "punchy" assumptions about post-2030 revenues. And its 72% gross margin, higher than Apple ever achieved, is an "open invitation to competitors". Huang tells "a compelling story about the world AI will create", and Nvidia's central role in it. "But for now it really is just a story."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for February 15

Political cartoons for February 15Cartoons Sunday's political cartoons include political ventriloquism, Europe in the middle, and more

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

Currencies: Why Trump wants a weak dollar

Currencies: Why Trump wants a weak dollarFeature The dollar has fallen 12% since Trump took office

-

Elon Musk’s starry mega-merger

Elon Musk’s starry mega-mergerTalking Point SpaceX founder is promising investors a rocket trip to the future – and a sprawling conglomerate to boot

-

TikTok: New owners, same risks

TikTok: New owners, same risksFeature What are Larry Ellison’s plans for TikTok US?

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history

-

Leadership: A conspicuous silence from CEOs

Leadership: A conspicuous silence from CEOsFeature CEOs were more vocal during Trump’s first term

-

Ryanair/SpaceX: could Musk really buy the airline?

Ryanair/SpaceX: could Musk really buy the airline?Talking Point Irish budget carrier has become embroiled in unlikely feud with the world’s wealthiest man

-

Powell: The Fed’s last hope?

Powell: The Fed’s last hope?Feature Federal Reserve Chairman Jerome Powell fights back against President Trump's claims

-

Taxes: It’s California vs. the billionaires

Taxes: It’s California vs. the billionairesFeature Larry Page and Peter Thiel may take their wealth elsewhere