Is a financial market crash around the corner?

Observers see echoes of 1929

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

It feels like old times, but not in a good way. Financial experts around the world are warning of an impending 1929-style financial market crash brought on by trade wars, large national debts and overbuilding in the AI sector.

“We will have a crash,” financial journalist Andrew Ross Sorkin told CBS News. Sorkin is promoting a new book, “1929: Inside the Greatest Crash in Wall Street History — and How It Shattered a Nation,” about the market collapse that sparked the Great Depression. But other voices are also sounding alarms. World markets are “susceptible to a disorderly adjustment” thanks to economic and political uncertainty, said G20 risk watchdog Andrew Bailey on Monday, per Reuters. Bank of England officials warned last week that the AI bubble driving tech stocks may soon burst, said CNBC. And JP Morgan CEO Jamie Dimon is similarly concerned about a “major market correction,” said Fortune. “Buckle up,” said International Monetary Fund chief Kristalina Georgieva last week, “uncertainty is the new normal and it is here to stay.”

Echoes of 1929?

The 1929 crash was the “definitive stock-market collapse,” said David Champion at Harvard Business Review. The 1920s were beset with trade protectionism, anti-immigrant fervor and new technologies that were upending “traditional livelihoods.” The question is whether finance executives have “absorbed the lessons of history by now.” After all, the echoes of 1929 in today’s economic landscape seem clear. “Once you start looking for similarities, you see them everywhere.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

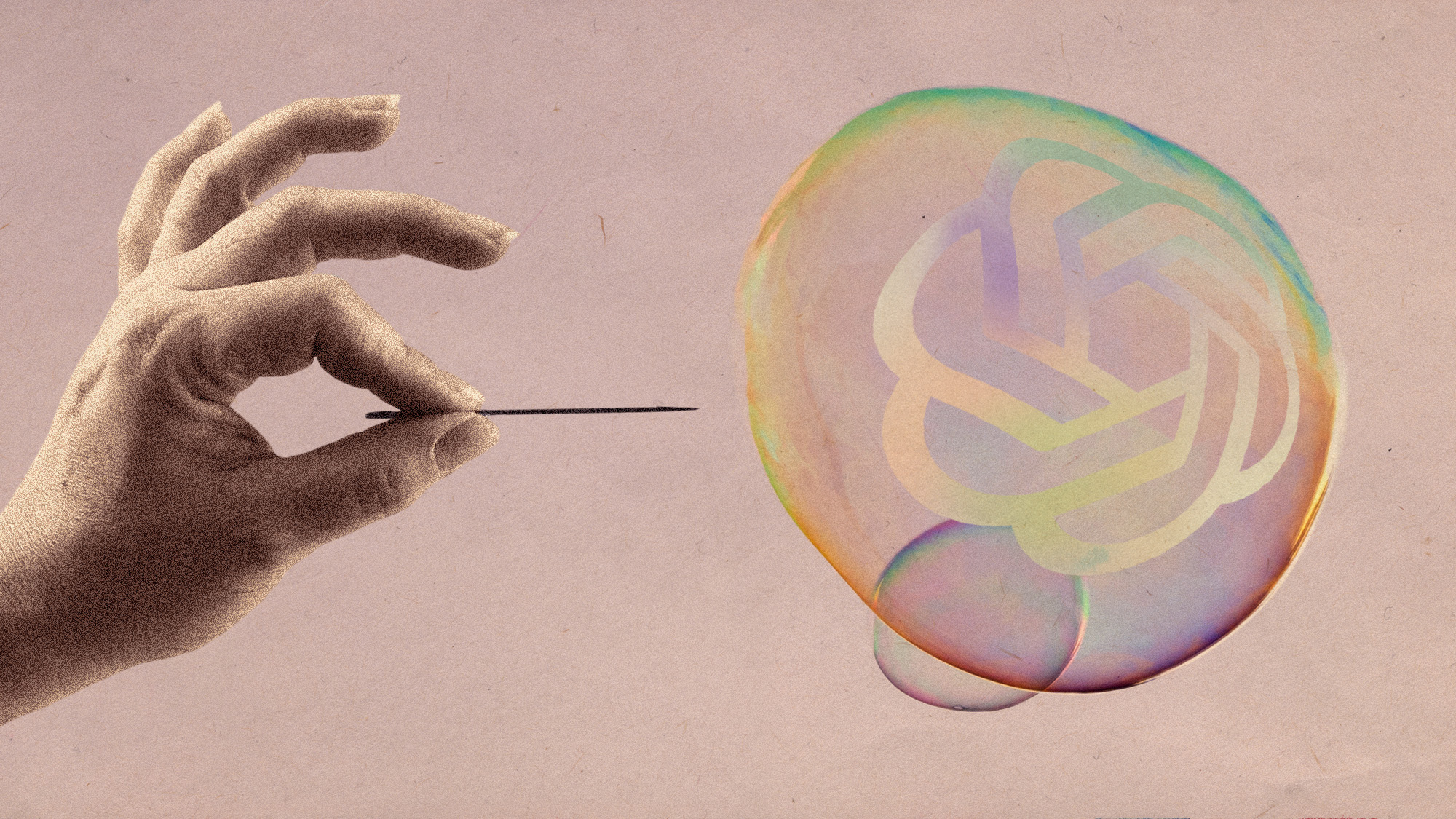

“The numbers just don’t make sense” when it comes to AI, said journalist Derek Thompson in his newsletter. Tech companies are spending $400 billion on artificial intelligence this year, which is more in inflation-adjusted terms than was spent on the entire Apollo moon program over a decade, yet it is “not clear” that those companies are “prepared to earn back the investment.” American consumers, after all, currently spend only $12 billion a year on AI services. Investors are still pouring money into tech, though. That looks like an “obvious economic bubble.” Bubbles pop, and “none of the typical rules for sensible investing can explain what’s going on with stock prices right now.”

Scary, but rare

Tech companies may be overinvesting in AI, but that does not mean investors should worry about a “contagion across the broader economy,” said Axios. The boom in tech investment is from “big, stable companies with the balance sheets to support their spending.”

Observers could be over-reading the signs of trouble. Bubble bursts are “memorable. They are colorful. They are scary,” said economic analyst William Goetzmann at The Wall Street Journal. But bubbles are also “much rarer than their presence in the public imagination.” Since 1887, the Dow Jones Industrial Average dropped 10% in a day just four times, and two of those were in 1929. But investors are always expecting the next disaster. Research shows they typically put odds of an imminent crash at 10-to-20%, which is “much greater than history suggests.”

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Joel Mathis is a writer with 30 years of newspaper and online journalism experience. His work also regularly appears in National Geographic and The Kansas City Star. His awards include best online commentary at the Online News Association and (twice) at the City and Regional Magazine Association.