Members of Congress put off mandatory financial disclosures for months without major consequences

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Fail to file or pay your taxes and you can land in some pretty hot water: Monthly fines up to 25 percent of your owed taxes are pretty much guaranteed, and bucking the system long enough could see you lose your house, car, or even freedom.

But if you're in Congress, the rules about mandatory financial disclosures are a lot more lax. May 15 was the deadline by which every representative was supposed to have filed their annual financial reports. And most did, but 10 members have yet to turn in their disclosures — and they face nearly no consequences for the delay.

The tardy 10 have already been given a 90-day extension, and the House Ethics Committee decided on Wednesday to allow another 30 days before any fines are imposed. And even then, depending on the number of stock transactions in their disclosures, a representative could theoretically miss a filing deadline for four years and still owe just $200 in fines.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Bonnie Kristian was a deputy editor and acting editor-in-chief of TheWeek.com. She is a columnist at Christianity Today and author of Untrustworthy: The Knowledge Crisis Breaking Our Brains, Polluting Our Politics, and Corrupting Christian Community (forthcoming 2022) and A Flexible Faith: Rethinking What It Means to Follow Jesus Today (2018). Her writing has also appeared at Time Magazine, CNN, USA Today, Newsweek, the Los Angeles Times, and The American Conservative, among other outlets.

-

Fine food on a budget

Fine food on a budgetThe Week Recommends Excellent value eateries with the Michelin inspectors’ seal of approval

-

Where to go for the 2027 total solar eclipse

Where to go for the 2027 total solar eclipseThe Week Recommends Look to the skies in Egypt, Spain and Morocco

-

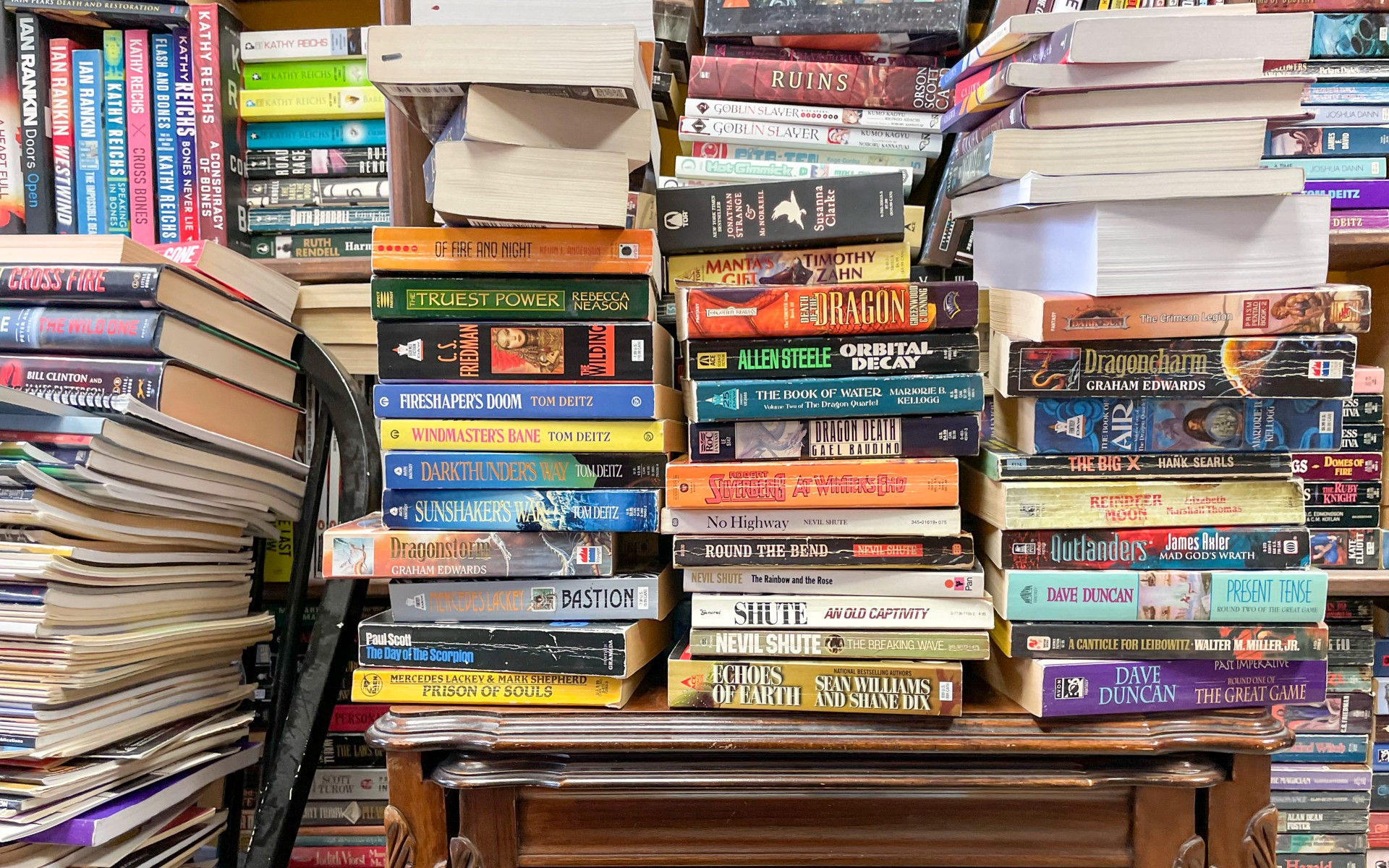

The end of mass-market paperbacks

The end of mass-market paperbacksUnder the Radar The diminutive cheap books are phasing out of existence

-

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstances

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstancesSpeed Read

-

Western mountain climbers allegedly left Pakistani porter to die on K2

Western mountain climbers allegedly left Pakistani porter to die on K2Speed Read

-

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governor

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governorSpeed Read

-

Los Angeles city workers stage 1-day walkout over labor conditions

Los Angeles city workers stage 1-day walkout over labor conditionsSpeed Read

-

Mega Millions jackpot climbs to an estimated $1.55 billion

Mega Millions jackpot climbs to an estimated $1.55 billionSpeed Read

-

Bangladesh dealing with worst dengue fever outbreak on record

Bangladesh dealing with worst dengue fever outbreak on recordSpeed Read

-

Glacial outburst flooding in Juneau destroys homes

Glacial outburst flooding in Juneau destroys homesSpeed Read

-

Scotland seeking 'monster hunters' to search for fabled Loch Ness creature

Scotland seeking 'monster hunters' to search for fabled Loch Ness creatureSpeed Read