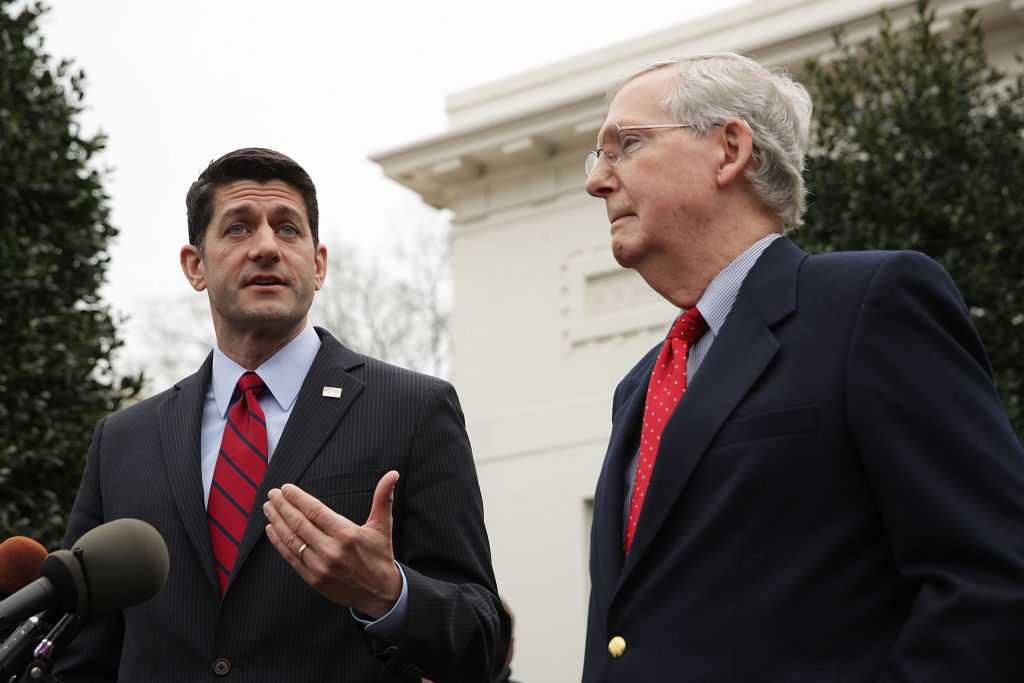

The House and Senate have resolved 'nothing really' on a final tax bill

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Senate hopes to vote on a negotiated final version of the Republican tax plan early next week, with the House voting no later than Wednesday and the whole package landing on President Trump's desk by a Dec. 20 deadline. But the progress of reaching an agreement between the chambers is slow going, and Republicans are acutely aware that the clock is ticking. "I don't think you can say at this point anything is really nailed down," Sen. John Thune (R-S.D.) confessed to Politico on Monday.

There are a number of thorny issues left to resolve, and the Senate is operating with strict budget rules. The corporate tax rate stands out as one topic of major debate, with the chambers agreeing to a lower 20 percent rate, but the Senate has suggested delaying the rate until 2019. A higher rate, such as 21 or 22 percent, is also being discussed to generate around $200 billion to offset the cost of other provisions. Questions about individual income brackets and state and local tax write-offs also have yet to be fully resolved.

Complicating matters is the looming end-of-the-year deadline, even as some Republicans "take a second look, making sure the final product is one Republicans can support," the Los Angeles Times writes. As Sen. Ron Johnson (R-Wis.) put it to the paper: "The desperation is palpable."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Thune indicated there is still a long road ahead. "Nothing really" has been resolved, he admitted to Politico. Read more about the differences between the House and Senate bills at The Week.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeva Lange was the executive editor at TheWeek.com. She formerly served as The Week's deputy editor and culture critic. She is also a contributor to Screen Slate, and her writing has appeared in The New York Daily News, The Awl, Vice, and Gothamist, among other publications. Jeva lives in New York City. Follow her on Twitter.

-

How Democrats are turning DOJ lemons into partisan lemonade

How Democrats are turning DOJ lemons into partisan lemonadeTODAY’S BIG QUESTION As the Trump administration continues to try — and fail — at indicting its political enemies, Democratic lawmakers have begun seizing the moment for themselves

-

ICE’s new targets post-Minnesota retreat

ICE’s new targets post-Minnesota retreatIn the Spotlight Several cities are reportedly on ICE’s list for immigration crackdowns

-

‘Those rights don’t exist to protect criminals’

‘Those rights don’t exist to protect criminals’Instant Opinion Opinion, comment and editorials of the day

-

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstances

Nobody seems surprised Wagner's Prigozhin died under suspicious circumstancesSpeed Read

-

Western mountain climbers allegedly left Pakistani porter to die on K2

Western mountain climbers allegedly left Pakistani porter to die on K2Speed Read

-

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governor

'Circular saw blades' divide controversial Rio Grande buoys installed by Texas governorSpeed Read

-

Los Angeles city workers stage 1-day walkout over labor conditions

Los Angeles city workers stage 1-day walkout over labor conditionsSpeed Read

-

Mega Millions jackpot climbs to an estimated $1.55 billion

Mega Millions jackpot climbs to an estimated $1.55 billionSpeed Read

-

Bangladesh dealing with worst dengue fever outbreak on record

Bangladesh dealing with worst dengue fever outbreak on recordSpeed Read

-

Glacial outburst flooding in Juneau destroys homes

Glacial outburst flooding in Juneau destroys homesSpeed Read

-

Scotland seeking 'monster hunters' to search for fabled Loch Ness creature

Scotland seeking 'monster hunters' to search for fabled Loch Ness creatureSpeed Read