Deciding how to invest: the key questions

In this series brought to you by the FCA, we explore some basic questions to ask yourself before taking the plunge

In this series brought to you by the FCA, we explore some basic questions to ask yourself before taking the plunge

Am I ready to invest?

Investing is inherently risky and not for everyone. Questions to consider before investing include: are you out of debt? Are you saving into a pension? Do you have the appropriate insurance policies set up to help you in case of disaster?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

If you can answer yes to all of those questions then it’s more likely that you are in a position to use some of your money to invest. But keep in mind that every type of investment has potential hazards and that you could get back less money than you put in.

There is no such thing as a free ride when it comes to investments - and if you’re being promised a high return, it’s often because the investments carry risk.

If you’re thinking of investing because you’ve been approached by someone promising unusually tempting returns, think very carefully before you stump up any capital. In general, no investment is worth making if the people selling it are resorting to contacting strangers to drum up business. If you receive an unexpected phone call or email, for example, the best policy is to ignore it. Any offers you get in this way are likely to be a scam.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Nick Hewer discusses the scam tactics fraudsters may use

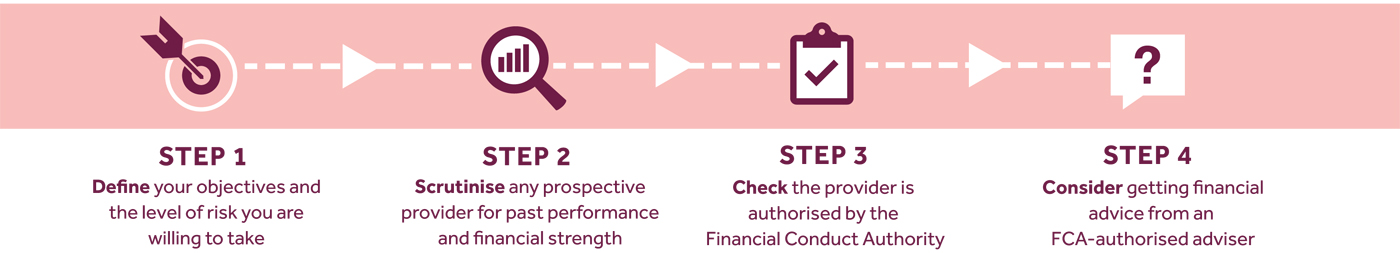

Instead, if you decide you want to put some money towards investments, the following questions should help you decide what type of investment is likely to be best for you.

How much risk do I want to take?

All investments carry some element of risk, but some are generally viewed as riskier than others. Of the investments commonly bought by consumers (shares, property, funds, and corporate and government bonds), shares are typically thought of as the most volatile and therefore the riskiest. Shares can rise and fall in price as a result of a range of factors that can be difficult to anticipate.

Corporate bonds are another option. These bonds are like IOUs issued by companies as a way of raising money. Essentially, you loan the firm capital and are ultimately repaid with interest, so you would hope to get back more than you put in. However, companies can and sometimes do go bust before repaying bondholders. Companies viewed as safe bets will be able to offer lower rates of interest, while companies perceived as having a higher risk of default will have to pay more to raise the money they need.

This brings us back to our earlier point about higher rewards often coming with higher risk. With government bonds, also known as gilts, the government would have to default in order for you not to get back what you’d been promised. However, this also means that they don’t tend to pay as much. In fact, when big-time investors are worried about risk, they sometimes flock to government bonds, which drives up the price and lowers the yield - how much you get back for what you pay. Sometimes this can even lead to negative yield - when people are willing to get back less than they paid in just because it’s safe.

The rate of inflation may also affect how you decide to invest. Many people choose to invest, rather than leaving their money in a bank account, when the rate of inflation exceeds the rate of interest paid on their bank deposits. When investing, you may want to consider how the possible returns compare to the rate of inflation, and the level of return you could get by simply keeping the cash in an interest-paying savings account.

Other risks may include:

Liquidity Risk: In other words, getting your money out when you need to. This can be especially relevant if you choose to invest directly in property.

Longevity Risk: This is the risk that you will outlive your savings and is especially important when considering retirement.

Horizon Risk: This could be an unforeseen event that causes you to sell investments earlier than you planned, which may mean that you lose money.

Does it sound too good to be true?

Despite what you might see at the cinema, or hear in the pub, investing isn’t like winning the lottery - you don’t get rich overnight. Plenty of scammers would have you believe that it is possible to make big money fast; perhaps telling you they have special insight, or know of an investment that hasn’t hit the market yet.

But remember, if it sounds too good to be true, it probably is. Stay away and don’t be tempted into making decisions that you may regret later.

Also bear in mind that scammers are not always easy to spot: many of them make convincing cases and have professional-looking marketing materials.

Should I take advice?

The Money Advice Service (MAS) gives general information about investing to help you weigh up your options. However, the MAS will not take into consideration your individual circumstances in the way that a financial adviser would.

An adviser will be able to help you create a plan to meet your goal and recommend the right balance of investments for your risk appetite, while taking into account how much you could afford to lose.

The MAS website has information on how to find a reputable financial adviser. You can also get further information from a group that represents advisers, such as the Personal Investment Management and Financial Advice Association (Pimfa).

Do I know who I’m dealing with? Make sure any investment firm or adviser you might use is authorised by the Financial Conduct Authority (FCA). If you use an unauthorised firm, you won’t have access to the Financial Services Compensation Scheme (FSCS) or to the Financial Ombudsman should you wish to make a complaint or in the event of a firm going bust.

Check out the FCA Warning List to learn more about the risks associated with different investments, and to find out which firms are known to be operating without authorisation: this includes “clone firms”, which masquerade as established companies to gain people’s trust. Go to fca.org.uk/scamsmart.

How much do I need to make?

It’s generally not a good idea to choose an investment solely according to how much money you think you might make. There are number of other factors that you should consider, including the volatility of your investments and how long you intend to remain invested.

Remember, returns are unpredictable and the higher you want your returns to be, the greater the odds that you’ll have to take more risk in trying to achieve them.

Think about what your priorities really are. After all, if you’re not seeking particularly high returns, why take on more risk than you need?

How much time am I willing to spend on my investments?

This relates to the question about getting financial advice, or alternatively, engaging an investment manager to make investments on your behalf.

A few hours a year might be all the time you need to focus on your portfolio once it’s up and running - but it’s also possible you might need to spend longer than that. You might find out your investments require more time than you are willing or able to spend.

If this is the case, you should consider hiring an adviser to assess your situation and goals in order to recommend a portfolio for you, or using a discretionary investment manager to tend your portfolio.

What about tax?

The issue of taxation also needs to be considered before investing, as your personal tax situation may have a bearing on your decision.

For UK tax payers, the tax benefits of investing in a pension plan can be considerable, especially if you are a higher-rate tax payer. So think about how your investment plans will fit in with any pension contributions.

There are other means of investing that can provide tax benefits. An Isa (Individual Savings Account) provides a tax-free way to save or invest.

It is also important to think carefully before withdrawing money from any investment as the timing and the amount of such a withdrawal could lead to you incurring a tax charge.

Do I care about ethics when investing my money?

Finally, remember that you may be investing in real companies, whose products or services may affect the wider world.

This might not matter to you, but some investors like to invest only in companies with which they agree from an ethical standpoint. For example, some people may choose to steer clear of investments associated with fossil fuels, or tobacco.

Whatever investment route you decide to take, make sure any firms you decide to deal with are legitimate. Remember, scammers may come across as very professional.

Use the Financial Services Register, available on the FCA website, to check whether a financial services firm is authorised by the FCA, and always avoid any firms that appear on the FCA’s Warning List.

-

Quiz of The Week: 28 February – 6 March

Quiz of The Week: 28 February – 6 MarchQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Why is France expanding its nuclear arsenal?

The Week Unwrapped: Why is France expanding its nuclear arsenal?Podcast Plus, why is the dinosaur market booming? And can North Korea regain its place at the top of women’s football?

-

The week’s best photos

The week’s best photosIn Pictures A vibrant festival, playful ponies, and more