Inheritance: why are Tories taking on the death tax?

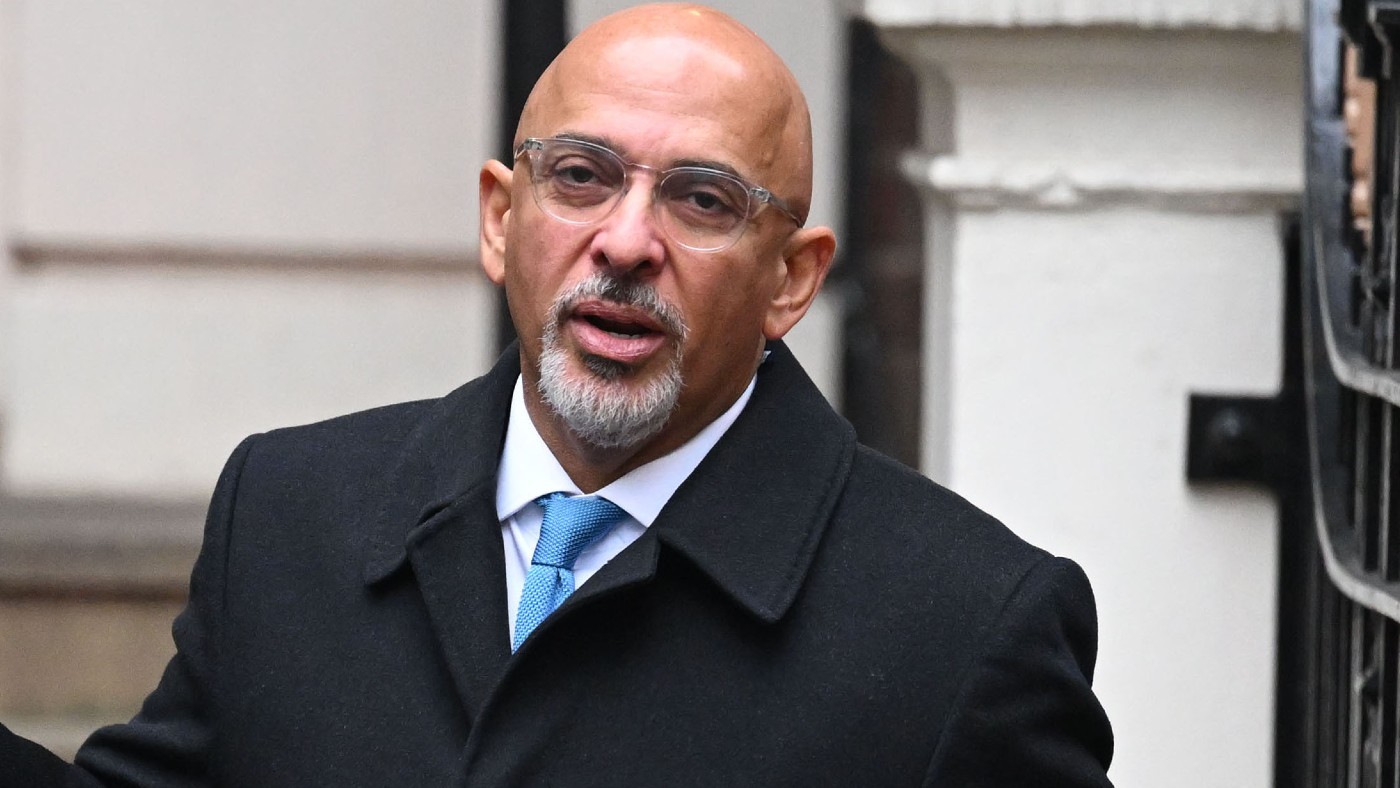

Campaign to abolish levy has support of more than 50 Tory MPs, including Liz Truss, Jacob Rees-Mogg and Nadhim Zahawi

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

“Few items of public policy raise the public’s hackles quite like inheritance tax,” said John Ashmore on CapX.

For many Brits, the idea that the state should intervene in the intimate matter of what you leave to your children “sticks in the collective craw”. Then there’s the unfortunate timing: HMRC presents the bereaved with a huge bill, a “death tax”. Others object to it on the grounds that it amounts to double taxation on assets that may have already been taxed when they were amassed, via income or capital gains tax.

Inheritance tax certainly polls “pretty damn badly”. (A recent survey by YouGov found that 50% of people in the UK thought it was unfair or very unfair, compared with just 19% who thought it was fair or very fair.) So you can see why The Daily Telegraph has launched a campaign to do away with it altogether, and why that has the support of more than 50 Tory MPs, including Liz Truss, Jacob Rees-Mogg and Nadhim Zahawi.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But would abolishing it be a good idea?

‘Tax on aspiration’

Inheritance tax may not be entirely fair, but neither is inheriting large amounts of unearned cash, said Emma Duncan in The Times. And it is often entirely unearned, because so much of it now derives from property wealth, amassed “due not to hard work, but to the rise in property prices”. Besides, less than 4% of estates actually attract the tax, which kicks in when they’re worth over £325,000 (usually twice that where a married couple’s estate is concerned), at a rate of 40%. And the benefits of abolishing it wouldn’t go “to the middle classes who have salted away a few bob”: the Resolution Foundation estimates that 70% of the gains would go to estates of over £1m, about half of them in London and the Southeast.

But that’s precisely the point, said Daniel Johnson in The Daily Telegraph. Because of property price inflation, this is “a tax that potentially affects almost any homeowner in the more prosperous parts of the country”. That is unfair and morally wrong. “The desire of one generation to help the next ought to be encouraged, not penalised.” This is “a tax on aspiration”.

‘Hefty tax cuts for the richest 4%’

Some Tories seem to think abolishing it would be popular, said Polly Toynbee in The Guardian. They’re deluded. In principle, people don’t like the idea of inheritance tax. But do the Conservatives really want to go into the next election, with the tax burden at a historic high, promising hefty cuts for the richest 4%? And what could be “more comic” than the multimillionaire Nadhim Zahawi leading this campaign, when his brief chancellorship is remembered mainly because he was sacked for failing to declare an investigation into his tax affairs?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The tax could certainly be reformed, said Paul Waugh in the i news site. At the moment, it’s absurdly easy to avoid if you have millions, yet impossible if the family home is your main asset. But the campaign to abolish it is doomed, for one simple reason: in the current climate, no chancellor will give up the £7bn that it raises every year.