Spring Statement 2022: highlights of Rishi Sunak’s ‘mini budget’

Chancellor lowers fuel duty and lifts the National Insurance threshold

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Chancellor Rishi Sunak has today unveiled his highly anticipated Spring Statement against a backdrop of rising fuel, energy and food costs.

Shortly before Sunak’s statement – which has been billed by the national press as a “mini budget” – the challenge facing the chancellor was “laid bare” as the Office for National Statistics confirmed that inflation has reached a 30-year high, rising 6.2% in the 12 months to February, said the BBC.

It seems that for the “umpteenth time” in Sunak’s two years at the Treasury, what should be a rather “modest” fiscal event has been “transformed by events” – such as the cost-of-living crisis exacerbated by the war in Ukraine – into something “much more ambitious”, said Andrew Sparrow in The Guardian, ahead of the statement.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In the end, some eagerly anticipated measures designed to help those dealing with the rising cost of living were introduced by the chancellor, such as a cut in fuel duty, a rise in the National Insurance (NI) threshold and a promise to cut the basic rate of income tax by 2024. But the social care levy, which had many across the political spectrum calling for its delay or removal, has remained.

Fuel duty cut

The chancellor’s first big headline announcement was a cut in fuel duty of 5p a litre, which he called “the biggest cut to all fuel duty rates ever”. The cut, which Sunak said was worth over £5bn, will be in place for a year until March 2023 and will take effect from 6pm tonight.

The RAC has said that cutting fuel duty by 5p will take “£3.30 off the cost of filling a typical 55-litre family car”.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

VAT on energy-saving devices removed

Households will now pay 0% VAT on energy-saving equipment such as solar panels and heat pumps, which the chancellor said could cut the cost of solar panel installation by up to £1,000. He said that the policy highlighted the “deficiencies” in the Northern Ireland Protocol, as it could not be immediately be applied to Northern Ireland – which will nevertheless receive equivalent funding.

Household support fund doubled

The household support fund will be given £500m of new money, raising support for poorer families to a billion. Councils are set to receive the additional funding in April, said Sunak.

Lifting of NI threshold

The planned National Insurance hike to pay for NHS health and social care was not delayed or removed as many had hoped and called for – Sunak said that the additional funding it would provide for the NHS was “needed now”. But, he said that the increase in NI was “not incompatible with reducing taxes on working families”.

In one of his biggest announcements in the Spring Statement, the chancellor said he would raise the threshold on NI payments by £3,000 – a significant increase to the planned £300 threshold rise. The change will allow people to earn £12,570 before NI becomes payable.

“That’s a £6bn personal tax cut for 30 million people across the United Kingdom,” said Sunak, who called it “the largest increase in a basic rate threshold ever, and the largest single personal tax cut in a decade.”

However, The Guardian reported that the increase to the threshold will not come into force in time for the new tax year in April, and will instead apply from July. According to the Treasury, that is “the earliest date that will allow all payroll software developers and employers to update their systems and implement changes”, said the paper.

Help for business

Sunak pledged to “reform” the research and development tax credits for private business, possibly making it more generous in the autumn budget. He also announced cuts to tax rates on business investment in the autumn, and an increase of £5,000 to Employment Allowance for small businesses.

Cuts to the basic rate of income tax by 2024

The basic rate of income tax will be cut from 20p in the pound to 19p before the end of the current parliament, announced the chancellor, who hailed it as a “tax cut for workers, for pensioners, for savers” and a “£5bn tax cut for over 30 million people”.

The promised basic income tax cut – which as the chancellor noted, had only been cut twice in the last 20 years – was Sunak’s “rabbit out of a hat” moment, said Sky News’s political correspondent Beth Rigby.

But, she asked “how difficult will it become for families to make ends meet” over the next two years before the promised tax cuts are mooted to take effect? The BBC’s Laura Kuenssberg noted that it was “unusual politics to make that kind of commitment two years away” – likely to come into effect in time for a general election.

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral

-

Is the UK economy returning to normal?

Is the UK economy returning to normal?Today's Big Question Tories claim UK has 'turned a corner' while Labour accuses government of 'gaslighting' public

-

New austerity: can public services take any more cuts?

New austerity: can public services take any more cuts?Today's Big Question Some government departments already 'in last chance saloon', say unions, as Conservative tax-cutting plans 'hang in the balance'

-

Would tax cuts benefit the UK economy?

Would tax cuts benefit the UK economy?Today's Big Question More money in people's pockets may help the Tories politically, but could harm efforts to keep inflation falling

-

Withdrawing benefits: 'war on work shy' or 'matter of fairness'?

Withdrawing benefits: 'war on work shy' or 'matter of fairness'?Talking Point Jeremy Hunt to boost minimum wage while cracking down on claimants who refuse to look for work

-

Sticky inflation and sluggish growth: why does UK economy continue to struggle?

Sticky inflation and sluggish growth: why does UK economy continue to struggle?Today's Big Question Food prices, Brexit and the Bank of England have been blamed for poor economic performance

-

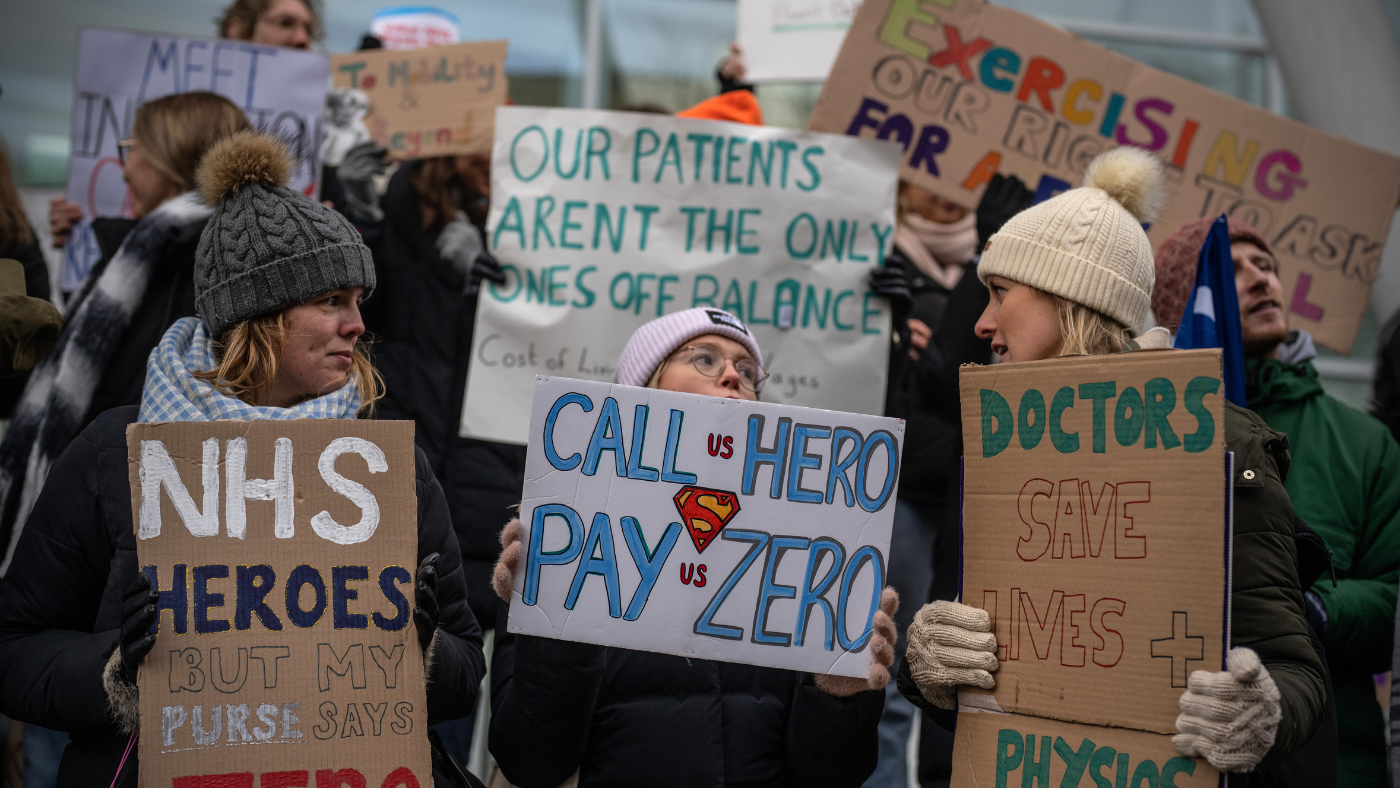

Public sector pay and inflation: what’s the link?

Public sector pay and inflation: what’s the link?Talking Point Economists say government warnings of wage-price spiral are overblown

-

Why UK companies are facing a dystopian, zero-growth future

Why UK companies are facing a dystopian, zero-growth futurefeature In prioritising stability, the Treasury risks ‘stifling enterprise and entrepreneurship’

-

Is the UK facing a ‘cost of doing business’ crisis?

Is the UK facing a ‘cost of doing business’ crisis?Talking Point Mass insolvencies loom as companies face fourfold increases in energy bills