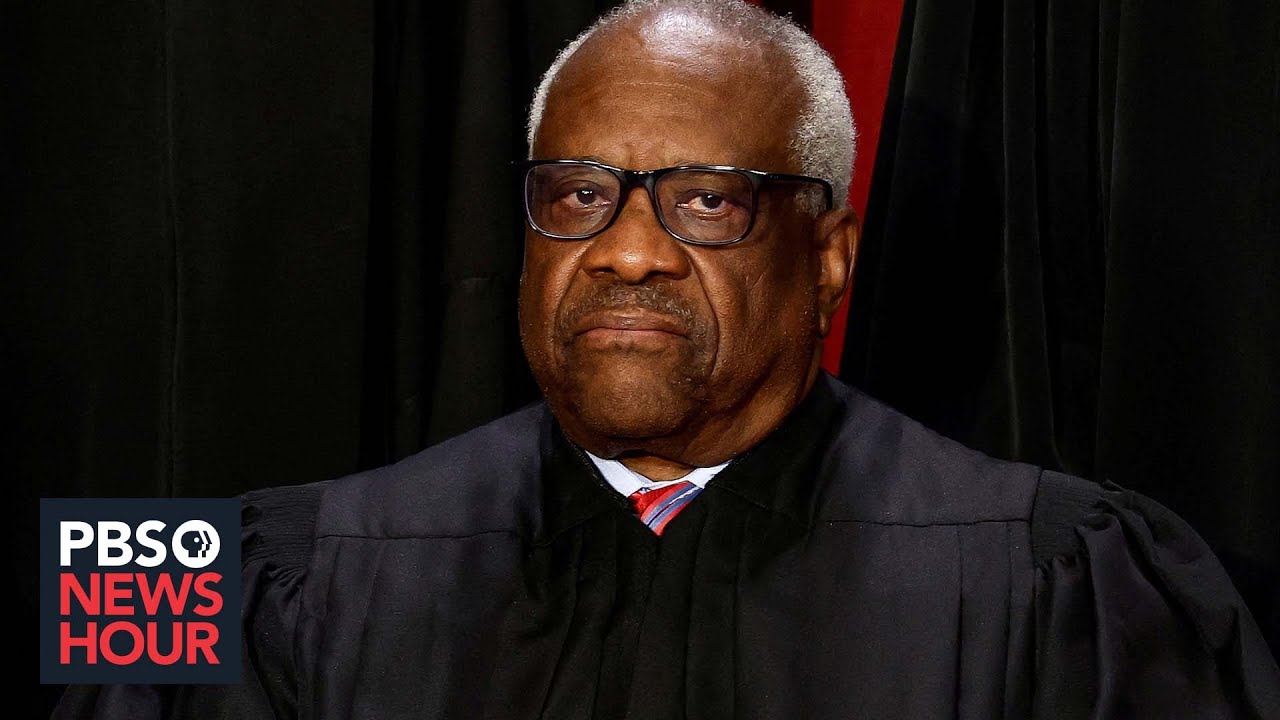

Clarence Thomas did not disclose real estate he sold to GOP megadonor Harlan Crow, report details

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Republican megadonor Harlan Crow bought three properties from Supreme Court Justice Clarence Thomas and his relatives in 2014, including the house Thomas' mother lives in — and Thomas did not report the sale on his financial disclosure form, ProPublica reported Thursday. Crow, a billionaire real estate heir and developer who is friends with Thomas, has paid for the justice's luxury vacations for the past two decades, and Thomas has not reported those gifts, either, ProPublica previous reported.

Thomas owned a third of the home in Savannah, Georgia, and two vacant lots on the same block that Crow purchased for $133,363. His failure to report the sale pretty clearly violates a 1978 law that requires federal officials, including Supreme Court justices, to disclose the details of most real estate transactions worth more than $1,000, four ethics law experts told ProPublica. Crow said in a statement that he bought the house to preserve it for a future museum dedicated to Thomas, but his intention has no bearing on the law, Gabe Roth, executive director of Fix the Court, tells PBS NewsHour.

"He needed to report his interest in the sale," Virginia Canter, a former government ethics lawyer now at the watchdog group CREW, told ProPublica. "Given the role Crow has played in subsidizing the lifestyle of Thomas and his wife, you have to wonder if this was an effort to put cash in their pockets." The failure to disclose the purchase suggests "Thomas was hiding a financial relationship with Crow," said Kathleen Clark, a legal ethics expert at Washington University in St. Louis.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Neither Thomas nor the Supreme Court immediately issued a public response to the report.

After Crow's company purchased the house, where Thomas' mother apparently continues to live, he paid at least $36,000 to upgrade and renovate it, ProPublica reports, and those upgrades and subsequent new builds in the vacant lots raised the value of all houses on the street. Crow began paying the house's roughly $1,500 in annual property taxes soon after the purchase, taking over an expense Thomas previously bore. You can read more about the "first known instance of money flowing" from Crow to Thomas at ProPublica.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

10 things you need to know today: January 6, 2024

10 things you need to know today: January 6, 2024Daily Briefing Supreme Court to rule on Trump being kept off 2024 presidential ballots, Hezbollah fires rockets toward Israel following Hamas leader’s death, and more

-

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstances

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstancesSpeed Read

-

Western mountain climbers allegedly left Pakistani porter to die on K2

Western mountain climbers allegedly left Pakistani porter to die on K2Speed Read

-

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governor

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governorSpeed Read

-

Los Angeles city workers stage 1-day walkout over labor conditions

Los Angeles city workers stage 1-day walkout over labor conditionsSpeed Read

-

Mega Millions jackpot climbs to an estimated $1.55 billion

Mega Millions jackpot climbs to an estimated $1.55 billionSpeed Read

-

Bangladesh dealing with worst dengue fever outbreak on record

Bangladesh dealing with worst dengue fever outbreak on recordSpeed Read

-

Glacial outburst flooding in Juneau destroys homes

Glacial outburst flooding in Juneau destroys homesSpeed Read