The United States of too much debt?

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The U.S. debt clock — which monitors U.S. federal government debt — sits at $17.5 trillion. But when it comes to debt, federal government debt should be the least of our worries. The U.S. government borrows money in its own currency, of which it can print more. Consumers and business can't just print dollars, like the U.S. government can. That makes them much more likely to default on their debt, and mass defaults can result in the devastating losses of economic confidence that trigger recessions and depressions.

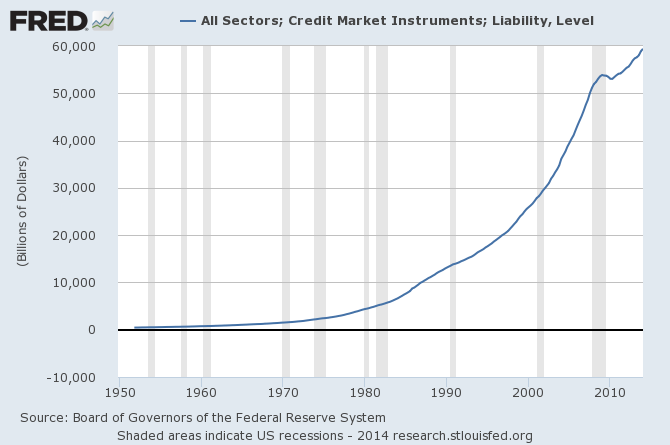

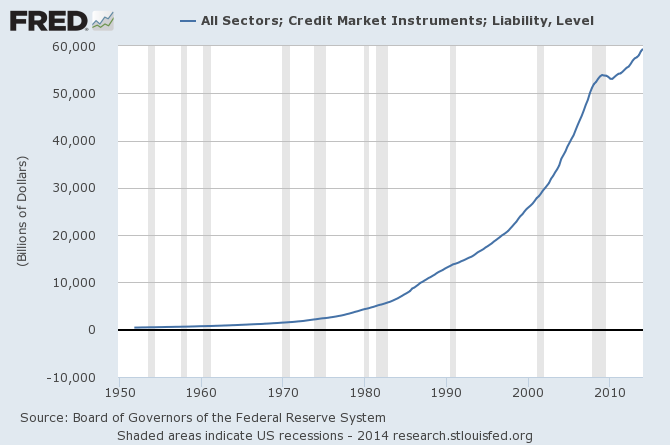

The total amount of debt in the U.S. economy, including individual debt, business debt, and federal and local government debt is much higher. It sits on the edge of crossing $60 trillion, meaning that there's over $42 trillion more debt than that issued by the federal government:

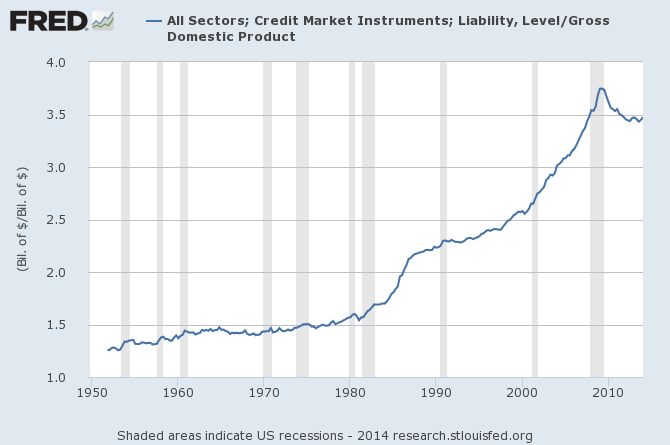

As a proportion of GDP, the total level of debt fell for a few years after the 2008 crisis, but now it's stabilizing:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Rising levels of debt are a double-edged sword. While they can spur more economic activity in the present, the more debt grows the more money consumers and businesses have to set aside to service their debts, potentially reducing future economic activity. So debt becomes dangerous to the economy when it grows faster than the economy itself, and debt levels growing faster than the economy can herald a recession.

We are not at that stage yet, but this is definitely something we should keep an eye on.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.