Searching for the companies pursuing a brighter future

The world is at a crossroads. It’s becoming increasingly clear the planet cannot continue to use up its resources at the current rate, churning out rubbish and poisonous gasses into the natural environment and atmosphere.

However, we can’t just hit ‘pause’ on everything. Consumers want freedom to do what they want when they want. They want to buy phones, TVs, fast food, and travel on holiday to exotic locations.

An alternative is to meet in the middle. The world must get better at doing more with less, being more sensitive to the environment, using resources more sparingly and reusing what we can. Consumers are increasingly aware of companies’ sustainability plans and credentials from businesses such as cosmetics group L’Oréal.

The future of business

The specialist investment manager, Martin Currie became a signatory to the Principles for Responsible Investment (PRI) agreement in 2009, and ever since, it has been refining and defining its approach to environmental, social, and governance (ESG) analysis. It has developed a rigorous framework for finding those businesses, such as L’Oréal, which are genuinely committed to a better future.

Sadly, not all businesses are preparing for the future in this way, meaning investors have to be rigorous when combing the market for companies that have the potential to survive and thrive in the years ahead.

Martin Currie Global Portfolio Trust’s investment team evaluates, measures and scores over 50 individual criteria for every company the manager considers. This systematic approach to ESG helps with the benchmarking and comparison of companies across industries and countries. The process goes further and is more profound than that of many other managers.

Morningstar*, a global fund ratings agency, independently assesses portfolios worldwide on performance and evaluates ESG and Sustainability factors. As of July 2023, it ranks Martin Currie Global Portfolio Trust in the top 1% globally out of 8,504 similar products (categorised as Global Equity Large Cap).

It has also awarded the trust with a Sustainability Rating of '5 globes' the highest possible and also a Low Carbon DesignationTM - an indication the companies in the portfolio are in alignment with the transition to a low-carbon economy.

While there are no guarantees Martin Currie’s ESG framework will achieve market-beating returns for a long-term investor, this depth of analysis and interrogation helps to build a clearer picture of the potential risks and growth potential of a company. This information provides valuable input to the stock selection process and help to identify which companies make it into the portfolio.

The manager’s ESG framework is essential - but is just one part of the extensive approach to researching investments.

Martin Currie Global Portfolio Trust

Martin Currie manages a range of funds and investments, including Martin Currie Global Portfolio Trust, a global equity portfolio including some of the world’s leading companies.

This investment trust owns a focused selection of the manager’s top investment ideas, offering investors exposure to a range of exciting international markets.

The investment team, led by Portfolio Manager Zehrid Osmani, seeks companies exposed to multi-decade growth ‘megatrends.’ It handpicks 25-40 of the most exciting ideas, those businesses with the potential to offer for long-term growth while also preparing for a better future.

The result of this in-depth approach is a portfolio of companies that combines growth potential along with strong ESG credentials.

L’Oréal is, in many respects, a good example of the investment team's approach in action. Not only has the business made firm commitments to reduce its impact on the planet, but it also looks well-positioned to take advantage of structural global growth trends.

Structural growth drivers

The global beauty market is expected to grow by a projected 6% a year through 2027, according to McKinsey*, led by growth in Asia. Analysis also suggests demand for beauty products with a purpose and ethical background will outpace the rest of the industry.

L’Oréal is already an industry leader, and its effective marketing and e-commerce developments have allowed it to grow in large markets such as China and Southeast Asia, where e-commerce sales now account for 50% of total sales*.

In 2020, the cosmetics firm launched the ‘L’Oréal for the Future’ programme, an ambitious set of goals designed to reduce its footprint on the environment.

These include science-based targets aligned with a 1.5-degree scenario, like the commitment to carbon neutrality across all its sites by 2025. It’s also banning all raw materials linked to deforestation from its supply chains by 2030, with all bio-ingredients coming from traceable sources.

L’Oréal is committed to a better future, and it’s an approach that’s already resonating with consumers.

Martin Currie’s analysis suggests the group’s “brand loyalty, ongoing marketing and digital capability are competitive advantages that could help to maintain its leadership position.”

It’s also a play on the investment manager’s “Emerging Consumer” megatrend framework.

Companies like L’Oréal typify the investment ethos of Martin Currie Global Portfolio Trust which seeks to invest in companies that are responsive to improving outcomes for society in general. Something we think we would all agree with as being a priority in current times.

Sources

1. Source for Morningstar data and ratings: Morningstar © September 2023 Morningstar, Inc. All rights reserved. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

2. Source: McKinsey, May 2023.

3. Source: Martin Currie, August 2023

To find out more visit: https://www.martincurrieglobal.com/articles/gpt-stock-story-loreal

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the securities discussed here were, or will prove to be, profitable.

Important Legal Information

This information is issued and approved by Franklin Templeton Investment Management Limited (FTIML). It does not constitute investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Past performance is not a guide to future returns. The return may increase or decrease as a result of fluctuations in the markets, in currency and/or in the portfolio.

Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The analysis of Environmental, Social and Governance (ESG) factors form an important part of the investment process and helps inform investment decisions. The strategy does not necessarily target particular sustainability outcomes.

The opinions contained in this document are those of the named manager(s). They may not necessarily represent the views of other Martin Currie managers, strategies or funds.

Shares in investment trusts are traded on a stock market and the share price will fluctuate in accordance with supply and demand and may not reflect the value of underlying net asset value of the shares. The majority of charges will be deducted from the capital of the company. This will constrain capital growth of the company in order to maintain the income streams.

There is no guarantee that Martin Currie Global Portfolio Trust will achieve its objective. Please consult your financial adviser before deciding to invest.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Kharg Island: Iran’s ‘Achilles heel’

Kharg Island: Iran’s ‘Achilles heel’The Explainer The vital Gulf oil hub has been untouched so far by US attacks

-

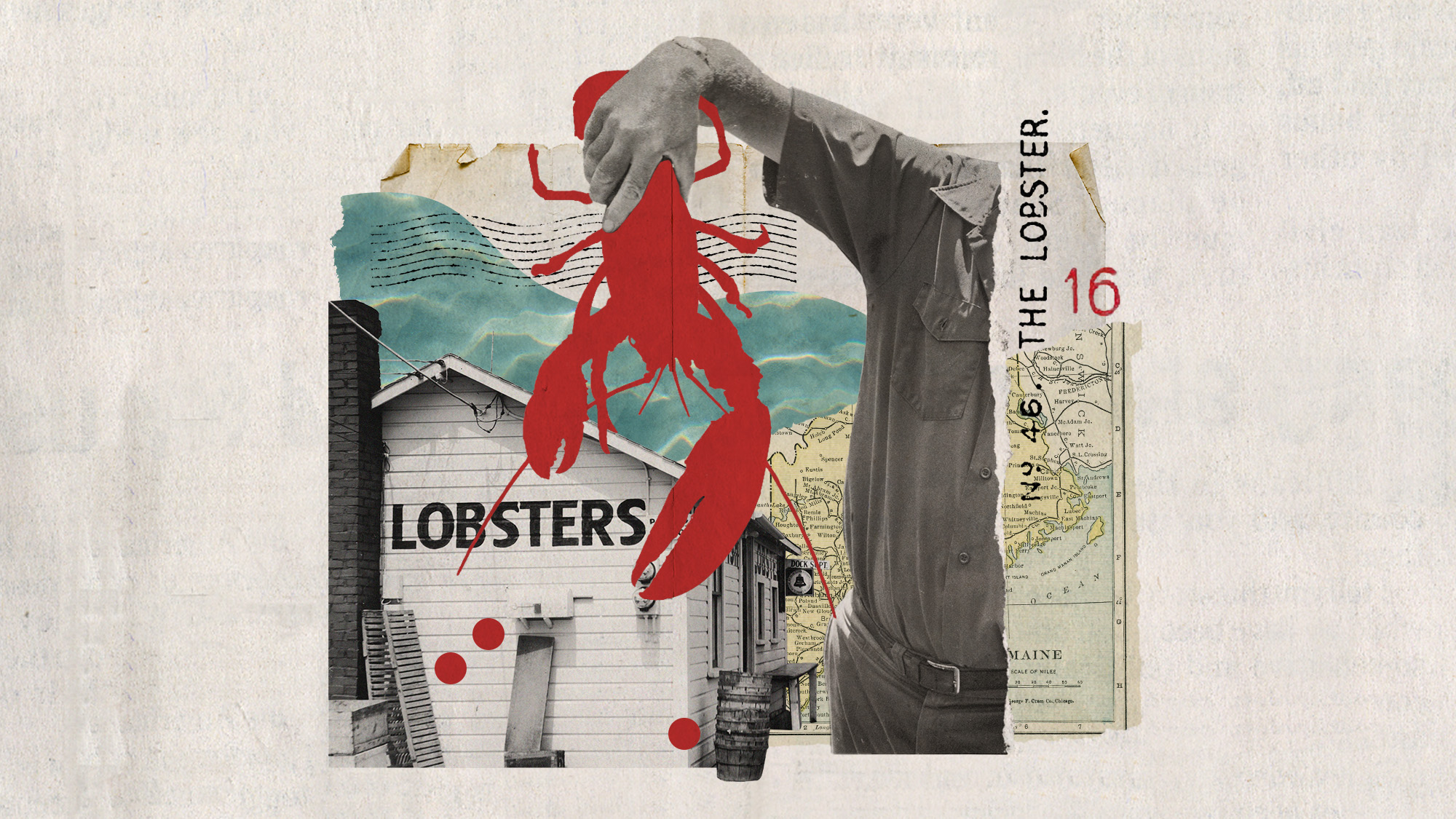

Surf and dearth: Maine’s lobster industry faces a reckoning

Surf and dearth: Maine’s lobster industry faces a reckoningunder the radar A shifting economy and climate change are causing issues for Mainers

-

Bone-chilling podcasts you may have missed this winter

Bone-chilling podcasts you may have missed this winterThe Week Recommends Environmental conflict, uncomfortable history and true crime encompassed the season’s best podcasts