68 percent of the nation's top retailers warn stagnant wages will hurt their bottom line

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The nation's top retailers — think Home Depot, Starbucks, and The Gap — are experts at separating you from your money. They just wish you had more of it.

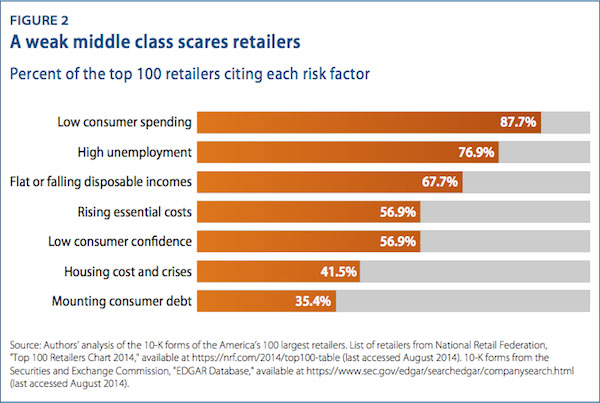

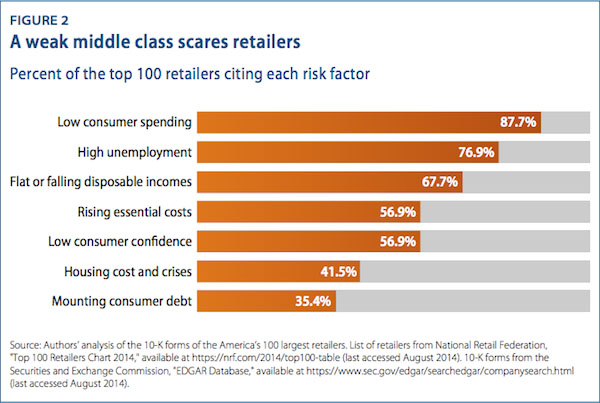

In a survey of the business "risk factor reports" companies are required to file with the Securities and Exchange Commission, the Center for American Progress found that 68 percent of the top 100 retailers in the U.S. cited "flat or falling disposable incomes" as a risk to their profits. Even greater percentages of top retailers were concerned about high unemployment and low consumer spending:

(Center for American Progress)

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

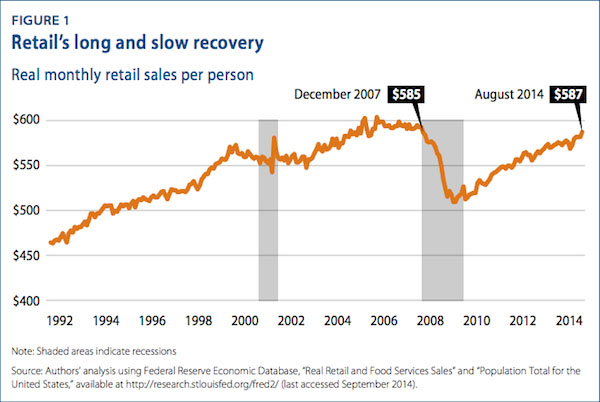

Overall, per capita retail sales have finally recovered to where they were before the Great Recession:

(Center for American Progress)

So why the concern from retailers? Mean household income is down 8 percent during a similar timeframe, and the cost of living for a family of four rose by $10,000 between 2000 and 2012. The combination of less income and a higher cost of living squeezes discretionary spending, leaving less purchasing power for most retailers' customer bases.

While the question of who's responsible for stagnant wages involves aspects of both economic policy and business investment, retailers may want to look in the mirror for part of the solution: As of May, 2013, the median hourly wage in the retail industry was $10.16 — just a few pennies above President Obama's proposed federal minimum wage of $10.10.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Mike Barry is the senior editor of audience development and outreach at TheWeek.com. He was previously a contributing editor at The Huffington Post. Prior to that, he was best known for interrupting a college chemistry class.