Republican suffer a big corporate defection on tax cuts as they gird up to roll out bill

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

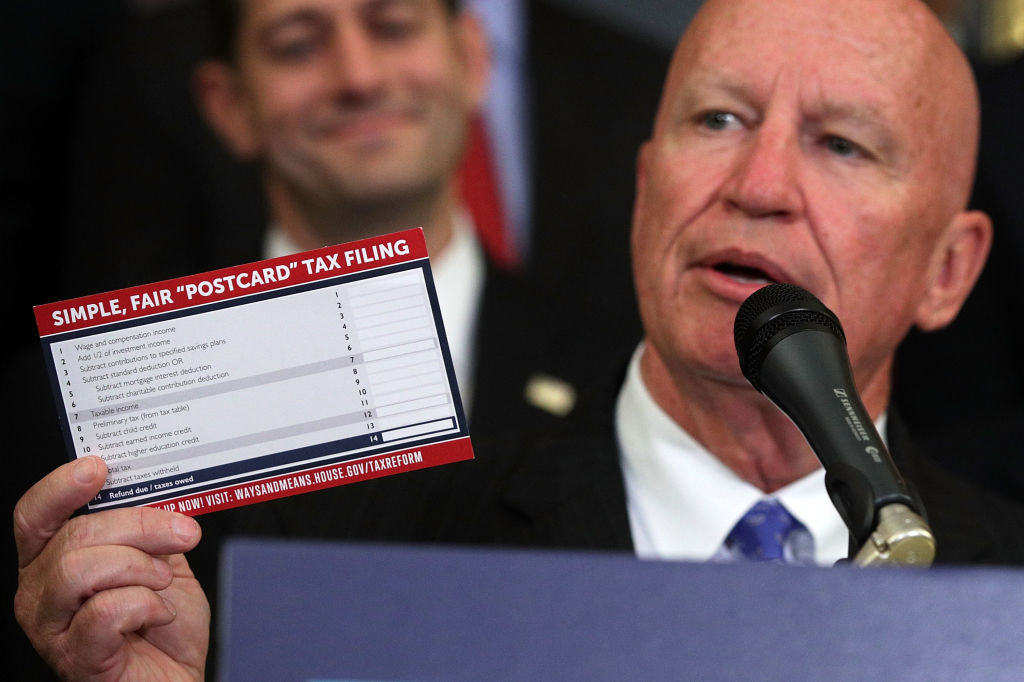

On Wednesday, House Ways and Means Committee Chairman Kevin Brady (R-Texas) plans to unveil the tax reform package he and other Republicans have been hammering out behind closed doors for months. Over the weekend, an influential corporate lobbying group, the National Association of Home Builders, took a bit of a shine off the bill, promising to actively oppose it after Brady informed that group that a "homeownership" tax credit the group has been working to include in the bill did not make the cut. "We will do everything we can to defeat this thing," said Jerry Howard, the NAHB's chief executive, including a nationwide campaign.

"Home builders are considered among the most politically influential groups, as they play a large role in the local economy for virtually every congressional district — and contribute millions to political campaigns," The Washington Post explains. Howard and Brady's staff worked together for months on the "homeownership tax credit," which would more or less replace two other deductions — mortgage interest and property tax — but GOP leaders had already promised too many people that they are keeping the mortgage-interest deduction, the Post reports.

Once Brady rolls out his tax package — which will apparently controversially cap pre-tax contributions to 401(k) accounts — Senate Republicans will start working on theirs. Getting a tax bill signed is the GOP's top legislative priority, and NAHB isn't expected to be the last influential group that objects to parts of the bill.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Peter has worked as a news and culture writer and editor at The Week since the site's launch in 2008. He covers politics, world affairs, religion and cultural currents. His journalism career began as a copy editor at a financial newswire and has included editorial positions at The New York Times Magazine, Facts on File, and Oregon State University.