The fight against the 'poverty premium' on insurance

Lower-income households can be hardest hit when it comes to monthly premiums

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The government, financial bodies and industry regulators are teaming up to address how and why low-income customers may be paying over the odds for insurance.

A taskforce has been established, including industry groups and consumer champions such as the Association of British Insurers (ABI), Citizens Advice and the consumer magazine Which?, to "tackle spiralling costs of car insurance", said a government press release.

The panel aims to identify the factors behind "rapidly rising" premiums. It will focus on the cost of premium finance, which lets consumers pay for insurance in monthly instalments, said The Times, but campaigners warn it creates a "poverty premium" due to the higher rates of interest customers end up paying.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

What is the poverty premium?

The poverty premium, said turn2us, is "the idea that the poor pay more for essential goods and services" as they may lack internet access or be on pre-payment meters.

It is essentially a "penalty for living in poverty", the charity explained, costing low-income households £490 a year on average and as much as £1,190 for some.

How does it affect insurance customers?

In the case of insurance, people on lower incomes may not be able to pay up front so end up paying more on a monthly basis, said turn2us.

It comes as car insurance costs have surged, said The Times, raising concerns that "some households cannot afford an essential service".

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

The average yearly rate when paying car insurance premiums on a monthly basis is 20% to 30%, said the Financial Conduct Authority (FCA), which is concerned that this "may not be providing fair value".

It has launched an investigation into monthly premium costs for motor and also home insurance, including the impact on lower-income households.

The regulator said more than 20 million people are estimated to pay for their insurance this way, and 79% of adults in financial difficulty have used the product.

Its review will explore how aware people are of their financing options and the role of commission, said the i news site, as well as "other potential barriers to effective competition".

How to cut your insurance costs

Rising repair costs and increased claims, as well as more vehicle thefts, said Forbes Advisor, are blamed for the "escalating costs" when it comes to insuring your home or vehicles.

However, there are ways to try to reduce your premiums. Shopping around using a comparison website is an "essential way" to find the right cover at the best price on both monthly instalments and annual payments.

Avoid auto-renewing without checking for better quotes, said Good Housekeeping, as you may be "needlessly overpaying for your next year's car insurance".

There are also certain times when it is best to buy insurance. The "cheapest time" to get a quote is 20 to 27 days before your renewal date, as "cover becomes more expensive the closer you get".

It may be nice to have a "noteworthy motor", said CompareTheMarket, but the car you drive can have a big impact on your insurance, as can "clocking up fewer miles" each year, which reduces the risk of accidents.

Setting a higher excess to pay if you make a claim can also mean a lower premium, said Which?. But be careful about setting the bar too high, as the cost “might make claiming on your insurance either pointless or too expensive”.

Marc Shoffman is an NCTJ-qualified award-winning freelance journalist, specialising in business, property and personal finance. He has a BA in multimedia journalism from Bournemouth University and a master’s in financial journalism from City University, London. His career began at FT Business trade publication Financial Adviser, during the 2008 banking crash. In 2013, he moved to MailOnline’s personal finance section This is Money, where he covered topics ranging from mortgages and pensions to investments and even a bit of Bitcoin. Since going freelance in 2016, his work has appeared in MoneyWeek, The Times, The Mail on Sunday and on the i news site.

-

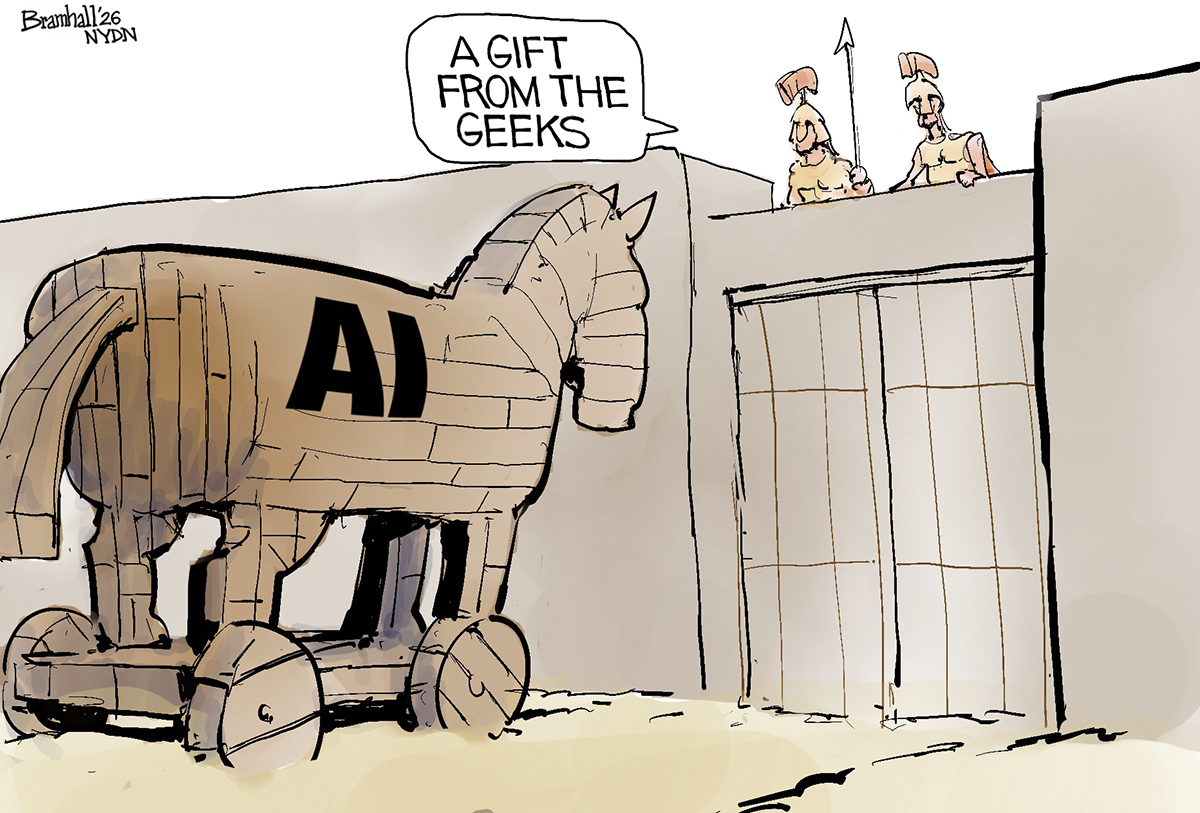

Political cartoons for February 19

Political cartoons for February 19Cartoons Thursday’s political cartoons include a suspicious package, a piece of the cake, and more

-

The Gallivant: style and charm steps from Camber Sands

The Gallivant: style and charm steps from Camber SandsThe Week Recommends Nestled behind the dunes, this luxury hotel is a great place to hunker down and get cosy

-

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in Iraq

The President’s Cake: ‘sweet tragedy’ about a little girl on a baking mission in IraqThe Week Recommends Charming debut from Hasan Hadi is filled with ‘vivid characters’