4 big ways the U.S. got coronavirus relief wrong, according to top government watchdog

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The U.S. Government Accountability Office released a report Thursday criticizing how the federal government distributed coronavirus relief checks and maintained medical supplies. Here are the four main problems it found.

1. Testing data errors. The Centers for Disease Control and Prevention "has not maintained complete or consistent data on the amount of COVID-19 testing," the GAO writes. With some states conflating virus and antibody testing, it's been hard to "track infections, mitigate effects, and make decisions on when to reopen communities," it continues.

2. Medical supply shortages. "The need for critical equipment and supplies to respond to COVID-19 across the nation quickly exceeded availability in the Strategic National Stockpile," the GAO notes. And while the government tried to increase that supply, state and local government still reported issues with accessing it.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

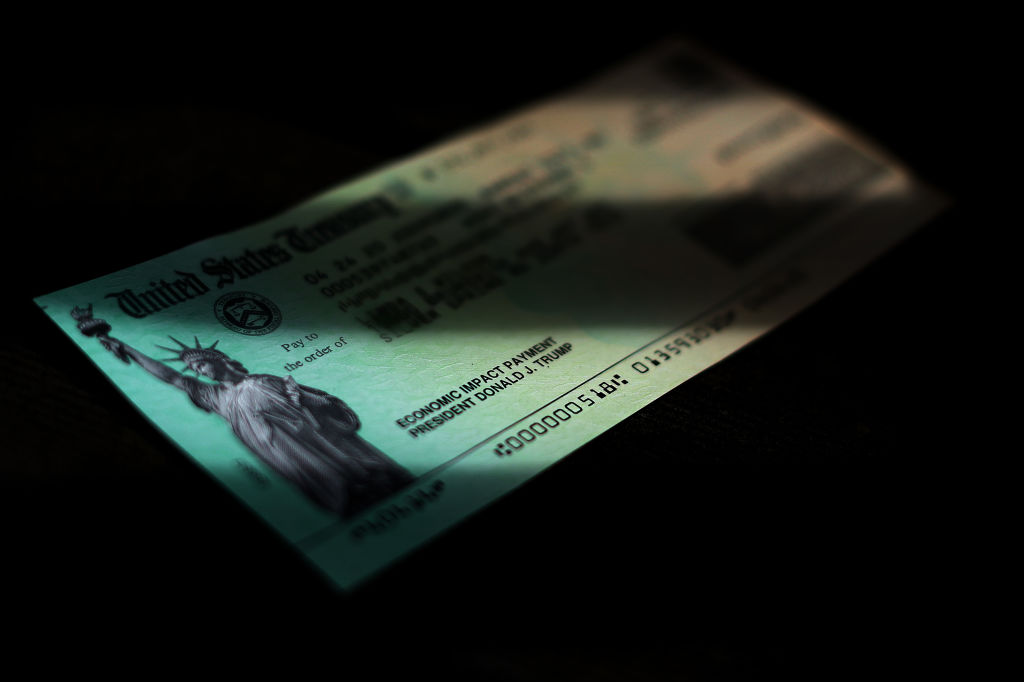

3. Economic impact payment distribution. The IRS and Treasury Department's processes for distributing coronavirus relief checks was very susceptible to fraud, the GAO found. That took root in the fact that as of April 30, the GAO found "almost 1.1 million payments totaling nearly $1.4 billion had gone to deceased people." States also lacked the infrastructure to distribute additional unemployment insurance to millions more people than usual.

4. Paycheck Protection Program inadequacies. The Small Business Administration "processed more than $512 billion in 4.6 million guaranteed loans through private lenders" to help businesses stay afloat during COVID-19 shutdowns, the GAO writes. But the SBA didn't explain how or when those loans would be paid back — and didn't provide much information to the GAO either, it says.

Find the whole GAO report here.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Kathryn is a graduate of Syracuse University, with degrees in magazine journalism and information technology, along with hours to earn another degree after working at SU's independent paper The Daily Orange. She's currently recovering from a horse addiction while living in New York City, and likes to share her extremely dry sense of humor on Twitter.

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Bad Bunny’s Super Bowl: A win for unity

Bad Bunny’s Super Bowl: A win for unityFeature The global superstar's halftime show was a celebration for everyone to enjoy

-

Witkoff and Kushner tackle Ukraine, Iran in Geneva

Witkoff and Kushner tackle Ukraine, Iran in GenevaSpeed Read Steve Witkoff and Jared Kushner held negotiations aimed at securing a nuclear deal with Iran and an end to Russia’s war in Ukraine

-

Pentagon spokesperson forced out as DHS’s resigns

Pentagon spokesperson forced out as DHS’s resignsSpeed Read Senior military adviser Col. David Butler was fired by Pete Hegseth and Homeland Security spokesperson Tricia McLaughlin is resigning

-

Judge orders Washington slavery exhibit restored

Judge orders Washington slavery exhibit restoredSpeed Read The Trump administration took down displays about slavery at the President’s House Site in Philadelphia

-

Hyatt chair joins growing list of Epstein files losers

Hyatt chair joins growing list of Epstein files losersSpeed Read Thomas Pritzker stepped down as executive chair of the Hyatt Hotels Corporation over his ties with Jeffrey Epstein and Ghislaine Maxwell

-

Judge blocks Hegseth from punishing Kelly over video

Judge blocks Hegseth from punishing Kelly over videoSpeed Read Defense Secretary Pete Hegseth pushed for the senator to be demoted over a video in which he reminds military officials they should refuse illegal orders

-

Trump’s EPA kills legal basis for federal climate policy

Trump’s EPA kills legal basis for federal climate policySpeed Read The government’s authority to regulate several planet-warming pollutants has been repealed

-

House votes to end Trump’s Canada tariffs

House votes to end Trump’s Canada tariffsSpeed Read Six Republicans joined with Democrats to repeal the president’s tariffs

-

Bondi, Democrats clash over Epstein in hearing

Bondi, Democrats clash over Epstein in hearingSpeed Read Attorney General Pam Bondi ignored survivors of convicted sex offender Jeffrey Epstein and demanded that Democrats apologize to Trump