Predictions for Rishi Sunak’s Spring Statement

Chancellor may cut fuel duty after pressure from campaigners and senior backbenchers

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Rishi Sunak’s Spring Statement may prove to be a difficult balancing act as he faces calls to increase defence spending and introduce measures to reduce the cost of living.

Sunak is set to deliver the spring statement on 23 March, alongside the latest Office for Budget Responsibility (OBR) forecasts, which are published twice a year.

The OBR is “widely expected to upgrade its forecasts”, giving the chancellor the option to “increase public spending while staying within his limits” after the Treasury received almost £9bn more in tax receipts in January 2022 than the previous year, said Sky News.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

As The Telegraph explained, the Spring Statement is “an opportunity for the Chancellor to provide an update on the overall health of the economy”, but is unlikely to include any “major tax or spending changes”, which are saved for the Budget, given once a year.

The Spring Statement can be likened to a “mini-Budget” and “tends to include the launch of a number of consultations on potential new policies”.

Petrol duty freeze

The chancellor dropped a “heavy hint” over the weekend that he would cut fuel duty by at least 5p, after he described it as “one of the biggest bills that people face” on Sky News’s Sophy Ridge on Sunday programme.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

“We are all seeing that when we are filling up our cars. I get that. That’s why we’ve frozen fuel duty already; I announced that in autumn. It’s the 11th consecutive year of fuel duty freezes and that really helps people, I know that,” he told the programme. He did add, however, that he couldn’t comment on specific measures that might be announced on Wednesday.

Any reduction in fuel duty – which is currently set at 58p a litre – is likely to be “strictly time-limited” by the chancellor, in light of the government’s net-zero promises, and “could be reversed within six months… if global oil prices stabilise, with a review likely to be held ahead of the autumn budget”, said The Times.

The chancellor has found himself under pressure from campaigners and senior Tory MPs such as Robert Halfon to cut fuel duty. Other European nations, such as France, Ireland and the Netherlands, have already cut fuel duty in an attempt to shield households and businesses from rising costs.

Halfon told the Financial Times earlier this month that ministers have warned that a cut in fuel duty will mean tax cuts won’t be possible later this year, but Halfon argued: “If pump prices go to £1.60, it won’t just be motorists but businesses and the NHS that are affected.”

Calls for tax and cost of living cuts

The chancellor is also considering raising the threshold at which people start paying National Insurance (NI), which could take 150,000 people out of paying the levy altogether, said The Times.

Government sources have said Sunak is considering “increasing the threshold in line with the updated forecast of inflation rising to 7.25 per cent in April”, said the paper, which would mean people would only start paying NI on income over £10,285.

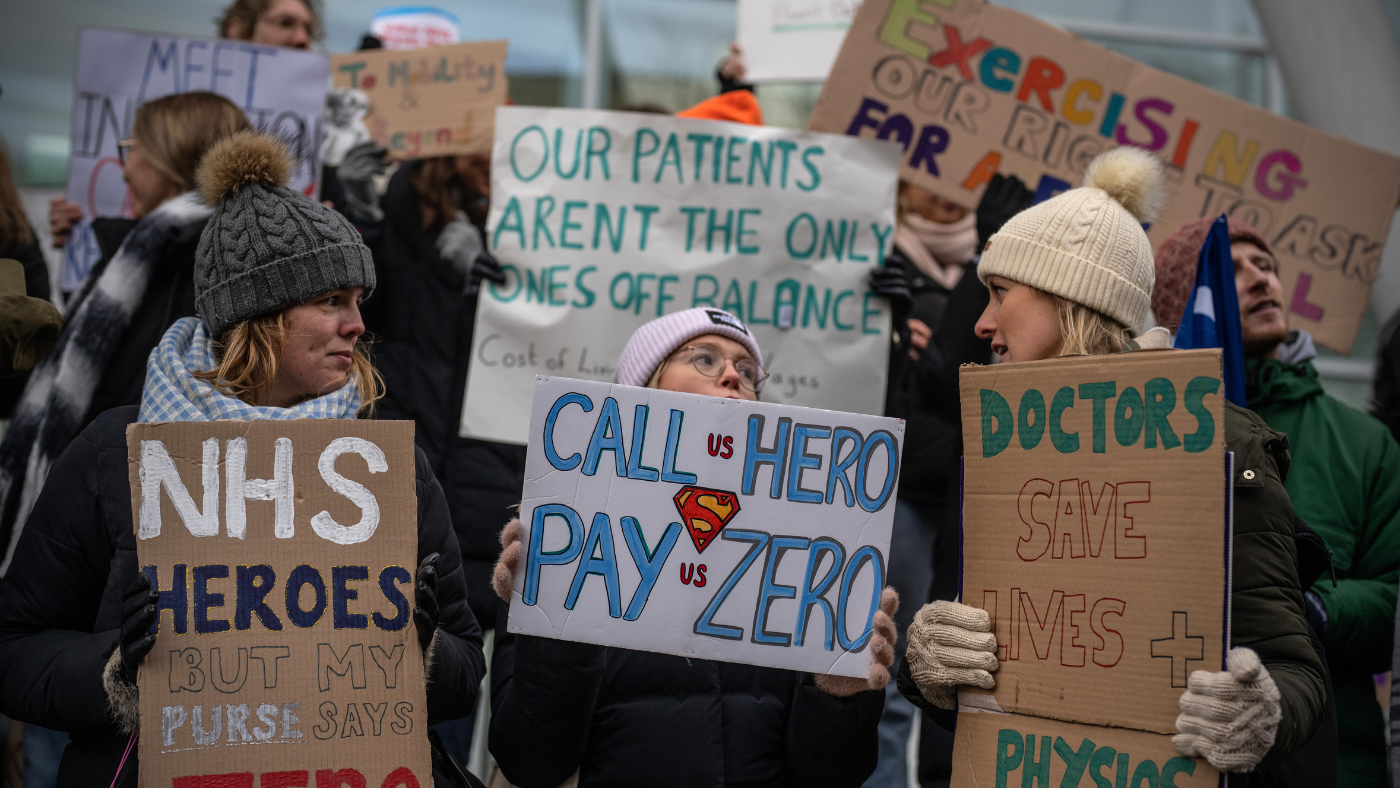

Sunak has so far ruled out reversing the 1.25% hike in NI, designed to fund health and social care, but raising the threshold would shield the lowest-paid from the rise.

There has also been speculation that the chancellor is looking at similar changes to income tax thresholds and allowances, reported The Telegraph. He is also under pressure to raise working age and pensioner benefits by a further five percentage points to 8.1 per cent, said the paper.

Sunak finds himself under pressure to alleviate the looming cost of living crisis, and may have to turn to “Covid-level intervention” to save energy markets from disaster, said Politico’s London Playbook.

Sunak has already announced a £9bn package to help households with the surging costs of energy bills, in the form of a repayable discount and a one-off rebate for council tax bands A to D, as well as £200 credit on energy bills to be repaid over the next five years.

The Times reports that the £200 credit could be raised as natural gas prices are expected to rise further due to sanctions imposed on Russia from Western nations.

But it is thought that Sunak will “hold off” on any “major action” to ease the pain of soaring energy prices for households, said the Daily Mail. The chancellor is understood to be “resisting laying out another big package of help” in his upcoming Spring Statement, as Treasury aides stress that costs could change by October when the price cap is set to be altered again. Boris Johnson is also set to announce a new energy strategy this week as he seeks to wean the UK off dependence on Russian oil.

Instead, “support for Universal Credit” is likely to be the focus of changes, said the paper. In the October budget, the Universal Credit taper rate was reduced, “so there’s speculation that this could be reduced even more”, said Which?.

Child benefit “may also be in line for a shake-up”, said the site. “The threshold for the high-income child benefit charge hasn’t increased with income tax band thresholds, meaning some basic-rate taxpayers will be forced to repay some of their child benefit payment if they earn more than £50,000,” explained Which?. Changes to child benefit “would help some household budgets”.

Many Tory MPs, such as Brexit opportunities minister Jacob Rees-Mogg, have been “pressing the case” for tax cuts, including a reversal of planned National Insurance increases which will fund NHS treatments and social care. Calls to scrap the planned new tax are supported by many on the Conservative right and the Labour Party.

Shadow chancellor Rachel Reeves said that the planned National Insurance rise next month will “demolish any benefit” from Sunak’s energy package by costing the average worker £342 next year, reported the Daily Mail.

But Sunak is “determined to resist such pressure,” said the Financial Times, “and has so far been backed by Johnson” – which means people will most likely see their tax bills rise from next month.

But Sunak is “determined to resist such pressure,” said the paper, “and has so far been backed by Johnson”. The chancellor fears injecting money “artificially” into the economy through measures such as scrapping the planned tax rise, “fearing it could push inflation even higher”, explained the FT.

Rise in defence spending

Any spending increase is most likely to go towards defence, sources told the Sky News, with “additional money for lethal aid for Ukraine” as well as increases in other areas of the defence budget “in the face of the increased threat to NATO from Russia”.

There is yet to be any formal submission from the Ministry of Defence, but Labour’s shadow defence secretary John Healey has said he expects there to be a “big boost to defence” in the Spring Statement. “The government must respond to increased threats and increased threats to our security in Europe,” he told Trevor Phillips on Sky News in early March.

Sorcha Bradley is a writer at The Week and a regular on “The Week Unwrapped” podcast. She worked at The Week magazine for a year and a half before taking up her current role with the digital team, where she mostly covers UK current affairs and politics. Before joining The Week, Sorcha worked at slow-news start-up Tortoise Media. She has also written for Sky News, The Sunday Times, the London Evening Standard and Grazia magazine, among other publications. She has a master’s in newspaper journalism from City, University of London, where she specialised in political journalism.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Is the UK economy returning to normal?

Is the UK economy returning to normal?Today's Big Question Tories claim UK has 'turned a corner' while Labour accuses government of 'gaslighting' public

-

New austerity: can public services take any more cuts?

New austerity: can public services take any more cuts?Today's Big Question Some government departments already 'in last chance saloon', say unions, as Conservative tax-cutting plans 'hang in the balance'

-

Five key takeaways from Jeremy Hunt's Autumn Statement

Five key takeaways from Jeremy Hunt's Autumn StatementThe Explainer Benefits rise with higher inflation figure, pension triple lock maintained and National Insurance cut

-

Would tax cuts benefit the UK economy?

Would tax cuts benefit the UK economy?Today's Big Question More money in people's pockets may help the Tories politically, but could harm efforts to keep inflation falling

-

Withdrawing benefits: 'war on work shy' or 'matter of fairness'?

Withdrawing benefits: 'war on work shy' or 'matter of fairness'?Talking Point Jeremy Hunt to boost minimum wage while cracking down on claimants who refuse to look for work

-

Sticky inflation and sluggish growth: why does UK economy continue to struggle?

Sticky inflation and sluggish growth: why does UK economy continue to struggle?Today's Big Question Food prices, Brexit and the Bank of England have been blamed for poor economic performance

-

Public sector pay and inflation: what’s the link?

Public sector pay and inflation: what’s the link?Talking Point Economists say government warnings of wage-price spiral are overblown

-

Why UK companies are facing a dystopian, zero-growth future

Why UK companies are facing a dystopian, zero-growth futurefeature In prioritising stability, the Treasury risks ‘stifling enterprise and entrepreneurship’